1. Bayani na RSI Divergence

The Dangi Ƙarfin Index (RSI) Bambance-bambance ra'ayi ne da ake amfani da shi traders da masu saka hannun jari don gano yuwuwar koma baya a yanayin kasuwa. Ya haɗu da ra'ayoyin RSI, a lokacinta oscillator wanda ke auna saurin gudu da canjin farashin farashi, tare da ka'idar rarrabuwar kawuna, yanayin da farashin kadari ke motsawa a kishiyar alamar fasaha. Wannan sashe yana nufin gabatar da masu farawa zuwa RSI Divergence, yana bayyana abubuwan da ya dace, yadda yake aiki, da mahimmancinsa a ciniki.

1.1 Menene RSI?

Kafin nutsewa cikin rarrabuwar RSI, yana da mahimmanci a fahimci Ƙarfin Ƙarfi (RSI) kanta. J. Welles Wilder Jr. ya haɓaka shi a cikin 1978, RSI shine oscillator mai saurin gaske wanda ke tashi daga 0 zuwa 100 kuma ana amfani dashi don auna yanayin da aka yi fiye da kima ko sama da ƙasa a farashin kadari. Fassarar gama gari ita ce ana ɗaukar kadara an yi sama da ƙera a lokacin da RSI ta kai sama da 70 kuma ana sayar da ita a ƙasa da 30.

1.2 Fahimtar Bambance-bambance

Bambance-bambancen yana faruwa lokacin da farashin kadari ke motsawa a kishiyar alamar fasaha ko wani wurin bayanai. A cikin mahallin RSI, bambance-bambance na iya zama sigina mai ƙarfi wanda ke nuna cewa yanayin farashin na yanzu na iya raunana kuma mai yuwuwar juyawa zai iya kasancewa a sararin sama.

- Banbancin Bullish: Wannan yana faruwa a lokacin da farashin ya haifar da ƙananan ƙananan, amma RSI yana samar da ƙananan ƙananan. Yana nuna cewa yayin da farashin ke faɗuwa, saurin ƙasa yana raguwa, yana nuna yuwuwar komawa sama.

- Bambancin Bambanci: Sabanin haka, bambance-bambancen bearish yana faruwa lokacin da farashin ya kai matsayi mafi girma, amma RSI yana yin ƙananan ƙananan. Wannan alamun cewa duk da karuwar farashi, ci gaba mai sama yana faduwa, wanda zai iya haifar da juyawa zuwa ga juyawa.

1.3 Muhimmancin Rarraba RSI a Kasuwanci

RSI bambance-bambance yana da ƙima ta traders saboda dalilai da yawa:

- Ƙimar Hasashen: Yana iya ba da alamun gargaɗin farko na yuwuwar juyewar yanayi, ƙyale traders don daidaita matsayin su daidai.

- hadarin management: Ta hanyar gano yiwuwar koma baya da wuri, traders na iya saita asarar tasha mai ƙarfi da sarrafa haɗarin su yadda ya kamata.

- versatility: Za a iya amfani da bambancin RSI a cikin yanayi daban-daban na kasuwa kuma ya shafi kayan aikin kuɗi da yawa, ciki har da hannun jari, forex, kayayyaki, da cryptocurrencies.

| Feature | description |

| Nau'in Nuni | Lokacin Oscillator |

| Babban Manufa | Gano yuwuwar juye-juye ta hanyar gano bambance-bambance tsakanin motsin farashi da karatun RSI. |

| Matakan gama gari | An Siya (> 70), Oversold (<30) |

| Nau'in Banbanci | Bullish (Farashin ↓, RSI ↑), Bearish (Farashin ↑, RSI ↓) |

| Applicability | Hannun jari, Forex, Kayayyaki, Cryptocurrencies |

| Muhimmanci | Ƙimar tsinkaya don juyawa, sarrafa haɗari, haɓaka |

2. Tsarin Lissafi na RSI

Fahimtar lissafin da ke bayan Ƙarfin Ƙarfin Ƙarfi (RSI) da kuma gano bambance-bambance yana buƙatar mataki-mataki mataki. Wannan sashe yana rushe tsarin zuwa sassa masu iya sarrafawa, yana tabbatar da cewa masu farawa zasu iya fahimtar yadda ake lissafin RSI kuma daga baya su gane siginar bambance-bambance. RSI da kanta ita ce oscillator mai saurin gaske, yana auna gudu da canjin motsin farashi a cikin takamaiman lokaci, yawanci kwanaki 14.

2.1 Lissafin RSI

Lissafin RSI ya ƙunshi matakai da yawa, yana mai da hankali kan matsakaicin riba da asara a cikin ƙayyadadden lokaci, bisa al'ada an saita zuwa lokuta 14. Anan ga sauƙin warwarewa:

- Zaɓi LokaciMatsakaicin lokacin lissafin RSI shine 14, wanda zai iya zama kwanaki, makonni, ko kowane lokaci trader zabi.

- Yi lissafin Matsakaicin Riba da Asara: Don lokacin da aka zaɓa, ƙididdige matsakaicin duk riba da asara. A lissafin farko, kawai a taƙaita duk ribar da aka samu, sannan a raba da lokacin (14).

- Sauƙaƙe Lissafin: Bayan an kididdige matsakaicin riba da asara na farko, ana daidaita lissafin da ke gaba ta hanyar ɗaukar matsakaicin da ya gabata, a ninka shi da 13, a ƙara riba ko asarar da ake samu a yanzu, sannan a raba jimlar da 14.

- Ƙirƙiri Ƙarfin Ƙarfi (RS): Wannan shine rabon matsakaicin riba zuwa matsakaiciyar asara.

- Yi lissafin RSI: Yi amfani da dabara (RSI = 100 - \frac{100}{1 + RS}), inda RS shine Ƙarfin Dangi.

| Mataki | description |

| 1. Zaɓi Lokaci | Yawanci lokuta 14; ƙayyade lokacin lissafin RSI. |

| 2. Matsakaicin Riba/Asara | Yi ƙididdige matsakaicin duk riba da asara a tsawon lokacin. |

| 3. Lissafi mai laushi | Yi amfani da matsakaita na baya don ci gaba da sabunta RSI, daidaita bayanai. |

| 4. Yi lissafin RS | Matsakaicin matsakaicin riba zuwa matsakaicin hasara. |

| 5. Lissafin RSI | Aiwatar da dabarar RSI don tantance ƙimar mai nuna alama. |

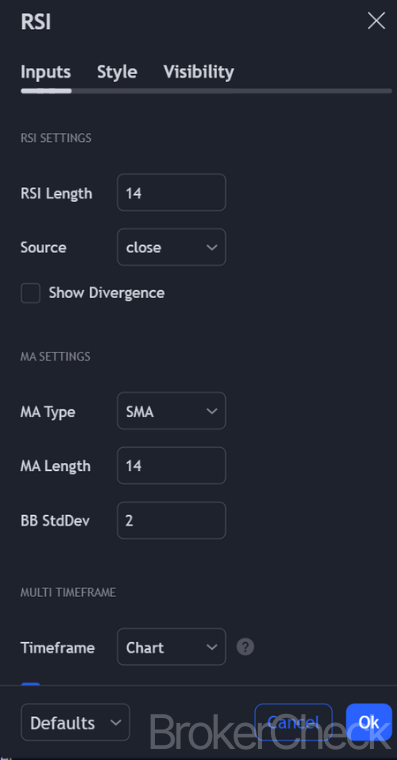

3. Ingantattun Darajoji don Saita a cikin Tsarukan Lokaci daban-daban

Zaɓin mafi kyawun ƙima don RSI saitin lokaci daban-daban yana da mahimmanci don haɓaka tasirin sa a ciki ciniki dabaru. Wannan sashe yana jagorantar masu farawa ta hanyar zaɓar mafi kyawun sigogi don RSI da fahimtar yadda waɗannan zaɓuɓɓuka ke tasiri aikin mai nuna alama a cikin yanayin kasuwa daban-daban.

3.1 Daidaitaccen Saitunan RSI

Madaidaicin saiti don Ƙarfin Ƙarfi (RSI) shine lokuta 14, wanda yake da yawa kuma ana amfani dashi a cikin yawancin kadarori da lokutan lokaci. Koyaya, daidaita lokacin zai iya daidaita ma'aunin hankali:

- Gajerun lokuta (misali, 9 ko 10): Ƙara hankali, sa RSI ya fi mayar da hankali ga canje-canjen farashin. Wannan yana da fa'ida ga ciniki na ɗan gajeren lokaci ko ƙwanƙwasa, saboda yana iya haskaka yanayin gajeriyar lokaci da juyawa da sauri.

- Tsawon lokaci (misali, 20 ko 25): Rage hankali, daidaita juzu'i na RSI. Wannan tsarin ya dace da dabarun ciniki na dogon lokaci, yana ba da ƙarin haske game da alkiblar gaba ɗaya ba tare da hayaniyar farashin ɗan gajeren lokaci ba.

3.2 Daidaita lokaci daban-daban

Mafi kyawun saitunan RSI na iya bambanta dangane da lokacin ciniki:

- Kasuwancin Rana (Gajeren lokaci): Don rana traders, ta yin amfani da ɗan gajeren lokacin RSI (misali, 9 zuwa 10) na iya zama mafi inganci. Wannan saitin yana taimakawa ɗaukar sauri, ƙungiyoyi masu mahimmanci, kamar waɗannan traders sun fi sha'awar aikin farashin ɗan gajeren lokaci.

- Kasuwancin Swing (Matsakaicin lokaci): Swing traders na iya samun daidaitaccen lokaci na RSI na 14 ko ɗimbin da aka daidaita (misali, 12 ko 16) mafi dacewa. Waɗannan saitunan suna ba da ma'auni tsakanin hankali da ikon tace hayaniyar kasuwa, daidaitawa da kyau tare da yanayin matsakaicin lokacin ciniki.

- Kasuwancin Matsayi (Dogon lokaci): Domin matsayi traders, tsawon lokacin RSI (misali, 20 zuwa 25) na iya samar da mafi kyawun sigina. Waɗannan saitunan suna rage hankalin RSI zuwa canje-canjen farashi na ɗan gajeren lokaci, suna mai da hankali kan ƙarfin halin da ake ciki da kuma bayar da ƙarin sigina don daidaitawa matsayi na dogon lokaci.

3.3 Gano Bambance-bambance a Tsare-tsare Mabambanta

Gano bambance-bambancen RSI shima ya dogara da zaɓin lokaci da saituna:

- Tsare-tsare na gajeren lokaci: Ana buƙatar ƙarin saka idanu akai-akai da saurin amsawa ga sigina daban-daban, idan aka ba da ƙarar hayaniyar kasuwa da mafi girman adadin siginar ƙarya.

- Tsare-tsare na Tsawon Lokaci: Alamun rarrabuwar kawuna gabaɗaya sun fi dogaro amma suna faruwa ƙasa akai-akai. Traders yana buƙatar yin haƙuri kuma yana iya amfani da ƙarin kayan aikin tabbatarwa don tabbatar da siginar rarrabuwa kafin ɗaukar mataki.

3.4 Nasihu masu Aiki don Ƙirƙirar Rarraba RSI

- Gwaji tare da Saituna: Traders yakamata suyi gwaji tare da lokutan RSI daban-daban don nemo mafi kyawun saitin da ya dace da salon kasuwancin su da kuma volatility daga cikin kadarorin da suke ciniki.

- Yi amfani da Ƙarin Tabbatarwa: Ba tare da la'akari da ƙayyadaddun lokaci ba, yin amfani da ƙarin alamomi ko dabarun bincike don tabbatarwa na iya haɓaka amincin siginar rarrabuwa.

- Yi la'akari da Yanayin Kasuwa: Tasirin takamaiman saitunan RSI na iya bambanta a cikin yanayin kasuwa daban-daban (misali, masu tasowa vs. kasuwanni masu iyaka), don haka yana da mahimmanci don daidaita saitunan dangane da yanayin kasuwa na yanzu.

| Salon Ciniki | Shawarwari Lokacin RSI | Advantages | sharudda |

| Day Trading | 9-10 | Mai sauri don amsawa, yana ɗaukar motsi na ɗan lokaci | Mafi girman yuwuwar siginar ƙarya |

| Swing Trading | 12-16 | Daidaita hankali da tace surutu | Yana buƙatar kulawa a hankali da daidaitawa |

| Matsayi Kasuwanci | 20-25 | Tace amo na ɗan gajeren lokaci yana mai da hankali kan abubuwan da ke faruwa | Alamun na iya zuwa a makara; yana bukatar hakuri |

4. Fassara da Aiwatar da Siginonin Rarraba RSI

Fassara da amfani da siginonin bambance-bambancen RSI daidai yana da mahimmanci ga traders suna neman yin amfani da wannan alamar don gano yuwuwar juyewar yanayi. Wannan sashe yana nufin jagorantar masu farawa ta hanyar fassarar siginonin RSI da yadda ake amfani da su yadda ya kamata a cikin yanke shawara na kasuwanci.

4.1 Fahimtar Siginonin Rarraba RSI

Siginonin Rarraba RSI sun zo cikin nau'ikan farko guda biyu: rarrabuwar kawuna da rarrabuwar kawuna, kowanne yana nuna yuwuwar juyewa a yanayin halin yanzu.

- Banbancin Bullish: Yana faruwa lokacin da farashin ya rubuta ƙananan ƙananan, amma RSI yana nuna ƙananan ƙananan. Wannan yana nuna raunin ƙasa da kuma yuwuwar juyewar yanayin sama mai zuwa.

- Bambancin Bambanci: Yana faruwa lokacin da farashin ya sami matsayi mafi girma, amma RSI yana nuna ƙananan ƙananan. Wannan yana nuna cewa hawan hawan sama yana raguwa, mai yuwuwar haifar da koma baya ga koma baya.

4.2 Aikace-aikace a cikin Dabarun Kasuwanci

Aiwatar da siginonin RSI a cikin dabarun ciniki ya ƙunshi matakai masu mahimmanci da yawa:

- Gano Sigina: Na farko, gano bambancin bambanci tsakanin aikin farashin da karatun RSI. Wannan yana buƙatar bambance-bambancen bayyane a cikin jagorancin farashin da kuma layin RSI.

- Tabbacin: Nemo ƙarin tabbaci na juyawar yanayin. Wannan na iya zama jujjuya tsarin kyandir, fita daga layin da aka yi, ko tabbaci daga wani mai nuna alama.

- Wurin Shiga: Ƙayyade wurin shigarwa bisa ga siginar tabbatarwa. Traders sau da yawa suna jira takamaiman ƙirar kyandir don kammala ko don farashi ya karya wani matakin kafin shigar da a trade.

- Tsaida Loss da Riba: Saita asara tasha don gudanar da haɗari, yawanci a ƙaramin ƙarami ko babba kafin siginar rarrabuwa. Za a iya saita matakin riba bisa mahimmin juriya ko matakan tallafi, ko amfani da rabon sakamako mai haɗari wanda ya yi daidai da tradedabarun r.

4.3 Misalai Masu Aiki

- Misalin Banbanci Mai Girma: Ka yi la'akari da wani labari inda farashin hannun jari ya ragu zuwa sabon ƙananan, amma RSI yana samar da ƙananan ƙananan. Idan wannan yana biye da tsarin kyandir mai ruɗewa, a trader na iya shigar da matsayi mai tsawo a kusa da kyandir, saita asarar tasha a ƙasa da ƙananan ƙananan kwanan nan da riba mai riba a matakin juriya na baya ko ta amfani da 2: 1 hadarin sakamako rabo.

- Misalin Bambancin Bambanci: Sabanin haka, idan farashin hannun jari ya kai wani sabon matsayi tare da RSI yana samar da ƙananan ƙananan kuma yana biye da tsarin kyandir mai jujjuyawar bearish, wannan na iya nuna alama mai kyau don shigar da ɗan gajeren matsayi. The trader zai saita asarar tasha sama da mafi girma na baya-bayan nan da karɓar riba a matakin tallafi da aka sani ko dangane da abubuwan da suka fi so.

| Mataki | description |

| Gano Sigina | Nemo bambance-bambance tsakanin rahusa farashin / highs da RSI lows / high nuna bambanci. |

| Tabbacin | Nemi ƙarin sigina (misali, ƙirar kyandir, wasu alamomi) don tabbatar da juye-juye. |

| Wurin Shiga | Shigar da trade bisa ga alamun tabbatarwa, la'akari da mafi kyawun lokaci da mahallin kasuwa. |

| Tsayawa Asarar ku kuma yi amfani | Saita asarar tasha a ƙananan ƙananan / babba kafin rarrabuwa kuma ku sami riba a matakan dabarun. |

5. Haɗa rarrabuwar RSI tare da Wasu Manufofi

Don haɓaka tasirin siginar Divergence RSI, traders sau da yawa haɗa su tare da wasu alamun fasaha. Wannan hanya mai ban sha'awa yana taimakawa tabbatar da sigina, rage ƙimar ƙarya, da inganta tsarin yanke shawara gaba ɗaya. Wannan sashe zai jagoranci masu farawa kan yadda ake haɗa RSI Divergence yadda ya kamata tare da sauran alamomi don ƙirƙirar dabarun ciniki mai ƙarfi.

5.1 Maɓallin Maɓalli don Haɗa tare da Rarraba RSI

- Matsakaicin Motsi (MAs): Matsakaicin Matsakaicin daidaita bayanan farashi don ƙirƙirar layin guda ɗaya mai gudana, yana sauƙaƙa gano alkiblar yanayin. Haɗa rarrabuwar RSI tare da MAs (kamar 50-day ko 200-day MA) na iya taimakawa tabbatar da ƙarfin juyewar yanayin.

- MACD (Matsakaicin Matsakaicin Canzawa): MACD tana auna ƙarfin kadari ta hanyar kwatanta matsakaicin motsi guda biyu. Bambanci tsakanin MACD da aikin farashin, lokacin da ke faruwa tare da RSI Divergence, na iya samar da sigina mai ƙarfi don yuwuwar juyewar yanayin.

- stochastic Oscillator: Kamar RSI, Stochastic Oscillator yana auna saurin motsin farashin. Lokacin da duka alamun Stochastic da RSI ke nuna rarrabuwar kawuna tare da farashin lokaci guda, yana iya nuna babban yuwuwar juyewar yanayin.

- Ƙididdigar Ƙararruwa: Alamar ƙararrawa, irin su Ƙaƙƙarfan Ƙaƙwalwa (OBV), na iya tabbatar da ƙarfin jujjuyawar yanayin da RSI Divergence ke nunawa. Ƙara ƙarar ƙara a cikin jagorancin juyawa yana ƙara sahihanci ga siginar.

5.2 Yadda ake Haɗa Alamomi tare da Rarraba RSI

- Tabbatar da Trend: Yi amfani da Matsakaicin Motsawa don tabbatar da gabaɗayan ingantacciyar hanyar da ake bi. Rarraba RSI mai ban tsoro a cikin haɓakawa ko rarrabuwar ra'ayi a cikin raguwa na iya zama sigina mai ƙarfi.

- Tabbatar da Lokacin Lokaci: MACD na iya taimakawa tabbatar da motsin motsin da RSI Divergence ya ba da shawara. Nemo layin MACD don ƙetare layin siginar sa ko nuna bambancin da ya dace da siginar RSI.

- Tabbatarwa tare da Stochastic Oscillator: Tabbatar da rarrabuwar RSI tare da rarrabuwa a cikin Stochastic Oscillator, musamman a cikin yankuna da aka yi yawa ko kuma aka wuce gona da iri.

- Tabbatar da ƙara: Bincika alamun ƙara don tabbatar da cewa ƙara yana goyan bayan siginar juyawa. Ƙara ƙarar kan alkiblar juyawa yana ba da rancen nauyi zuwa siginar rarrabuwa.

5.3 Aikace-aikacen Aiki da Misalai

- Haɗa RSI da MACD: Idan RSI ya nuna rarrabuwar kawuna a lokaci guda MACD ya ketare sama da layin siginar sa, wannan na iya zama siginar siya mai ƙarfi.

- Rarraba RSI da Matsakaicin Motsawa: Spotting RSI Divergence yayin da farashin ke gabatowa mai mahimmanci motsi matsakaici (kamar 200-day MA) na iya nuna yiwuwar billa daga MA, yana tabbatar da jujjuyawar yanayin.

5.4 Mafi kyawun Ayyuka don Haɗa Alamomi

- Guji Ragewa: Zaɓi alamun da ke ba da nau'ikan bayanai daban-daban (yanayi, ƙarfin hali, ƙara) don guje wa sigina mara nauyi.

- Nemo Haɗuwa: Mafi kyawun sigina yana faruwa lokacin da aka sami haɗuwa tsakanin alamomi da yawa, yana nuna yiwuwar samun nasara mafi girma. trade.

- Backtesting: Koyaushe sake gwadawa dabarun ku akan bayanan tarihi don tabbatar da ingancin sa kafin amfani da shi a cikin yanayin ciniki na gaske.

| nuna alama | Nufa | Yadda ake Haɗa tare da RSI Divergence |

| motsi Averages | Tabbatar da Trend | Tabbatar da alƙawarin tafiya tare da MAs. |

| MACD | Tabbatar da lokaci | Nemo madaidaicin layin MACD da rarrabuwa. |

| stochastic Oscillator | Ƙaddamarwa da matakan da aka yi sama da su | Tabbatar da bambance-bambance musamman a cikin matsanancin matakan. |

| Ƙididdigar Ƙararruwa | Tabbatar da ƙarfin juyewar yanayi | Bincika ƙarar ƙara akan alkiblar juyawa. |

6. Gudanar da Hadarin tare da RSI Divergence Trading

Gudanar da haɗari mai inganci yana da mahimmanci yayin ciniki tare da RSI Divergence, kamar kowane dabarun ciniki. Wannan sashe zai tattauna yadda traders na iya aiwatar da dabarun sarrafa haɗari don kiyaye jarin su yayin amfani da siginar Rarraba RSI. Manufar ita ce don taimakawa masu farawa su fahimci mahimmancin sarrafa haɗari da kuma samar da hanyoyi masu amfani don amfani da waɗannan ka'idoji a cikin ayyukan kasuwancin su.

6.1 Saitin Dakatar da Asara

Ɗaya daga cikin muhimman abubuwan da ke tattare da haɗarin haɗari shine amfani da oda na asara. Lokacin ciniki akan siginar Divergence RSI:

- Don Banbancin Bullish: Sanya asarar tasha a ƙasa mafi ƙarancin kwanan nan a cikin aikin farashin da ya dace da siginar rarrabuwa.

- Don Bambancin Bearish: Saita asarar tasha kawai sama da babban kwanan nan mai alaƙa da rarrabuwa.

Wannan dabarar tana taimakawa iyakance yuwuwar asara idan kasuwa ba ta motsawa cikin alkiblar da ake tsammani bayan siginar rarrabuwar kawuna.

6.2 Girman Matsayi

Girman matsayi yana da mahimmanci don sarrafa adadin haɗarin da aka ɗauka akan kowane trade. Ya ƙunshi ƙayyade adadin babban birnin da za a ware wa a trade bisa ga asarar tasha da kuma trader's hadarin haƙuri. Dokar gama gari ita ce yin haɗari fiye da 1-2% na babban kasuwancin kasuwanci akan guda ɗaya trade. Ta wannan hanyar, ko da jerin asara ba za su yi tasiri sosai ga babban jarin ba.

6.3 Amfani da Dokokin Riba

Yayin da dakatarwar hasara ke karewa daga babban asara, ana amfani da odar riba don samun riba a matakin da aka ƙayyade. Saita matakan riba yana buƙatar yin nazarin ginshiƙi don yuwuwar juriya (a cikin saitin bullish) ko matakan tallafi (a cikin saitin bearish) inda farashin zai iya juyawa.

6.4 Bambance-bambance

diversification a fadin dukiya ko dabaru daban-daban na iya rage haɗari. Lokacin ciniki dangane da alamun RSI Divergence, yi la'akari da yin amfani da dabarun a cikin kasuwanni ko kayan aiki daban-daban. Wannan hanya tana yada haɗari kuma tana iya kare fayil ɗin daga rashin daidaituwa a cikin kadari ɗaya.

6.5 Ci gaba da Kulawa da Daidaitawa

Kasuwanni suna da ƙarfi, kuma yanayi na iya canzawa cikin sauri. Ci gaba da lura da wuraren buɗewa yana ba da damar traders don daidaita asarar tasha, ɗaukar odar riba, ko rufe matsayi da hannu don amsa sabbin bayanai ko ƙungiyoyin kasuwa. Wannan daidaitawa na iya haɓaka sarrafa haɗari sosai.

6.6 Misalin Gudanar da Hadarin Aiki

Fatan wata trader yana da asusun ciniki na $ 10,000 kuma yana bin ka'idar haɗarin 2%, kada su yi kasada fiye da $ 200 akan guda ɗaya. trade. Idan an saita asarar tasha 50 pips daga wurin shigarwa a cikin a Forex trade, Ya kamata a daidaita girman matsayi don kowane motsi na pip bai kai $ 4 ba ($ 200 hadarin raba ta 50 pips).

| Dabarun Gudanar da Hadarin | description |

| Saitin Dakatar da Asara | Sanya asara tasha don iyakance yuwuwar asara, dangane da raguwa/maɗaukaki na kwanan nan daga siginar rarrabuwa. |

| Girman Matsayi | Ayyade da trade girman dangane da nisan asarar tasha da haƙurin haɗari, sau da yawa 1-2% na babban birnin kasar. |

| Amfani da odar Riba | Saita matakan riba a wuraren dabaru don tabbatar da riba kafin yuwuwar juyewar yanayin. |

| diversification | Yada haɗari ta hanyar yin amfani da dabarun a kan kadarori ko kayan aiki daban-daban. |

| Ci gaba da Kulawa da Daidaitawa | Daidaita tasha asarar, ɗauki riba, ko kusa da matsayi yayin da yanayin kasuwa ya canza. |