Taswirar Rayuwa ta USD/JPY

1. Fahimtar USD/JPY

Kasuwancin USD/JPY ya ƙunshi hulɗa tare da mafi girma da na uku mafi girma na tattalin arzikin ƙasa a duniya - Amurka da Japan. Sanin asali na iya haɓakawa sosai ciniki dabaru kuma suna samar da riba mai mahimmanci.

USD / JPY shi ne nau'in kudin da ke wakiltar canjin tsakanin dalar Amurka (USD) da yen Jafan (JPY). Adadin ya nuna adadin yen da ake buƙata don siyan dalar Amurka ɗaya. Yana da mahimmanci a fahimci cewa ciniki na biyu ya ƙunshi siyan kuɗi ɗaya yayin sayar da ɗayan.

a cikin Forex kasuwa, wannan biyu yana cikin mafi nauyi traded, yawanci yana fifita ƙwararru traders saboda iyawarsa volatility. Halaye mai ban mamaki na USD / JPY biyu ne ta ji na ƙwarai to swings a kasuwa ji. Yawancin lokaci, lokacin da mahalarta kasuwar suka fi ƙin haɗari, sun kasance suna karkatar da jari daga kadarorinsu masu haɗari kuma zuwa cikin amincin dalar Amurka, suna samar da daidaitattun wurare masu aminci.

Don fahimtar ƙimar ciniki USD/JPY, a trader dole ne a lissafta alamomin tattalin arziki daban-daban, gami da Babban Samfuran Cikin Gida (GDP), inflation rates, da kuma yawan riba da aka saita ta Tarayyar Tarayya da Babban Bankin Japan. Bugu da ƙari, abubuwan da ke faruwa na geopolitical na iya ƙirƙirar damar samun riba ko, idan ba a sarrafa su a hankali ba, asara.

USD / JPY na iya ba da bincike mai ban sha'awa kuma, mai yuwuwa, dama mai fa'ida a ciki Forex ciniki. Ƙarfin sa da haɗin kai zuwa manyan gidajen tattalin arziki guda biyu suna bayarwa traders faffadan damammaki. Koyaya, yana da mahimmanci a ci gaba da sabuntawa game da yanayin tattalin arziƙin ƙasashen biyu da abubuwan da ke faruwa a duniya waɗanda ke shafar tunanin kasuwa. Misali, ma'auratan an san su da iyawar sa don canzawa tare da sauye-sauye a cikin babban sha'awar kasuwa wanda aka tsara ta hanyar labaran siyasa da tattalin arziki.

Fasahar ciniki ba ta dogara ga ilimi kawai ba. Hakuri, tarbiya, hadarin gudanarwa, da ma'anar lokaci duk abubuwa ne masu mahimmanci. Sabili da haka, dabarun USD/JPY mai nasara dole ne ya zama cikakke, yana yin amfani da bincike kan fasaha, fahimtar mahimman alamun tattalin arziki, da la'akari da ra'ayin kasuwa. Don nasarar kewayawa na Forex kasuwa, zurfin fahimtar waɗannan bangarorin, tare da hana harsashi tsarin ciniki, yana da mahimmanci ga kowane trader shiga cikin kuɗin USD/JPY.

1.1. Fahimtar Biyu: USD/JPY

USD / JPY, nau'in kuɗin da ke nuna yawan yen Jafananci-yana yiwuwa a saya da ɗaya Dalar Amurka, na iya zama zaɓi mai ban sha'awa don forex traders. Ko da kuwa gaskiyar cewa waɗannan biyun suna aiki a cikin tsarin manyan ƙasashe biyu na duniya, fahimtar abubuwan da ke tattare da shi ba zai iya zama mai mahimmanci ba.

Matsakaicin musanya USD/JPY yana tsara muhimmin fage na duniya forex kasuwa. Muhimmin sifa ɗaya da ya kamata a tuna da waɗannan biyun ita ce, na musamman, Japan tattalin arziƙin tushen tattalin arziƙin waje ne. Don haka, kamfanoni na Japan akai-akai suna musayar yen su zuwa dala-wanda zai iya yin tasiri akan farashin wannan kuɗin.

Hankali ga mafi girman ra'ayin kasuwa wani sifa ce ta USD/JPY. Dalilai kamar rashin zaman lafiya na duniya ko canza sheka kayayyaki farashin zai iya haifar da gagarumin motsi a cikin farashinsa.

Yana da ban sha'awa kuma a lura cewa waɗannan biyun suna da ɗabi'a don daidaitawa da bayanan Baitulmalin Amurka. Tunda ana ganin bayanan Baitul mali a matsayin mafakar tsaro a lokutan rashin tabbas na kasuwa, duk wani hauhawar darajarsu yakan haifar da hauhawar darajar yen, saboda yawan bashin Amurka da Japan ke da shi.

Idan aka ba waɗannan sauye-sauye, dabaru forex traders haɓaka ingantaccen fahimtar alamomin tattalin arziki da yanayin kasuwa don hasashen yiwuwar sauye-sauye a cikin USD/JPY. Don haka, fahimtar zurfafawa game da wannan biyu yana da mahimmanci ga traders yayin yanke shawarar ko 'saya' ko 'sayar'. Don haka, kasuwancin kuɗi yana tafe ne a kan yanke shawara mai fa'ida dangane da cikakkiyar fahimta da kuma nazari a hankali game da halayen ma'auratan.

2. Ingantattun Dabarun Ciniki

Kasuwancin kuɗi daban-daban na buƙatar dabaru daban-daban kuma wannan zoben gaskiya ne musamman lokacin cinikin USD/JPY. Waɗannan biyun suna da tasiri sosai ta hanyar ci gaban geopolitical da tunanin kasuwa. Domin samun inganci trade wannan biyun, traders dole ne su yi amfani da dabaru iri-iri ciki har da fasaha analysis da kuma muhimmin bincike.

Binciken fasaha yana mai da hankali kan tsarin farashi da yanayin kasuwa. Kayayyakin aiki kamar layin layi, tallafi da matakan juriya, Fibonacci retracements, kuma Bollinger Makada na iya zama da amfani. Layin layi taimaka gano alkiblar kasuwa, ko haɓakawa ne, koma baya, ko ta gefe. Matakan tallafi da juriya nuna matakan farashin inda kasuwa ta tarihi ta nuna wasu matakan tallafi ko juriya. Traders ayyana waɗannan matakan don ƙirƙirar matsi trades, bugu trades, ku trades bisa bounces.

Nazarin asali a gefe guda, yayi la'akari da bayanan tattalin arziki da abubuwan da suka faru na geopolitical. Misali, canje-canjen farashin riba ta hanyar Tarayyar Tarayya ko Bank of Japan na iya tasiri sosai tsakanin USD/JPY. Abubuwan da suka faru na tattalin arziki na duniya da alamun tattalin arzikin cikin gida kamar GDP, yawan rashin aikin yi, da trade ma'auni duk na iya yin tasiri ga darajar kuɗi.

hankali tantance tunani wani mabuɗin ɗan wasa ne lokacin ciniki USD/JPY. Sau da yawa, ana ganin yen Jafan a matsayin amintaccen kudin waje, don haka a lokutan rashin tabbas na tattalin arzikin duniya ko rashin zaman lafiya, yen na iya samun riba yayin da USD na iya raunana.

Rungumar waɗannan dabarun - bincike na fasaha, bincike na asali, da nazarin jin dadi - na iya taimakawa traders kewaya keɓaɓɓen halayen USD/JPY biyu. Kula da waɗannan abubuwan da amfani da cikakkun dabaru na iya haifar da nasara trades. Ka tuna, kowace dabara tana ɗaukar lokaci da aiki don aiwatarwa yadda ya kamata.

2.1. Dabarar Cinikin Rana

A duniyar Forex, Kasuwancin rana shine dabarun tursasawa, musamman tasiri ga nau'i-nau'i na kasuwanci kamar USD/JPY. Ciniki na rana na iya ba da riba mai kyau idan an san yanke shawara da ƙididdige su. Fahimtar kasuwa ya zama tushen wannan dabara; traders na buƙatar bin labaran duniya sosai, neman abubuwan da za su iya rinjayar farashin musayar kuɗi. Rahoton bayanan tattalin arziki, al'amuran siyasa da labarai na kuɗi na iya yin tasiri sosai akan ƙimar USD/JPY.

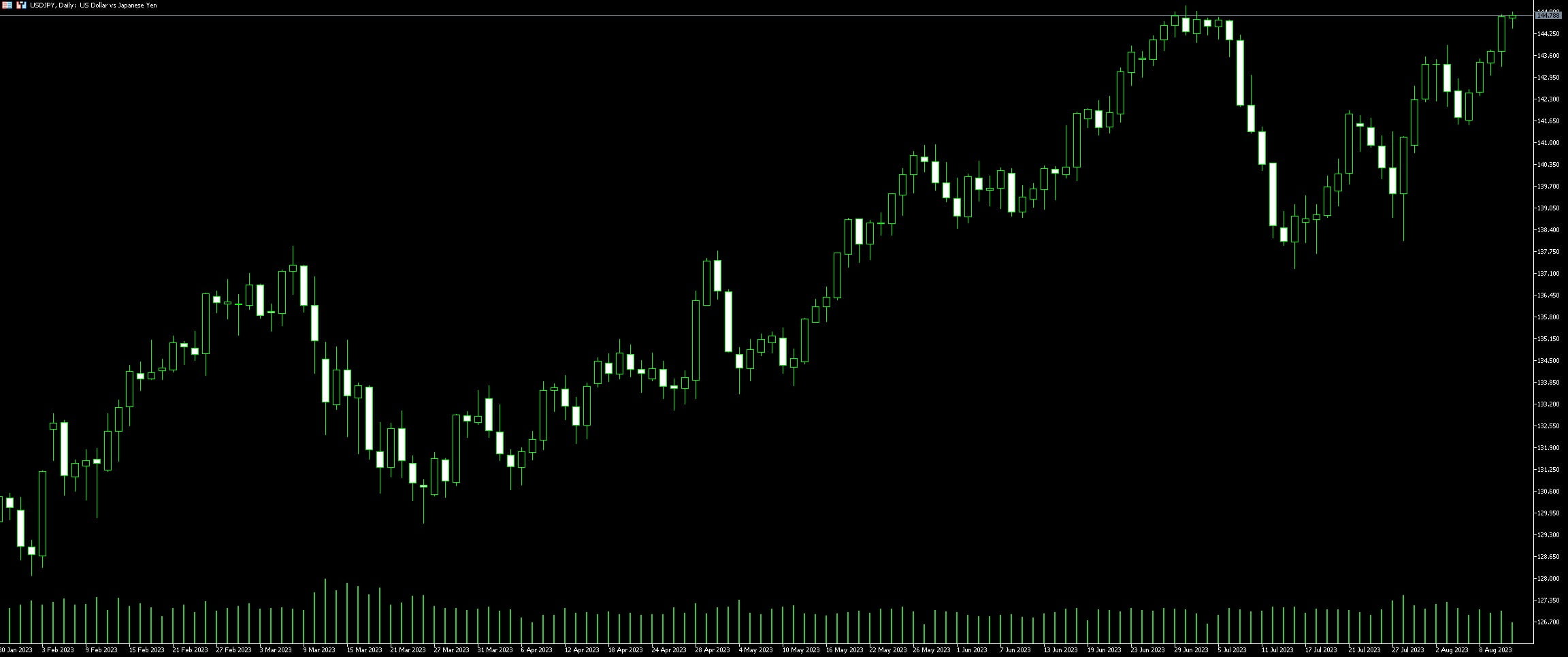

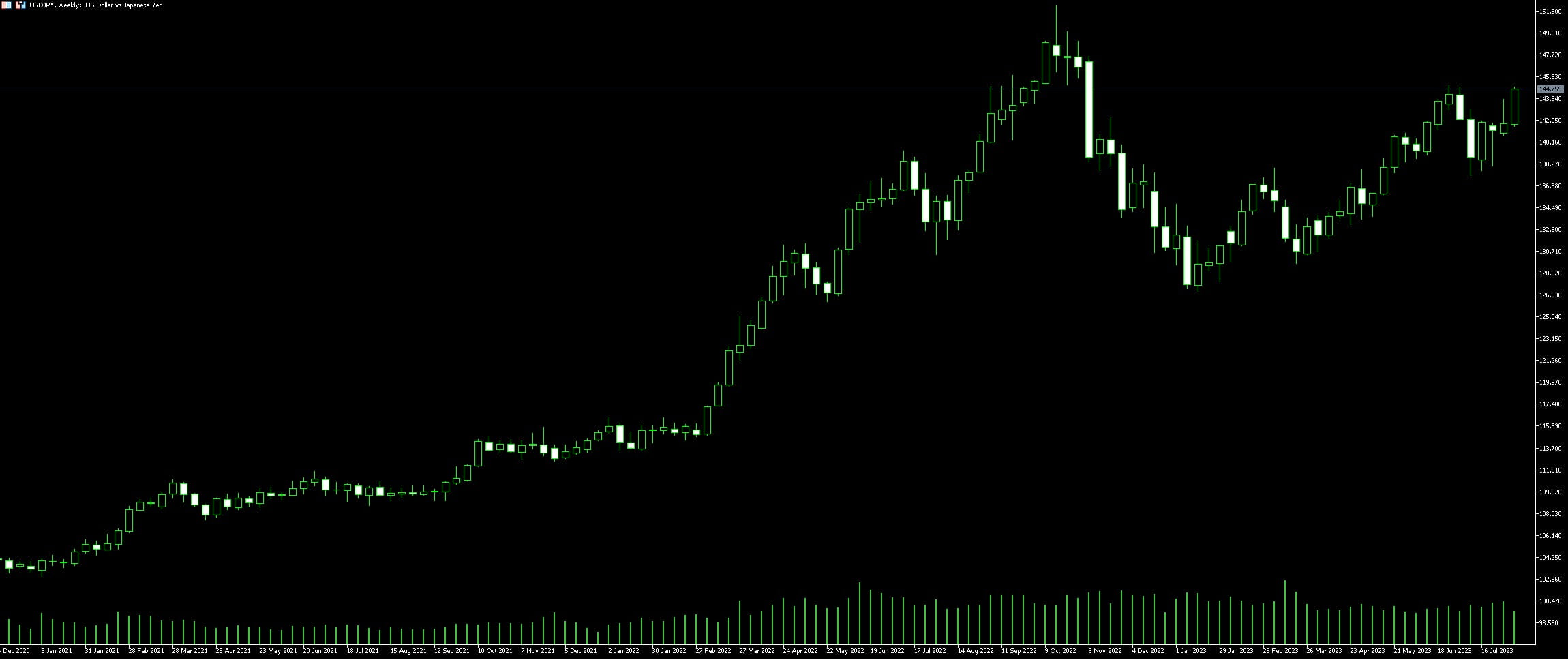

Lokacin tsara dabarun ciniki na rana don USD/JPY, la'akari da lokaci. Ranar al'ada trade yana ƙasa da kwana ɗaya don tsabar kuɗi akan saurin canjin kasuwa. Zaɓi tsarin lokaci wanda ke nuna matakin jin daɗin ku. Mai sauri lokacinta traders, alal misali, na iya tafiya taswira na mintuna biyar, yayin da ake ci gaba traders na iya zaɓar na sa'a, awa huɗu, ko jadawalin yau da kullun.

fasaha analysis muhimmin bangare ne na dabarun ciniki na yau da kullun. Yana nuna alamun farashi, samar da shigarwa da wuraren fita don haɓaka riba. Kayan aiki kamar ƙirar fitila, tallafi da matakan juriya, da alamun fasaha kamar Matsakaicin Matsakaicin Canzawa (MACD) da Dangi Ƙarfin Index (RSI) zai iya ƙarfafa yanke shawara.

A ƙarshe, kiyaye a daidaitaccen rabo-lada mai haɗari kuma m tasha-hasara umarni - umarni mai sarrafa kansa wanda ke rufe wuraren ciniki lokacin da farashin ya kai matakin da aka ƙayyade - garkuwa daga hasara mai yawa. Wannan yana tabbatar da a trader ci gaba da trade wata rana, ko da abubuwa sun yi tsami.

Yana da kyau a lura cewa yayin da wannan hanyar za ta iya samun riba, saurin saurinsa da yuwuwar hasara mai yawa na iya sa ta zama mara dacewa ga kowa. Don haka, ba tare da gajiyawa ba yin aiki akan ingantaccen dabarun ciniki na yau da kullun shine mabuɗin don juriyar aiki da ci gaba mai dorewa.

2.2. Dabarar Cinikin Swing

Kasuwancin Swing yana aiki a ƙarƙashin yanayin cewa haɓaka a kasuwannin hada-hadar kudi suna zagaye-zagaye, kuma wato, cewa wadannan zagayawa suna iya tsinkaya. Ko da yake ya fi guntu akan tsarin lokaci fiye da dabarun saka hannun jari na dogon lokaci, dabarun ciniki har yanzu yana buƙatar digiri na haƙuri, horo, da ingantaccen nazari. Kudin USD/JPY, tare da haɓaka liquidity da ƙananan yadawa, filin ne mai kyau don aiwatar da dabarun ciniki na lilo.

Yin amfani da kayan aikin nazari da yawa don ganowa trends a cikin motsin farashi yana da mahimmanci a cikin wannan tsarin ciniki. Kayan aiki kamar Fibonacci Retracement da kuma motsi Average Banbancin Haɗuwa (MACD) yana aiki don gano yiwuwar shigarwa da wuraren fita, yana haifar da ingantaccen damar ciniki. Duban ginshiƙi na USD/JPY na dogon lokaci yana nuna yanayin hawan keke wanda ke juyawa traders daukan advantage na.

Ta hanyar sanya a saya oda a wani ƙananan matsayi a cikin yanayin da kuma a sayarda oda a matsayi mai girma, traders yana nufin haɓaka riba da rage hasara. Koyaya, mahimman halayen dabarun ciniki na lilo shine sanin lokacin da ya kamata fita kasuwa. Idan ba tare da matakan riga-kafi ba, ana iya ɗaukar mutum cikin sauƙi ta hanyar karkatar da kasuwa cikin sauri zuwa akasin shugabanci.

Ci gaba a tsarin gudanar da haɗari wani muhimmin sashi ne na kowane dabarun ciniki. Ƙaddamar da 'dakatar da asarar' da 'cibi' riba' rata yana taimakawa wajen iyakance yuwuwar asara da kare riba. Haɗa waɗannan dabarun zai tabbatar da ingantaccen dabarun ciniki na USD/JPY.

Yin amfani da tushen kasuwa kusa da fasaha analysis damar traders don hango ko hasashen yiwuwar Trend swings. Manufofin tattalin arziki kamar alkaluman Babban Samfuran Cikin Gida (GDP), ƙimar riba, da al'amuran siyasa suna tasiri sosai tsakanin USD/JPY. Sanin abubuwan tattalin arziki masu zuwa na iya tabbatar da tallavantageous, taimaka hango ko hasashen yiwuwar kasuwar ƙungiyoyi. Haɗin waɗannan ƙa'idodin a cikin dabarun kasuwancin ku na lilo zai ƙarfafa yuwuwar ribar da kuma kariya daga asarar da ba ta dace ba.

3. Haɓaka Ƙwarewar Kasuwanci

Aiwatar da dabarun ciniki mai nasara Yana da mahimmanci idan aka zo ciniki USD/JPY. Cikakken fahimtar kasuwa, tare da tsarin nazari muhimmanci inganta ciniki basira. Mabuɗin alamun da za a kallo sun haɗa da lambobin GDP, yanke shawarar ƙimar riba, da ƙididdiga na aiki. Wannan bayanan, wanda ake samu a kalandar tattalin arziki, yana taimakawa wajen hasashen yuwuwar motsi a cikin biyun.

Yin nazarin ayyukan da suka gabata shima yana taimakawa wajen hasashen abubuwan da zasu faru nan gaba. Jadawalin tarihi ba da haske mai mahimmanci ga ƙwararru traders, ba da damar hango halayen ma'auratan a ƙarƙashin yanayin tattalin arziki daban-daban. Haɓaka ikon fassara waɗannan ginshiƙi yana gabatar da tallavantagemu yi tsalle a cikin tafiyar ciniki.

Har ila yau, yin amfani da maganin rigakafi kayan aikin bincike na fasaha, kamar ra'ayin kasuwa, matsakaicin motsi, da oscillators, yana kaifin fatauci. Waɗannan kayan aikin suna taimakawa wajen nuna yuwuwar shigarwa da wuraren fita, da sarrafa shawarwarin ciniki yadda ya kamata.

Hakanan yana da kyau a shiga cikin ilimin ƙwararru traders. Dandalin tattaunawa da dandalin ciniki na zamantakewa wurare ne masu kyau don samun hikima daga waɗanda suka haɓaka ƙwarewarsu akan lokaci. Abubuwan da aka raba anan suna aiki azaman ƙarin ilimi, wadatar novice traders tare da ilimin farko.

A ƙarshe, akai akai tabbatar da waɗannan dabaru da dabaru. Mafi yawan brokers bayar da asusun demo wanda ke daidaita yanayin kasuwancin gaske, yana ba da kyakkyawan yanayi don yin aiki ba tare da haɗarin ainihin babban birnin ba. Ta hanyar aiwatar da daidaitattun ayyuka, traders suna haɓaka dabara mai ƙarfi, suna samun ƙwarewa a cikin yin shawarwari kan ƙimar kasuwar USD/JPY.

3.1. Kwarewa Ta hanyar Demo Accounts

Kware da yanayin kasuwancin USD/JPY ta hanyar nutsar da kanku a cikin yanayin ciniki wanda aka kwaikwayi. Demo ciniki asusun bayar da dandamali inda farkon-lokaci traders na iya haɓaka ƙwarewarsu, haɓaka dabara, da sanin kansu da canjin kasuwa-duk ba tare da haɗarin babban jari ba.

Yi la'akari da halayen ciniki na USD/JPY. Yi motsin ku a cikin sa'o'in kasuwar Asiya, lokacin da ya fi dacewa ya zama mara ƙarfi. Kasancewa daya daga cikin mafi traded tsabar kudi nau'i-nau'i a cikin Forex kasuwa, asusun demo yana ba da dama ta musamman don fahimtar yadda ma'auratan USD/JPY ke ɗaukar labaran tattalin arziki da ke fitowa daga manyan ƙasashe na duniya, a tsakanin sauran abubuwa.

Dabarun nazarin kasuwa fasaha ce mai mahimmanci wanda kowane trader ya kamata. Asusun Demo yana gayyatar ku don ganowa kuma ku kware duka dabarun bincike na asali da fasaha. Babban bincike priori yana magance abubuwa kamar fitar da bayanan tattalin arziki da al'amuran siyasa, yayin da bincike na fasaha duk game da nazarin yanayin kasuwan da ya gabata don kwatanta halayen farashi na gaba.

Ikon yin aiki tradeYin amfani da kuɗaɗen ƙira a cikin yanayin kasuwa na ainihin lokaci yana da fa'ida musamman don fahimta yin amfani da kuma sauran forex- takamaiman ra'ayoyi. Leverage ya shafi lamuni da aka bayar broker zuwa trader, yana ba ku damar buɗe wuraren da suka fi girma a cikin asusunku. Yin amfani da alhaki yana da mahimmanci saboda yana iya haɓaka duka riba da asara.

Yi bayanin cewa hakuri da daidaito suna da mahimmanci lokacin ciniki USD/JPY koda a cikin saitin demo. Manufar ba ita ce gaggauwa da samun riba ba, amma don haɓaka salon ciniki da dabarun da ke ba da sakamako akai-akai.

3.2. Cigaba da Samun Labaran Kasuwa

A cikin fannin ciniki na kuɗi biyu, da sanin yakamata labarin kasuwa yana da matukar mahimmanci. Musamman ma, yayin da ake mu'amala da ma'amala da ma'aikata biyu masu aiki kamar USD/JPY, duka dalar Amurka (Dalar Amurka) da JPY (Yen na Japan) suna da alaƙa sosai ga al'amuran tattalin arzikin ƙasashensu. Ayyukan waɗannan tattalin arziƙin galibi suna yin tasiri kai tsaye ga canjin farashin ma'aurata.

Ciniki da USD / JPY yana nuna wani abu kamar karanta tatsuniyar garuruwa biyu. Traders dole ne a ci gaba da sa ido kan yanayin tattalin arziki na manyan kasashe biyu na duniya - Amurka da Japan. Sakin manyan bayanai kamar kididdigar aikin yi, alkaluman hauhawar farashin kayayyaki, babban abin da ake samu a cikin gida (GDP), ko shawarar kuɗin ruwa na babban bankin zai iya haifar da gagarumin motsi a cikin canjin USD/JPY. Kowane ɗayan waɗannan bayanan yana samar da wani muhimmin sashi na labarai na kasuwa, yana buƙata traders' hankali.

Tsayawa gaba da ainihin-lokaci labarai updates bayar traders da advantageos ma'ana. Juyawa, juye-juye kwatsam, ko karyewar tsarin suna zama da sauƙin fahimta tare da wannan fahimtar. Yana da kamar ajiye kunne ga ƙasa a cikin sararin shimfidar wuri na Forex ciniki.

Baya ga wannan, da yanayin siyasa Hakanan yana ƙara zuwa labarai na kasuwa suna taka muhimmiyar rawa a kasuwancin USD/JPY. Zaɓuɓɓuka, tashin hankalin siyasa, canje-canjen siyasa, ko al'amuran siyasa da ba zato ba tsammani na iya haifar da rashin daidaituwa a cikin kuɗin musanya. Saboda haka, kiyayewa ya zama al'ada mai mahimmanci don traders yana son samun nasara aiki a cikin cinikin USD/JPY.

Bugu da ƙari, rikice-rikice na duniya ko abubuwan da ke haifar da ra'ayin haɗari na iya haifar da traders don saka hannun jari a cikin amintattun agogo kamar Yen na Japan. A cikin waɗannan lokutan, sanin abubuwan taimako na labarai na kasuwa a cikin yanke shawara akan lokaci, don haka haɓaka yuwuwar yuwuwar riba a kasuwancin USD/JPY.

A taƙaice, ko ɗan takara akan Wall Street ko matsakaicin dillali trader, fahimta, nazari, da tura labaran kasuwa a cikin kasuwancin USD/JPY ba kawai wanda aka fi so ba amma mahimmanci, tsara dabarun ciniki da yanke shawara.

4. Kwarewar Babban Ra'ayi

Shiga fagen ciniki na USD/JPY yana buƙatar fahimta mai ƙarfi game da abubuwan da suka ci gaba. Yayin nazarin fasaha da bincike na asali sa ginshiƙi, aikace-aikace na ci-gaba theories damar da trader wani gefe a cikin wannan kasuwa mai fa'ida sosai.

Intermarket Analysis yana taimakawa sosai lokacin da ake mu'amala da nau'ikan kuɗi kamar USD/JPY. Tasirin sauye-sauye na canje-canje tsakanin sassa daban-daban kamar shaidu, kayayyaki da ãdalci na iya yin tasiri ga darajar kuɗi. Alal misali, canje-canje a cikin haɗin gwiwar Amurka suna karkatar da jagorancin USD/JPY akai-akai.

Wani makami mai ƙarfi a cikin a trader's arsenal shine fahimtar juna Indicators na tattalin arziki. Dukansu manufofin Japan da Amurka na iya yin tasiri sosai ga nau'in kuɗin. Ido mai kula da ƙimar aikin yi, GDP, ƙimar riba, da sauran alamomin tattalin arziki na taimakawa wajen hango abubuwan da ke faruwa da motsi.

Abubuwan Geopolitical Hakanan yana da iko mai mahimmanci akan USD/JPY. Tasirin wani lamari na siyasa sau da yawa yana nan da nan kuma mai tsanani. Trade yaƙe-yaƙe, rikice-rikice na yanki ko sauye-sauyen siyasa, waɗannan al'amura na iya haifar da hauhawar farashin kayayyaki a wasu lokuta.

A ƙarshe, mabuɗin don cin nasara ciniki shine Ilimin halin dan Adam na Kasuwanci. Yana da mahimmanci a kiyaye haƙiƙa, sarrafa motsin rai don yanke shawarar ciniki mai kyau. Kai tsaye a tradeBabban abokin, yana ba da kwanciyar hankali a cikin rudanin kasuwa.

Kowane ra'ayi na ci gaba kayan aiki ne, wanda idan aka yi amfani da shi da wayo, yana taimakawa wajen tsinkayar motsin USD/JPY. Ƙwarewar waɗannan ka'idodin suna inganta a tradeayyukan r, suna share hanyar samun nasara.

4.1. Fahimtar Ƙarfafawa a cikin USD/JPY

A cikin frenetic duniya na forex ciniki, ɗayan biyu yana da suna don kasancewa musamman mara tabbas: USD / JPY. Haɗin kai dalar Amurka da Yen Jafananci sananne ne saboda rashin ƙarfi, saboda yanayin tattalin arziƙin ƙasashen biyu. A matsayinsa na farko da na uku mafi girma na tattalin arziki a duniya, sauye-sauye a cikin waɗannan biyun na iya haifar da abubuwa da yawa.

volatility yana nufin ƙimar bambancin farashin ciniki na kayan aikin kuɗi. Babban matakan suna nuna cewa farashin na iya canzawa sosai a cikin ɗan gajeren lokaci, mai yuwuwar wakiltar babbar dama ga forex traders. Duk da haka, babban rashin ƙarfi kuma yana nufin haɗari mafi girma. Biyu USD/JPY suna baje kolin sifa mai ban sha'awa inda canjin sa ya bambanta dangane da lokacin rana.

Akin ga sauran forex nau'i-nau'i, ciniki na USD/JPY ya fi canzawa yayin tsaka-tsakin zaman Asiya da London. Wannan shi ne lokacin da duka biyun tattalin arzikin suka taru a cikin kasuwancin duniya wanda ke haifar da saurin farashin farashi. Sabanin haka, ma'auratan suna son daidaitawa yayin zaman Asiya saboda matsayin Japan a matsayin a babban cibiya don forex tsarin ciniki.

Bugu da ƙari, rashin daidaituwar USD/JPY yana tasiri ta hanyar mahimman bayanan tattalin arziki kamar ƙimar riba, rashin aikin yi, da alkaluman GDP na Japan da Amurka. hankali wannan dangantaka tsakanin bayanan tattalin arziki da rashin daidaituwa yana da mahimmanci ga kowa trader neman yunƙurin yin cinikin wannan biyun.

Halaye ɗaya na musamman game da USD/JPY shine azancin sa ga al'amuran geopolitical na duniya, wanda zai iya ƙara haɓaka. Misali, ana yawan ganin ma'auratan a matsayin "mafi aminci" a lokutan rashin tabbas na tattalin arzikin duniya, wanda ke nufin zai iya jawo sha'awar ciniki mai girma kuma saboda haka, rashin daidaituwa.

Kusan a juzu'i, waɗannan abubuwan da ke sanya USD/JPY su zama nau'i-nau'i masu canzawa sosai kuma suna ba da damar ciniki na musamman. Mai kwazo forex trader, dauke da cikakken bincike, kayan aikin da suka dace, da kyakkyawar fahimtar waɗannan masu canji, na iya amfani da waɗannan sauye-sauyen farashin don amfanin su.

4.2. Kasuwancin Maɗaukaki Mai Girma (HFT)

Lokacin zurfafa zurfafa cikin nuances na ciniki USD/JPY, manufar Harkokin Kasuwanci mai Girma (HFT) ya zama babba. HFT yana amfani da manyan algorithms da ikon sarrafa kwamfuta zuwa trade da sauri, sau da yawa ya haɗa da yawa trades a cikin ɓangarorin daƙiƙa guda. Yawanci, waɗannan trades nufin kama ƙaramin riba amma yana faruwa a irin wannan adadi mai yawa wanda zai iya haifar da riba mai yawa gabaɗaya.

Don aiwatar da dabarun HFT, traders kuma sun dogara da cibiyoyin bayanai da ke kusa da mu'amalarsu gwargwadon yiwuwa. Wannan yana rage jinkirin lokaci kuma yana ba da izinin ciniki cikin sauri. Misali, USD/JPY trader na iya amfani da dabarun HFT don yin amfani da rarrabuwar kawuna na ɗan lokaci a cikin ƙimar ma'aurata tsakanin musayar, aiwatarwa. trades a kusa-ainihin lokaci.

Wani bangare na HFT a cikin kasuwancin USD/JPY ya ƙunshi amfani da tsinkaya algorithms. Waɗannan Algorithms suna nazarin bayanan tarihi da na kasuwa na ainihi, suna hasashen sauye-sauyen ƙimar kuɗin kuɗin kafin su faru. Traders aiwatar da HFT tare da algorithms tsinkaya suna amfani da waɗannan damar, sayayya ko siyar da ɗaiɗaikun USD/JPY cikin sauri don ƙarin ribar da za ta iya tarawa cikin lokaci.

Duk da waɗannan tallanvantages, yana da kyau a lura cewa HFT ba dabarun ciniki ba ne. HFT na iya haifar da walƙiya ya fado- ba zato ba tsammani, raguwar ƙima a cikin ƙimar kuɗi saboda tsananin aikin siyarwa. Wannan na iya zama mai mahimmanci musamman yayin ciniki nau'i-nau'i na kuɗi masu canzawa kamar USD/JPY. Traders dole ne, don haka, yi amfani da kayan aikin sarrafa haɗari da dabarun, gami da odar tasha-asara da ƙayyadaddun umarni, don kiyayewa daga yuwuwar asara yayin saurin canjin kasuwa.