1. Menene TRIX?

TRIX a lokacinta oscillator wanda ke tsaye ga Matsakaicin Matsakaicin Sau Uku. Jack Hutson ne ya kirkiro shi a farkon shekarun 1980 kuma an tsara shi don tace hayaniyar kasuwa da ke iya yaudara traders game da ainihin shugabanci na kasuwa. TRIX ana ƙididdige su ta hanyar ɗaukar juzu'i mai laushi sau uku motsi matsakaici na farashin rufewa sannan kuma yin lissafin yawan canji kashi na matsakaicin.

Tsarin TRIX shine kamar haka:

TRIX = (EMA3_yau - EMA3_jiya) / EMA3_jiya * 100

Inda EMA3 shine sau uku ƙarancin ƙaƙƙarfan motsi.

Babban layin TRIX yawanci ana tsara shi tare da layin sigina, wanda shine matsakaicin motsi na layin TRIX kanta. Crossovers tsakanin waɗannan layukan biyu na iya nuna yuwuwar siye ko siyarwar sigina.

Hakanan ana iya amfani da TRIX don ganowa abubuwan da aka yi yawa da yawa a kasuwa. Lokacin da layin TRIX ya kasance a matsakaici ko ƙananan matakan, yana iya ba da shawarar cewa kadarar ta wuce gona da iri kuma saboda gyara. Traders sau da yawa suna kallon rarrabuwar kawuna tsakanin TRIX da farashi kuma, wanda zai iya nuna yuwuwar juyawa.

2. Ta yaya kuke saita TRIX akan Dandalin Kasuwancin ku?

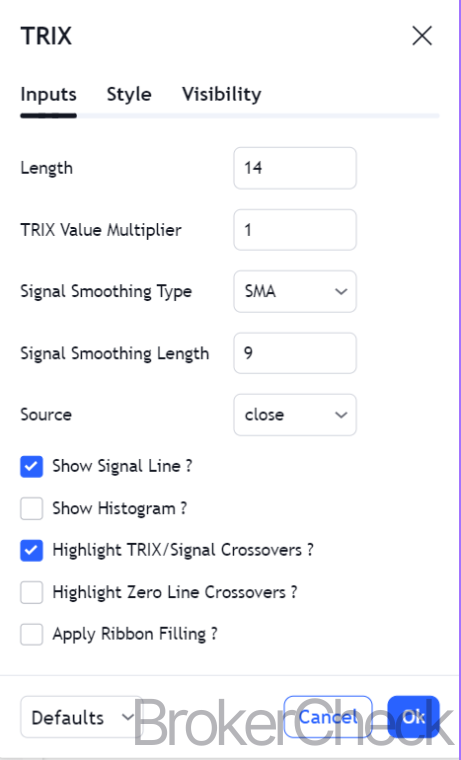

Matsaloli masu zuwa zasu iya taimaka maka saita TRIX akan dandalin ciniki:

2.1. Zaɓin Madaidaicin Tsarin Lokaci don TRIX

Zaɓin lokacin da ya dace don alamar TRIX yana da mahimmanci don daidaitawa tare da manufofin kasuwancin ku da yanayin kasuwa na kadarar ku.

- Lokacin gajere traders sau da yawa amfani da guntun firam ɗin lokaci, kamar 1-minti zuwa 15-minti ginshiƙi, don ɗaukar saurin motsi da ficewa a cikin wannan ranar ciniki.

- Da bambanci, lilo traders iya gwammace sa'a zuwa 4-hour ginshiƙi don riƙe mukamai na kwanaki ko makonni da yawa, suna neman riba daga gajere zuwa yanayin matsakaici.

- Masu zuba jari na dogon lokaci iya amfani kullum zuwa mako-mako ginshiƙi, mai da hankali kan yanayin da ya fi girma da rashin mayar da martani ga sauyin farashin cikin rana.

Zaɓin firam ɗin lokaci yana tasiri hankalin alamar TRIX zuwa canje-canjen farashi. Gajeren lokaci haifar da layin TRIX mafi mahimmanci wanda ke amsawa da sauri ga ƙungiyoyin farashi. Akasin haka, dogon lokaci Frames samar da layin TRIX mai santsi, rage siginar ƙarya amma mai yuwuwar jinkirta shigarwa da wuraren fita.

Don kwatanta tasirin zaɓin lokaci, yi la'akari da misalai masu zuwa inda aka saita lokacin TRIX zuwa 15 da layin sigina zuwa 9:

| Lokaci | Hankalin TRIX | Daidai Domin |

| 1-minti | high | Scalping |

| 15-minti | matsakaici | Day Trading |

| 1-hour | Lower | Swing Trading |

| Daily | Mafi ƙasƙanci | Zuba Jari na Tsawon Lokaci |

2.2. Daidaita Ma'aunin TRIX don Ƙarfafawa

Daidaita sigogin alamar TRIX don dacewa kasuwar volatility muhimmin mataki ne na inganta ayyukansa. Ta hanyar tweaking sigogi na TRIX, traders na iya sa mai nuna alama ya fi dacewa da yanayi mara kyau ko kuma ya fi kwanciyar hankali yayin lokutan kasuwa mafi shuru.

Don kasuwanni masu saurin canzawa, rage lokacin TRIX zai sa mai nuna alama ya fi dacewa da canje-canjen farashin. Wannan damar traders don kama ƙungiyoyi masu sauri da amsa da sauri ga haɓakar kasuwa. Duk da haka, yana da mahimmanci a yi taka tsantsan kamar yadda TRIX mafi mahimmanci zai iya samar da ƙari alamun karya. Sabanin haka, a cikin kasuwa mai ƙarancin ƙarfi, haɓaka lokacin TRIX na iya taimakawa tace hayaniya da samar da ƙarin amintattun sigina, kodayake a hankali.

Anan ga jagora don daidaita lokacin TRIX bisa ga rashin daidaituwa:

| Karɓar Kasuwa | Daidaita Lokacin TRIX | Tasiri |

| high | Ragewa | Yana ƙara azanci, saurin sigina |

| low | ƙara | Rage hankali, sigina masu santsi |

Don layin sigina, dabaru iri ɗaya ya shafi. Lokacin layin sigina mafi guntu zai amsa da sauri, wanda ya dace da kasuwanni masu canzawa, yayin da lokaci mai tsawo zai sassauta motsin layin siginar, wanda ya fi dacewa da ƙarancin yanayi.

Yi la'akari da gyare-gyare masu zuwa don yanayin kasuwa daban-daban:

| Yanayin Kasuwa | Lokacin TRIX | Lokacin Layin Sigina |

| Babban Volatility | 12 | 7 |

| Matsakaicin Ƙarfafawa | 15 | 9 |

| Voarancin Volatility | 18 | 12 |

2.3. Haɗa TRIX tare da Wasu Manufofin Fasaha

Ana inganta tasirin mai nuna alama na TRIX idan aka haɗa shi da wasu fasaha analysis kayan aiki. Haɗa TRIX tare da Dangi Ƙarfin Index (RSI), Matsakaicin Matsakaicin Canzawa (MACD), ko stochastic Oscillator zai iya inganta sigina kuma ya rage yuwuwar shigarwar karya ko fita.

- Alal misali, RSI zai iya taimakawa tabbatar da siginonin TRIX ta hanyar gano yanayin da aka yi fiye da kima ko aka yi.

- Lokacin haɗa TRIX tare da MACD, traders neman tabbatar da canje-canjen yanayi.

- The stochastic Oscillator yana da amfani don gano abubuwan da aka yi fiye da kima ko na ɗan lokaci.

- Bollinger makada Hakanan zai iya haɓaka TRIX ta hanyar ba da alamun gani game da rashin ƙarfi da matakan farashin yanzu dangane da ƙa'idodin tarihi.

Matakan goyon baya da matakai Wani ƙari ne mai mahimmanci, yana ba da mahallin mahallin siginar TRIX. Madaidaicin layin TRIX kusa da maɓalli na tallafi ko matakin juriya na iya ba da shawarar ƙaƙƙarfan motsi idan matakin ya keta.

Anan ga tebur mai kwatancen yadda kowane mai nuna alama zai iya dacewa da TRIX:

| Alamar fasaha | aiki | Ya cika TRIX Ta |

| RSI | Yana gano abin da aka yi fiye da kima/sayi | Tabbatar da TRIX crossovers |

| MACD | Yana nuna sauye-sauyen yanayi da kuzari | Ƙarfafa siginonin yanayi |

| stochastic | Sigina sun wuce gona da iri | Tabbatar da iyakar gajeren lokaci |

| Bollinger makada | Yana nuna rashin ƙarfi da ƙa'ida | Haskaka yuwuwar juyawa |

| Taimako/Juriya | Yana bayyana shingen farashi | Fahimtar siginar TRIX |

3. Yadda ake amfani da TRIX don Binciken Trend?

Lokacin amfani da TRIX don nazarin yanayin, traders yana mai da hankali kan wasu mahimman fannoni: sigina na bullish da bearish, rarrabuwar kawuna, da ƙetare. Wadannan abubuwa suna taimakawa wajen yanke shawara game da shigarwar kasuwa da wuraren fita.

3.1. Gano Bullish da Siginonin Bearish tare da TRIX

The TRIX mai nuna alama yana aiki azaman kayan aiki don gano alkibla da kuzari, tare da kulawa ta musamman ga sigina mai ƙarfi da bearish.

- Sigina mai ƙarfi Ana haifar da shi lokacin da layin TRIX ya ketare sama da layin siginar ko layin sifili, yana nuna yuwuwar haɓakar haɓakawa da damar fara matsayi mai tsayi.

- Sabanin haka, siginar bearish ana gano su lokacin da layin TRIX ya ketare ƙasa da siginar siginar ko layin sifili, yana ba da shawarar saurin ƙasa da sigina don la'akari da ɗan gajeren matsayi ko fita matsayi mai tsayi.

Gane siginar Ta hanyar TRIX ana ƙara tsaftacewa ta hanyar lura da gangaren layin TRIX kanta. Wani gangare mai hawa sama zai iya ƙarfafa sigina mai ƙarfi, yayin da gangaren ƙasa zai iya tabbatar da siginar bearish.

Sifili line crossovers wani abu ne mai mahimmanci, inda layin TRIX da ke ƙetare layin sifili daga ƙasa yana nuna alamar ƙarfafawa a cikin ingantacciyar yanayin, kuma ƙetare daga sama yana nuna alamar ƙarfafawa a cikin mummunan yanayin.

| Ayyukan Layin TRIX | Ayyukan Layin Sigina | Layin Zero Crossover | Tasiri |

| Ketare a sama | Ketare a sama | Daga kasa | Sigina mai ƙarfi mai ƙarfi |

| Ketare ƙasa | Ketare ƙasa | Daga sama | Siginar Ƙarfi Mai Ƙarfi |

| gangara zuwa sama | Kusa da crossover | N / A | Matsalolin Bullish |

| gangara zuwa ƙasa | Kusa da crossover | N / A | Yanayin Bearish |

Ana iya haɓaka amincin siginar TRIX ta tabbaci daga bayanan girma ko ƙarin alamun fasaha, tabbatar da hakan traders ba sa yin aiki akan tabbataccen ƙarya. Misali, siginar TRIX mai ban tsoro tare da ƙara girma da ƙirar kyandir mai goyan baya na iya ba da madaidaicin shigarwa.

A aikace, traders ya kamata a yi hankali da bulala- siginonin karya waɗanda zasu iya faruwa a gefe ko kasuwanni masu tsinke. Don rage wannan hadarin, wasu traders na iya yin amfani da tacewa, kamar jiran layin TRIX ya wuce wani ƙima kafin yin la'akari da ingantaccen sigina ko amfani da alamar na biyu don tabbatarwa.

3.2. Ciniki Bambance-bambancen Amfani da TRIX

Bambance-bambancen ciniki tare da TRIX mai nuna alama wata hanya ce da ake amfani da ita don gano bambance-bambance tsakanin motsin mai nuna alama da aikin farashin kadari. Waɗannan bambance-bambance na iya sau da yawa annabta yuwuwar koma baya a halin yanzu. Traders yana buƙatar yin taka tsantsan don nau'ikan bambance-bambancen guda biyu: banbance-banbance da kuma rabuwa.

Bambamcin bulsh yana faruwa lokacin da farashin kadari ya haifar da sabon ƙarancin, amma TRIX yana samar da mafi girman ƙasa, yana ba da shawarar raguwar saurin ƙasa da yuwuwar motsi zuwa sama. Da bambanci, rabuwa yana faruwa ne lokacin da farashin kadari ya sami sabon matsayi yayin da TRIX ke yin rikodin ƙaramin girma, yana nuna raguwar haɓakar haɓakawa da yuwuwar juyawa ƙasa.

Anan ga bayanin mai sauri don ganowa TRIX bambance-bambance:

| price Action | Alamar TRIX | Nau'in Banbanci |

| Ƙananan Ƙasa | Mafi Girma | Banbancin Bullish |

| Mafi Girma | Ƙananan Highs | Bambancin Bambanci |

Waɗannan bambance-bambancen na iya zama maƙasudi masu mahimmanci ga traders, yana ba da gargaɗin farko na gajiya mai tasowa. Duk da haka, bambance-bambance kada a yi amfani da shi a ware. An fi amfani da su tare da wasu kayan aikin bincike na fasaha don tabbatarwa. Misali, ana iya tabbatar da rarrabuwar kawuna a cikin TRIX ta hanyar jujjuyawar ƙirar kyandir ko karatu mai yawa akan Abokin Harkokin Fassara (RSI).

3.3. Amfani da TRIX Cross-Overs azaman Matsalolin Shiga ko Fita

Farashin TRIX yi aiki a matsayin lokuta masu mahimmanci don traders don yanke shawarar shiga ko fita. Wadannan ƙetare suna faruwa lokacin da layin TRIX ya haɗu tare da layin sigina, sau da yawa yana nuna motsi a cikin hanzari da yuwuwar canji a cikin al'amuran al'ada.

Makin shiga yawanci ana gano su lokacin da layin TRIX ya ketare sama da layin sigina, yana ba da shawarar haɓaka haɓakawa da yuwuwar haɓakawa. Traders na iya ɗaukar wannan alama don buɗe matsayi mai tsayi. Akasin haka, wuraren fita ana ba da shawarar lokacin da layin TRIX ya ketare ƙasa da siginar siginar, yana nuna raguwar raguwa da yuwuwar raguwa, yana haifar da ɗan gajeren matsayi mai yiwuwa ko rufe matsayi mai tsayi.

Tasirin waɗannan sigina na iya bambanta dangane da zaɓaɓɓen tsarin lokaci da yanayin kasuwa. Sabili da haka, yana da mahimmanci don daidaita sigina na giciye tare da mafi girman yanayin da kuma neman tabbatarwa ta hanyar wasu alamomi ko ƙididdigar girma.

Ga rashi na Farashin TRIX sigina:

| Layin TRIX | Tasiri | Yiwuwar Aiki |

| Sama layin sigina | Ƙara ƙarfi | Wurin shiga don matsayi mai tsawo |

| A ƙasa layin sigina | Rage ƙarfi | Wurin fita na dogon lokaci ko Shiga don gajeriyar matsayi |

Traders ya kamata ku sani cewa in kasuwanni masu canzawa, TRIX giciye na iya faruwa akai-akai, yana haifar da yuwuwar bulala. Don magance wannan, wasu traders na iya aiwatar da ƙarin masu tacewa, kamar buƙatar ƙetare don kiyayewa na wani takamaiman lokaci ko wuce ƙayyadaddun ƙira kafin yin aiki da siginar.

4. Menene Mafi kyawun Dabaru don Haɗa TRIX?

Haɗa TRIX a cikin dabarun ciniki ya ƙunshi hanya mai ban sha'awa. Dabarun masu zuwa zasu iya taimaka muku fahimtar wannan ra'ayi ta hanya mafi kyau:

4.1. TRIX da Matsakaicin Haɗuwa

TRIX da matsakaita matsakaita gabatar da duo mai ƙarfi a cikin bincike na fasaha. Traders sun sami ra'ayi mara kyau game da yanayin kasuwa da canje-canjen yanayi ta hanyar haɗa TRIX tare da matsakaicin motsi. Daidaitaccen aikin ya ƙunshi amfani da wani madaidaicin bayanin motsi (EMA) na layin TRIX, yawanci sama da lokacin tara. Wannan EMA yana aiki azaman layin sigina; lokacin da TRIX ya ketare sama da EMA, yana nuna damar siye, yayin da giciye da ke ƙasa na iya nuna alamar siyarwa.

Yin amfani Farashin TRIX tare da matsakaicin motsi yana ba da damar traders don tace hayaniya da mai da hankali kan mahimman motsin kasuwa. EMA yana ba da wakilci mai laushi na TRIX oscillation; don haka, lokacin da layin TRIX ya karkata sosai daga EMA, zai iya nuna haɓaka mai ƙarfi ko yuwuwar juyewa.

Anan akwai sauƙin wakilci na siginar ciniki da aka samar daga TRIX da matsakaita matsakaita:

| Matsayin Layin TRIX | Matsayin EMA | Siginar ciniki |

| Sama EMA | tashin | Sayi sigina |

| Kasa EMA | fadowa | Siginar siyarwa |

Farashin TRIX su ne muhimmin bangaren wannan dabarun. Ƙimar giciye sama da EMA ana ɗaukarsa a matsayin mai ban tsoro, musamman idan tare da haɓaka ƙarar ciniki ko wasu alamun fasaha masu tabbatarwa. A gefen juyawa, ana ganin giciye a ƙasa EMA a matsayin mai ɗaukar nauyi, yana ba da garantin ƙarin bincike da yuwuwar aiki idan an tabbatar da ƙarin siginar bearish.

Cikin sharuddan yanayin kasuwa, TRIX za a iya keɓance shi don dacewa da yanayin da ake ciki. A cikin lokutan babban rashin ƙarfi, rage lokacin TRIX na iya sa shi ya fi dacewa ga canje-canjen farashin, yayin da tsawaita lokacin a cikin matakan kwanciyar hankali na iya taimakawa wajen guje wa ƙimar ƙarya.

Teburin da ke ƙasa yana zayyana gyare-gyare don saitunan TRIX dangane da juzu'in kasuwa:

| Karɓar Kasuwa | Daidaita Lokacin TRIX | Nufa |

| high | Gajeren lokaci | Saurin amsawa ga canje-canjen kasuwa |

| low | Tsawon Lokaci | Rage hayaniya da haɓaka ingancin sigina |

4.2. Haɗa TRIX tare da Tsarin Candlestick

Haɗawa da Matsakaici Mai Fasa Sau Uku (TRIX) tare da Tsarin kyandir bayar traders tare da haɗin gwiwa mai ƙarfi don nuna alamar shigarwa da wuraren fita. Wannan haɗin gwiwar yana haɓaka ikon TRIX don tace hayaniyar kasuwa da kuma gano ƙarfin yanayi, yayin da ƙirar kyandir ke ba da alamun gani game da tunanin kasuwa da yuwuwar motsin farashin.

Samuwar sandar kyandir, kamar a guduma or cika damuwa samfuri, wanda ke faruwa tare da siginar TRIX mai ban tsoro-kamar layin TRIX mai tsallakewa sama da layin siginar sa ko layin sifili—na iya ƙarfafa yuwuwar motsin farashin sama. Sabanin haka, tsarin kyandir ɗin bearish kamar na tauraron harbi or bearish engulfing, tare da siginar TRIX na bearish, na iya nuna yiwuwar raguwa.

Tebur na gaba yana nuna yadda traders na iya fassara haɗakar siginar TRIX tare da ƙirar fitila:

| Siginar TRIX | Tsarin Candlestick | Tasirin Aiki |

| Bulgariya | Tsarin Bullish | Siginar Siyayya mai ƙarfi |

| Bearish | Tsarin Bearish | Siginar Siyarwa mai ƙarfi |

4.3. TRIX a cikin Yanayin Kasuwa Daban-daban

The Matsakaici Mai Fasa Sau Uku (TRIX) yana aiki azaman oscillator mai ƙarfi wanda zai iya dacewa da yanayin kasuwa daban-daban ta hanyar tace ƙananan motsin farashi da kuma nuna yanayin da ake ciki. Amfaninsa ya bambanta a ko'ina cikin abubuwan da ke faruwa, da iyaka, da yanayin kasuwa masu canzawa.

In kasuwanni masu canzawa, Ƙwararren TRIX ga canje-canjen farashin yana ba shi damar tabbatar da ƙarfi da tsayin daka. Traders na iya yin amfani da wannan ta hanyar daidaita matsayinsu tare da TRIX crossovers da bambance-bambancen da ke ƙarfafa alkiblar yanayin da ke gudana.

In kasuwanni masu canzawa, sabani akai-akai na iya haifar da bulala, tada hankali traders don daidaita lokacin TRIX don ingantaccen sigina. Wani ɗan gajeren lokaci na iya zama da fa'ida don amsawa ga canje-canjen farashin, yayin da tsayin lokaci zai iya rage siginar ƙarya a cikin lokuta marasa ƙarfi.

Kasuwannin iyaka ko na gefe haifar da kalubale don ci gaba oscillators kamar TRIX. Alamun karya sun fi zama ruwan dare kamar yadda rashin ingantaccen yanayin zai iya haifar da ɓarna siginonin ketare. Nan, traders na iya haɗa TRIX tare da wasu kayan aikin fasaha, kamar Bollinger makada or Oscillators kamar Stochastics, don ƙarin auna alkibla da ƙarfin kasuwa.

Daidaita saitunan TRIX dangane da yanayin kasuwa na iya haɓaka aikin sa:

| Yanayin Kasuwa | Daidaitawa | Bayanin |

| trending | Bi crossovers da divergences | Daidaita tare da motsin yanayi |

| maras tabbas | Rage lokacin TRIX | Amsa da sauri ga saurin motsin farashi |

| Yankunan baya | Haɗa tare da sauran alamomi | Rage siginonin ƙarya daga rashin tsari |

5. Abin da za a yi la'akari lokacin ciniki tare da TRIX?

Lokacin la'akari da aikace-aikacen TRIX a cikin ciniki, ana buƙatar kimanta sigogi masu zuwa a hankali:

5.1. Muhimmancin Gudanar da Hadarin

Gudanar da haɗari yana tsaye azaman ginshiƙin cin nasara ciniki, musamman lokacin amfani da alamun fasaha kamar TRIX. Manufar ita ce a rage yuwuwar asara yayin da ake samun riba mai yawa, daidaiton da ke buƙatar tsara dabaru da aiwatar da horo. Gudanar da haɗari mai tasiri yana haifar da fahimtar rashin daidaituwar kasuwa, ta amfani da tasha-hasara oda yadda ya kamata, da kuma ƙayyade girman matsayi masu dacewa.

Umarni-asarar umarni are a tradelayin farko na r na kariya daga motsin kasuwa kwatsam wanda zai iya haifar da hasara mai yawa. Ta hanyar saita odar tasha-asara a matakin da ya dace da goyan bayan fasaha ko juriya ko ƙayyadadden kaso daga wurin shigarwa, traders na iya iyakance bayyanar su.

Matsayin matsayi daidai yake da mahimmanci. Ya kamata a daidaita girman matsayi bisa ga tradeHaƙurin haɗari na r da rashin daidaituwa na kasuwa. Yana da hankali don yin haɗari kawai juzu'in babban kasuwancin ciniki akan kowane ɗayan trade don jure jerin asara ba tare da rage yawan asusun mutum ba.

Anan ga taƙaitaccen bayyani na mahimman abubuwan sarrafa haɗari:

- Dokokin Tsayawa-Asara: Saita a matakan dabaru don ɗaukar hasara mai yuwuwa.

- Girman Matsayi: Daidaita bisa ga haɗarin haɗari da yanayin kasuwa.

- Tsare Jari: Ba da fifikon kariyar jarin ciniki don tabbatar da dawwama a kasuwa.

Teburin mai zuwa yana taƙaita mahimman dabarun sarrafa haɗari:

| Bangaren Gudanar da Hadarin | Nufa | Dabarun Aiwatarwa |

| Dokokin Tsayawa-Asara | Iyakance yuwuwar asara | Saita a matakan fasaha ko kashi daga shigarwa |

| Girman Matsayi | Sarrafa adadin babban birnin da ke cikin haɗari | Dangane da rashin ƙarfi da haɗarin ci |

| yin amfani | Haɓaka yuwuwar dawowa | Yi amfani da adalci don sarrafa haɓakar haɗari |

5.2. Iyakoki na TRIX a cikin Kasuwancin Sideways

TRIX, ko Matsakaicin Ƙarfafa Sau Uku, wani oscillator ne da ake amfani da shi don gano yanayin da aka yi fiye da kima ko aka yi a kasuwa, da kuma auna ƙarfin aiki. Duk da haka, in kasuwanni na gefe, inda farashin farashin ke iyakance zuwa madaidaicin kewayon ba tare da bayyananniyar yanayin ba, TRIX na iya fuskantar iyakoki:

- Alamomin karya: TRIX na iya haifar da siginar giciye waɗanda ba su dace da ƙayyadaddun farashin farashi ba, yana haifar da yanke shawara mara kyau na ciniki.

- Alamar Lagging: A matsayin oscillator mai ƙarfi, TRIX na iya raguwa a kasuwannin gefe, yana ba da jinkirin bayanai waɗanda ƙila ba su da mahimmanci.

- Rage inganci: Ba tare da yanayin ba, ƙarfin TRIX yana raguwa yayin da yake dogara ga jagora da kuma juriya na ƙungiyoyin farashi don yin tasiri.

Traders ya kamata a yi taka tsantsan yayin dogaro da TRIX a cikin kasuwannin da ba sa canzawa. Ga wasu la'akari:

- Tabbacin: Nemo tabbaci daga wasu alamomi ko hanyoyin bincike don tabbatar da siginar TRIX.

- Daidaita Saituna: Canza hankalin mai nuna alama ta hanyar daidaita lokacin lissafin don dacewa da yanayin kewayo.

- Manunni Masu Ƙarfafawa: Haɗa TRIX tare da alamun da ke aiki da kyau a kasuwanni na gefe, kamar oscillators (RSI, Stochastics) ko alamun tushen girma.

| shawara | Abu Na Aiki |

| Sigina na Karya a Kasuwannin Gefe | Yi amfani da ƙarin alamomi don tabbatarwa |

| Lagging Yanayin TRIX | Daidaita saitunan TRIX don rage raguwa |

| Kayayyakin Ƙari | Yi amfani da oscillators ko alamun girma tare da TRIX |

5.3. Daidaita Dabarun Don Daidaita Salon Ciniki Na Mutum

Adaidaita ciniki dabaru ga salon mutum ɗaya yana da mahimmanci don haɓaka amfani da alamun fasaha kamar TRIX. Traders sun bambanta a tsarinsu na haɗari, da martani ga ƙungiyoyin kasuwa, da sa'o'in lokacin saka hannun jari, yana buƙatar keɓancewar hanyar bincike na fasaha.

masu yin kwalliya, alal misali, waɗanda ke shiga cikin sauri da yawa trades, na iya amfana daga amfani da ɗan gajeren lokacin TRIX don cin gajiyar motsin kasuwa cikin sauri. Akasin haka, lilo traders Neman dama a cikin kwanaki da yawa ko makonni na iya fifita tsawon lokacin TRIX don tace amo da kuma mai da hankali kan sauye-sauye masu mahimmanci.

Teburin da ke ƙasa yana misalta yadda za a iya daidaita saitunan TRIX bisa ga salon ciniki:

| Salon Ciniki | Daidaita Lokacin TRIX | Bayanin |

| Scalping | Gajeren lokaci | Ɗauki saurin motsin farashi |

| Swing Trading | Tsawon Lokaci | Tace gajeriyar rashin zaman lafiya |

Anan akwai mahimman abubuwan da yakamata kuyi la'akari yayin keɓance TRIX:

- Sanin: Daidaita buƙatar sigina na farko akan haɗarin ƙararrawar ƙarya.

- TabbacinYi amfani da ƙarin alamomi ko kayan aiki don tabbatar da siginar TRIX.

- Market AnalysisCi gaba da nazarin yanayin kasuwa don tabbatar da cewa saitunan TRIX sun kasance masu dacewa.

| Aspect | La'akari na musamman |

| Sanin | Daidaita TRIX don daidaita lokacin sigina da daidaito |

| Tabbacin | Yi amfani da wasu alamomi don tabbatar da sigina |

| Market Analysis | A kai a kai sake tantance yanayin kasuwa don ingantaccen amfani da TRIX |