1. Bayanin Ma'anar Sauyewar Tarihi

1.1 Menene Canzawar Tarihi?

Canjin Tarihi (HV) ma'aunin ƙididdiga ne na tarwatsawar da aka samu don tsaro da aka bayar ko fihirisar kasuwa a kan takamaiman lokaci. Mahimmanci, yana ƙididdige yawan farashin kadara ya bambanta a baya. Ana bayyana wannan ma'auni azaman kashi kuma galibi ana amfani dashi traders da masu zuba jari don aunawa hadarin hade da wani kadari na musamman.

1.2 Muhimmanci a Kasuwannin Kudi

Muhimmancin Volatility na Tarihi ya ta'allaka ne ga ikonsa na ba da haske game da motsin farashin da ya gabata na kadari, wanda ke da mahimmanci don yanke shawarar ciniki mai fa'ida. Babban rashin daidaituwa yana nuna girman sauye-sauyen farashi da yuwuwar haɗari mafi girma, yayin da ƙarancin rashin ƙarfi yana ba da ƙarin kwanciyar hankali da ƙarancin motsin farashi.

1.3 Yadda Canzawar Tarihi Ya bambanta da Ƙaƙƙarfan Ƙarfafawa

Yana da mahimmanci a bambance Canjin Tarihi daga Ƙwararren Ƙwararru (IV). Yayin da HV ke kallon motsin farashin da ya gabata, IV yana kallon gaba kuma yana nuna tsammanin kasuwa na rashin daidaituwa a nan gaba, yawanci ana samo shi daga farashin zaɓuɓɓuka. HV yana ba da rikodin gaskiya na halayen kasuwa na baya, yayin da IV hasashe ne.

1.4 Aikace-aikace a cikin Kasuwanci da Zuba Jari

Traders sau da yawa amfani da Volatility na Tarihi don tantance ko farashin kadari a halin yanzu yana da yawa ko kaɗan idan aka kwatanta da sauyin da ya yi a baya. Wannan kima zai iya taimakawa wajen yanke shawara game da shigarwa da wuraren fita a kasuwa. Masu saka hannun jari na iya amfani da HV don daidaita haɗarin faɗuwar fayil ɗin su, suna fifita kadarorin tare da ƙarancin ƙarfi don dabarun ra'ayin mazan jiya.

1.5 Nau'o'in Canjin Tarihi

Akwai nau'ikan Volatility na Tarihi da yawa, gami da:

- Ƙunƙarar ɗan gajeren lokaci: Yawanci ana ƙididdige shi a tsawon lokaci kamar kwanaki 10 ko 20.

- Matsayin Matsakaici: Yawancin lokaci ana auna sama da kwanaki 50 zuwa 60.

- Ƙarfafawa na dogon lokaci: An yi nazari na tsawon lokaci mai tsawo, kamar kwanaki 100 ko fiye.

Kowane nau'i yana hidima daban-daban ciniki dabaru da hangen nesa na zuba jari.

1.6 Advantages da Iyakance

Advantages:

- Yana ba da kyakkyawar hangen nesa na tarihi game da halayen kasuwa.

- Mai amfani ga duka gajere traders da masu zuba jari na dogon lokaci.

- Yana taimakawa wajen gano lokutan babban haɗari da yuwuwar rashin kwanciyar hankali na kasuwa.

gazawar:

- Ayyukan da suka gabata ba koyaushe ke nuna sakamako na gaba ba.

- Baya lissafin abubuwan kasuwa kwatsam ko canje-canje.

- Maiyuwa ya zama ƙasa da tasiri a kasuwanni tare da canje-canjen tsari.

| Aspect | description |

|---|---|

| definition | Auna tarwatsawar dawowa don tsaro ko fihirisar kasuwa a kan takamaiman lokaci. |

| Zancen | An gabatar da shi azaman kashi. |

| Anfani | Ƙimar haɗari, fahimtar ƙungiyoyin farashin da suka gabata, ƙirƙira dabarun ciniki. |

| iri | gajere, Matsakaici, Dogon lokaci. |

| Advantages | Hangen tarihi, mai amfani a cikin dabarun ciniki, gano haɗari. |

| gazawar | Ƙayyadaddun ayyukan da suka gabata, keɓanta taron kasuwa kwatsam, batutuwan canjin tsari. |

2. Tsarin Lissafi na Ƙaƙƙarfan Tarihi

Ƙididdiga na Ƙarfafawar Tarihi ya ƙunshi matakai da yawa, da farko yana juyawa akan matakan ƙididdiga. Manufar ita ce ƙididdige ƙimar bambancin farashin tsaro a kan takamaiman lokaci. Ga rugujewar tsari:

2.1 Tattara bayanai

Da fari dai, tattara bayanan farashi na tarihi na tsaro ko fihirisa. Wannan bayanan yakamata ya haɗa da farashin rufewa yau da kullun akan lokacin da kuke son ƙididdige ƙima, yawanci kwanakin ciniki 20, 50, ko 100.

2.2 Lissafin Komawa Kullum

Yi ƙididdige dawowar yau da kullun, wanda shine canjin kaso na farashin daga rana ɗaya zuwa gaba. Tsarin dawowar yau da kullun shine:

Daily Return = [(Today's Closing Price / Yesterday's Closing Price) - 1] x 100

2.3 Madaidaicin Ƙididdigar Maɓalli

Na gaba, ƙididdige madaidaicin karkatar da waɗannan dawowar yau da kullun. Madaidaicin karkata shine ma'auni na adadin bambancin ko tarwatsawa a cikin saitin dabi'u. Babban ma'auni mai mahimmanci yana nuna rashin ƙarfi. Yi amfani da daidaitaccen dabarar karkatacciyar hanyar da ta dace don saitin bayanan ku (samfuri ko yawan jama'a).

2.4 Shekara-shekara Ƙarfafawa

Tunda ana amfani da dawowar yau da kullun, ƙididdigar ƙididdiga ta yau da kullun. Don haɓaka shi shekara-shekara (watau canza shi zuwa ma'aunin shekara-shekara), ninka madaidaicin karkata zuwa tushen murabba'in adadin kwanakin ciniki a cikin shekara. Yawan adadin da aka yi amfani da shi shine 252, wanda shine matsakaicin adadin kwanakin ciniki a cikin shekara. Don haka, dabarar rashin daidaituwa na shekara-shekara shine:

Annualized Volatility = Standard Deviation of Daily Returns x √252

| Mataki | tsari |

|---|---|

| data Collection | Tara farashin rufewa na yau da kullun na tarihi |

| Komawa Kullum | Yi ƙididdige canjin kashi a farashin yau da kullun |

| Daidaitaccen Karkatawa | Yi ƙididdige madaidaicin karkatar da dawowar yau da kullun |

| Shekara-shekara | Ƙirƙirar daidaitattun daidaito ta √252 don haɓaka shekara |

3. Ingantattun Darajoji don Saita a cikin Tsarukan Lokaci daban-daban

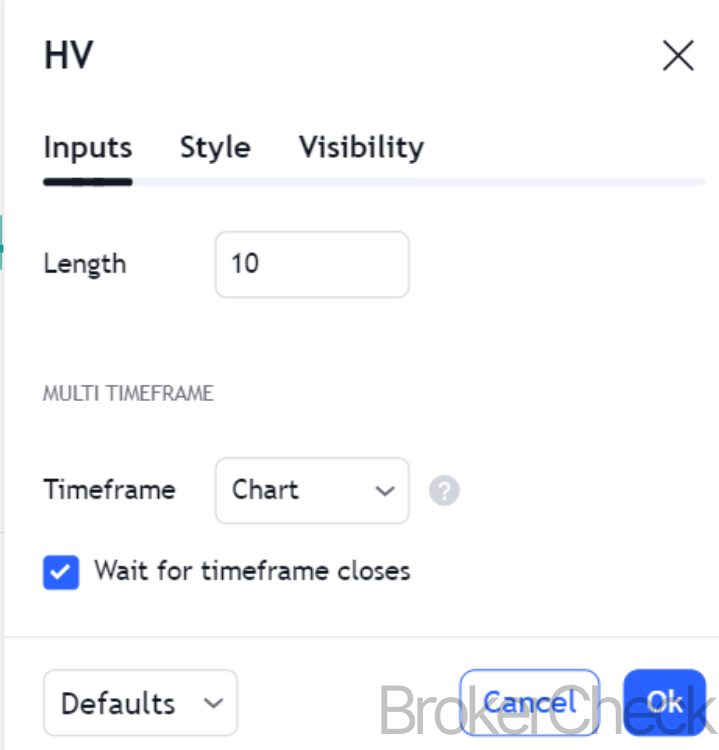

3.1 Fahimtar Zaɓin Tsarin Lokaci

Zaɓin mafi kyawun lokacin don Ma'auni na Volatility (HV) yana da mahimmanci saboda kai tsaye yana rinjayar fassarar da aikace-aikacen mai nuna alama a cikin dabarun ciniki daban-daban. Ƙididdigar lokaci daban-daban na iya ba da haske a cikin gajeren lokaci, matsakaici, da kuma na dogon lokaci.

3.2 Tsare-tsare na gajeren lokaci

- duration: Yawanci yana tsakanin kwanaki 10 zuwa 30.

- Aikace-aikace: Mafi dacewa don gajeren lokaci traders kamar rana traders ko swing traders.

- halayyar: Yana ba da ma'auni mai sauri, mai amsawa na kwanan nan kasuwar volatility.

- Mafi kyawun ƙimar: Wani ɗan gajeren lokaci, kamar kwanaki 10, galibi ana fifita shi don azancin sa ga ƙungiyoyin kasuwa na kwanan nan.

3.3 Matsakaici-Tsawon Lokaci

- duration: Yawancin lokaci tsakanin kwanaki 31 zuwa 90.

- Aikace-aikace: dace da traders tare da hangen nesa na matsakaici, kamar matsayi traders.

- halayyar: Daidaita amsawa tare da kwanciyar hankali, yana ba da ƙarin zagayen ra'ayi na juzu'in kasuwa.

- Mafi kyawun ƙimar: Lokaci na kwanaki 60 zaɓi ne na kowa, yana ba da daidaitaccen ra'ayi na kwanan nan da ɗan ɗan gajeren lokaci.

3.4 Tsawon Lokaci

- duration: Gabaɗaya kwanaki 91 ko fiye, yawanci kwanaki 120 zuwa 200.

- Aikace-aikace: Mai amfani ga masu zuba jari na dogon lokaci suna mai da hankali kan yanayin kasuwa mafi girma.

- halayyar: Yana nuna yanayin da ake ciki a cikin canjin kasuwa na tsawon lokaci mai tsawo.

- Mafi kyawun ƙimar: Ana yawan amfani da tsawon kwanaki 120 ko kwanaki 200, yana ba da haske game da jujjuyawar kasuwa na tsawon lokaci.

3.5 Abubuwan Da Ke Tasirin Mafi kyawun Zaɓin Tsararren Lokaci

- Tsarin ciniki: Ya kamata lokacin da aka zaɓa ya daidaita tare da tradedabarun r ko masu saka hannun jari da manufofinsu.

- Yanayin Kasuwa: Hanyoyin kasuwa daban-daban (bullish, bearish, a gefe) na iya buƙatar gyare-gyare a cikin zaɓaɓɓen lokaci.

- Halayen Kadari: Hanyoyin haɓakawa na iya bambanta sosai a cikin dukiyoyi daban-daban, yana buƙatar daidaitawa a cikin ƙayyadaddun lokaci.

| Lokaci | duration | Aikace-aikace | halayyar | Mafi kyawun darajar |

|---|---|---|---|---|

| Gajeren Lokaci | 10-30 kwanaki | Kasuwancin Rana/Swing | Mai da martani ga sauye-sauyen kasuwa na kwanan nan | 10 days |

| Matsakaici-Lokaci | 31-90 kwanaki | Matsayi Kasuwanci | Daidaitaccen ra'ayi na kwanan nan da abubuwan da suka gabata | 60 days |

| Tsawon Lokaci | 91 + kwana | Zuba jari na dogon lokaci | Yana nuna tsawaita yanayin canjin kasuwa | Kwana 120 ko 200 |

4. Fassarar Canjin Tarihi

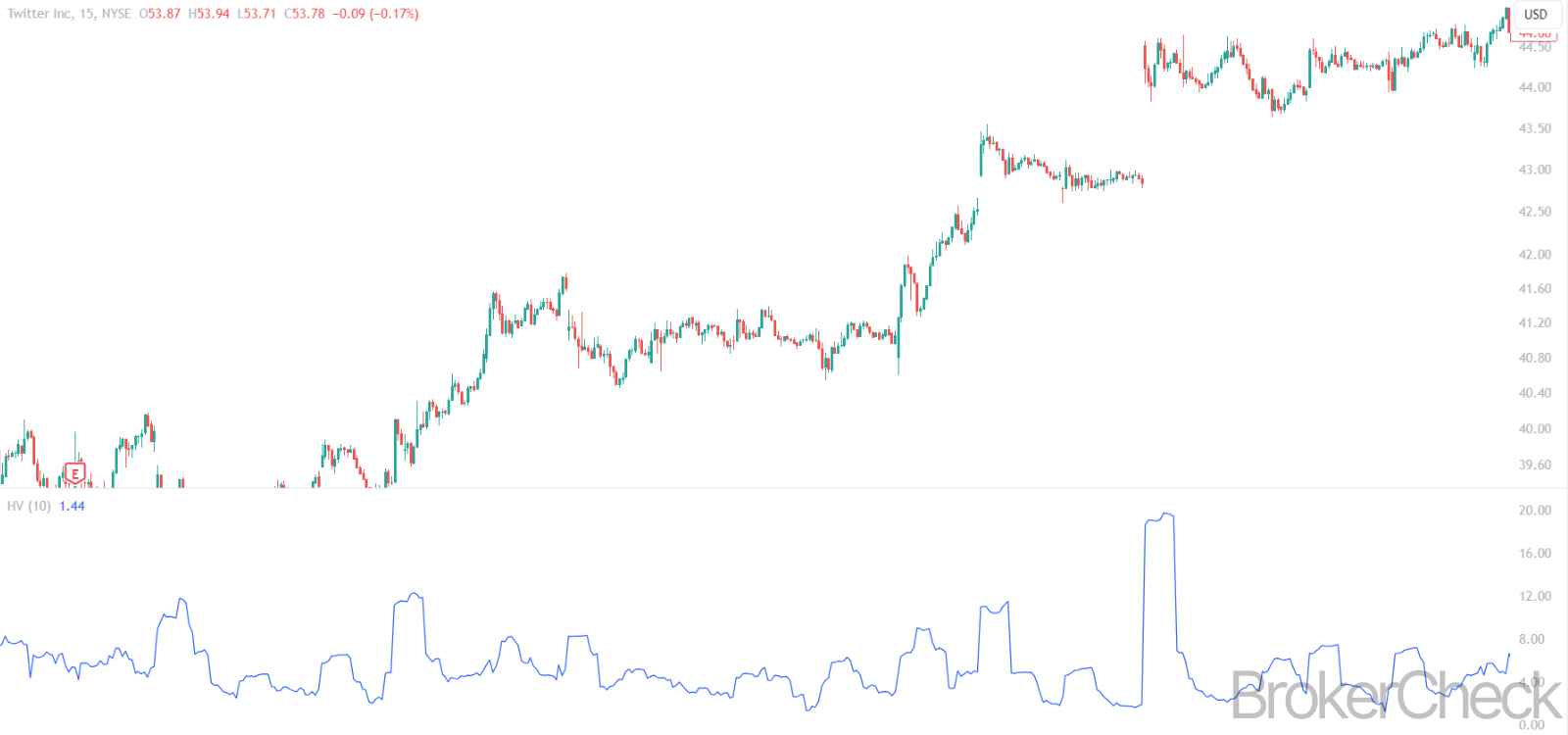

4.1 Fahimtar Karatun Sauyewar Tarihi

Fassara ma'aunin Volatility na Tarihi (HV) ya ƙunshi nazarin ƙimarsa don fahimtar yanayin rashin ƙarfi na tsaro ko kasuwa. Maɗaukakin ƙimar HV suna nuna babban canji, yana nuna girman sauye-sauyen farashi, yayin da ƙananan ƙimar ke ba da shawarar ƙarancin canzawa da ƙarin ƙaƙƙarfan motsin farashi.

4.2 Babban Haɓakawa na Tarihi: Abubuwan Tafiya da Ayyuka

- Ma'ana: Babban HV yana nuna cewa farashin kadari yana canzawa sosai akan lokacin da aka zaɓa.

- Tasiri: Wannan na iya nuna ƙara haɗarin haɗari, yuwuwar rashin zaman lafiyar kasuwa, ko lokutan rashin tabbas na kasuwa.

- Ayyukan masu saka hannun jari: Traders na iya neman damar kasuwanci na ɗan gajeren lokaci a cikin irin waɗannan wurare, yayin da masu zuba jari na dogon lokaci za su iya yin taka tsantsan ko sake la'akari da dabarun sarrafa haɗarin su.

4.3 Ƙarƙashin Ƙarƙashin Tarihi: Tasiri da Ayyuka

- Ma'ana: Ƙananan HV yana nuna cewa farashin kadari ya kasance da kwanciyar hankali.

- Tasiri: Wannan kwanciyar hankali na iya nuna ƙananan haɗari amma kuma yana iya ɗaukar lokaci na canzawa (kwantar da hankali kafin hadari).

- Ayyukan masu saka hannun jari: Masu zuba jari na iya la'akari da wannan wata dama ce ta zuba jari na dogon lokaci, yayin da traders na iya yin taka tsantsan game da yuwuwar yuwuwar haɓakar rashin ƙarfi mai zuwa.

4.4 Nazartar Juyin Halittu a cikin Sauyawar Tarihi

- Tashi Trend: Haɓakawa a hankali a cikin HV akan lokaci na iya nuna haɓaka tashin hankali na kasuwa ko kuma motsin farashi mai zuwa.

- Ragewar Trend: Rage yanayin HV na iya ba da shawarar daidaita kasuwa ko komawa zuwa mafi kwanciyar hankali bayan lokaci mara ƙarfi.

4.5 Amfani da HV a cikin Yanayin Kasuwa

Fahimtar mahallin yana da mahimmanci. Misali, HV na iya tashi yayin al'amuran kasuwa kamar rahoton samun kuɗi, al'amuran ƙasa, ko sanarwar tattalin arziki. Yana da mahimmanci a daidaita karatun HV tare da mahallin kasuwa don ingantaccen fassarar.

| Karatun HV | abubuwan | Ayyukan masu saka hannun jari |

|---|---|---|

| Babban HV | Ƙara haɗari, rashin kwanciyar hankali | Dama na ɗan gajeren lokaci, sake kimanta haɗarin |

| Low HV | Kwanciyar hankali, yuwuwar rashin ƙarfi mai zuwa | Saka hannun jari na dogon lokaci, taka tsantsan don ƙazantattun ƙazanta |

| Tashi Trend | Gina tashin hankali, motsi masu zuwa | Shirya don yuwuwar canjin kasuwa |

| Ragewar Trend | Kasuwar daidaitawa, komawa cikin kwanciyar hankali | Yi la'akari da ƙarin tabbataccen yanayin kasuwa |

5. Haɗa Canzawar Tarihi tare da Wasu Manufofi

5.1 Haɗin kai na Manubai da yawa

Haɗa Ƙaƙwalwar Tarihi (HV) tare da wasu alamomin fasaha na iya haɓaka nazarin kasuwa, samar da cikakkiyar ra'ayi. Wannan haɗin yana taimakawa wajen tabbatar da siginar ciniki, sarrafa haɗari, da kuma gano damar kasuwa na musamman.

5.2 HV da Matsakaicin Motsawa

- Dabarun Haɗawa: Haɗa HV tare da Matsakaicin Motsawa (MAs) na iya yin tasiri. Alal misali, HV mai tasowa tare da a motsi matsakaici crossover na iya sigina ƙara rashin tabbas na kasuwa ya zo daidai da yuwuwar canjin yanayi.

- Aikace-aikace: Wannan haɗin yana da amfani musamman a cikin dabarun bin hanyoyin ko jujjuyawa.

5.3 HV da Bollinger Bands

- Dabarun Haɗawa: Bollinger Makada, waɗanda ke daidaita kansu dangane da juzu'in kasuwa, ana iya amfani da su tare da HV don fahimtar haɓakar canjin da kyau. Misali, babban karatun HV tare da fadada Bollinger Band yana nuna haɓakar canjin kasuwa.

- Aikace-aikace: Mafi dacewa don tsinkayar lokutan babban rashin ƙarfi wanda zai iya haifar da damar fashewa.

5.4 HV da Ƙarfin Ƙarfi (RSI)

- Dabarun Haɗawa: Yin amfani da HV tare da RSI zai iya taimakawa wajen gano ko babban yanayin rashin ƙarfi yana da alaƙa da abin da aka yi fiye da kima ko siyar.

- Aikace-aikace: Mai amfani a ciki lokacinta ciniki, ku traders na iya auna ƙarfin motsin farashin tare da rashin daidaituwa.

5.5 HV da MACD

- Dabarun Haɗawa: The Matsakaicin Matsakaicin Canzawa (MACD) mai nuna alama, lokacin da aka yi amfani da shi tare da HV, yana taimakawa wajen fahimtar ko motsi mara ƙarfi yana da goyan baya da ƙarfi.

- Aikace-aikace: Mai tasiri a cikin dabarun bin hanyoyin, musamman wajen tabbatar da ƙarfin abubuwan da ke faruwa.

5.6 Mafi kyawun Ayyuka don Haɗa Alamomi

- Karin Bayani: Zaɓi alamun da suka dace da HV don samar da ra'ayoyi daban-daban na nazari (tsari, motsi, ƙara, da sauransu).

- Gujewa Rikici: Yawancin alamomi na iya haifar da gurguntaccen bincike. Ƙayyadadden adadin alamomi don kiyaye tsabta.

- Gwajin baya: Koyaushe sake gwadawa dabarun hada HV tare da wasu alamomi don duba tasirin su a cikin yanayi daban-daban na kasuwa.

| hade | Strategy | Aikace-aikace |

|---|---|---|

| HV + Matsakaicin Motsawa | Tabbatar da sigina don canje-canjen yanayi | Dabarun masu biyo baya, juzu'i |

| HV + Bollinger Bands | Gano high volatility da breakouts | Breakout dabarun ciniki |

| HV + RSI | Ƙimar rashin ƙarfi tare da yanayin siyayyar da kasuwa ke yi | Lokacin ciniki |

| HV + MACD | Tabbatar da ƙarfin yanayi tare da rashin ƙarfi | Dabarun masu biyo baya |

6. Gudanar da Haɗari tare da Canjin Tarihi

6.1 Matsayin HV a cikin Gudanar da Hadarin

Volatility na Tarihi (HV) kayan aiki ne mai mahimmanci a cikin sarrafa haɗari, yana ba da haske game da juzu'in kadari na baya. Fahimtar HV yana taimakawa wajen daidaita dabarun sarrafa haɗari bisa ga rashin daidaituwar saka hannun jari.

6.2 Saita Tsayawa-Asara da Matakan Riba

- Aikace-aikace: HV na iya jagorantar saitin tasha-hasara da matakan riba. Maɗaukakin haɓakawa na iya ba da garantin faffadan tasha-asara don gujewa fita da wuri, yayin da ƙananan rashin ƙarfi zai iya ba da izinin tsayawa.

- Dabarun: Makullin shine daidaita matakan hasarar tsayawa da riba tare da rashin daidaituwa don daidaitawa hadari da sakamako yadda ya kamata.

6.3 Bambance-bambancen Fayiloli

- Bincike: Karatun HV a cikin dukiyoyi daban-daban na iya sanar da kai rarrabuwa dabarun. Haɗin kadarori tare da matakan sauye-sauye na iya taimakawa wajen ƙirƙirar madaidaicin fayil.

- Aiwatarwa: Haɗa kadarori tare da ƙananan HV na iya yuwuwar daidaita fayil ɗin yayin yanayin kasuwa mai rikice-rikice.

6.4 Girman Matsayi

- Dabarun: Yi amfani da HV don daidaita girman matsayi. A cikin mahalli mafi girma na rashin ƙarfi, rage girman matsayi zai iya taimakawa wajen sarrafa haɗari, yayin da a cikin ƙananan saitunan rashin daidaituwa, manyan matsayi na iya zama mai yiwuwa.

- Lissafi: Wannan ya haɗa da tantance HV na kadari dangane da jimlar haɗarin fayil gabaɗaya.

6.5 Shiga kasuwa da Lokacin Fita

- Analysis: HV na iya taimakawa wajen tantance madaidaicin shigarwa da wuraren fita. Shigar a trade a lokacin ƙananan HV na iya gaba da yiwuwar fashewa, yayin da fita a lokacin babban lokacin HV na iya zama mai hankali don kauce wa manyan swings.

- Tunani: Yana da mahimmanci a haɗa bincike na HV tare da wasu alamomi don lokacin kasuwa.

| Aspect | Aikace-aikace | Strategy |

|---|---|---|

| Matakan Tsaida-Asara/Daukar Riba | Daidaita iyaka bisa HV | Daidaita matakan tare da rashin daidaituwar kadara |

| Rarraba Fayiloli | Zaɓin kadari don madaidaitan fayil | Cakuda manyan kadarorin HV da ƙananan ƙananan |

| Girman Matsayi | Sarrafa bayyanawa a cikin yanayi maras ƙarfi | Daidaita girman bisa HV na kadari |

| Lokaci na Kasuwa | Gano wuraren shiga da fita | Yi amfani da HV don lokaci tare da sauran alamomi |