1. Menene Ultimate Oscillator?

A fagen ciniki, da bambanta tsakanin Ultimate Oscillator da farashin aiki alama ce mai mahimmanci don traders. Bambanci mai ban sha'awa yana faruwa lokacin da farashin ke yin rikodin ƙarancin ƙasa, amma oscillator yana haifar da ƙarami mafi girma, yana ba da shawarar raunana ƙasa. lokacinta. Sabanin haka, bambance-bambancen bearish shine lokacin da farashin ya kai matsayi mafi girma yayin da oscillator ke haifar da ƙaramin tsayi, yana nuna faɗuwa sama. Traders yakamata su kula da waɗannan tsarin bambance-bambance a hankali, kamar yadda sau da yawa sukan riga da gagarumin koma baya na farashin.

Ƙarfin Ƙarshen Oscillator shine haɗuwa na lokaci guda uku daban-daban oscillators, yawanci 7-lokaci, 14-lokaci, da kuma 28-lokaci. Ƙimar ƙarshe ita ce jimlar ma'auni na waɗannan oscillators guda uku, tare da tsawon lokaci masu tsayi suna karɓar ƙarancin nauyi. Wannan ma'aunin nauyi ya dogara ne akan imani cewa ƙarin bayanan kwanan nan sun fi dacewa da yanayin kasuwa na yanzu.

Anan ga ainihin ƙayyadaddun tsarin lissafin:

- Yi ƙididdige Matsi na Siyan (BP) da Madaidaicin Rage (TR) na kowane lokaci.

- Takaita BP da TR na kowane lokaci guda uku.

- Ƙirƙiri ɗanyen makin kowane lokaci ta hanyar rarraba jimlar BP da jimillar TR.

- Aiwatar da nauyi ga kowane lokaci (lokacin 7 yana da mafi girman nauyi, sannan lokacin 14, sannan kuma lokaci 28).

- Karatun Ultimate Oscillator na ƙarshe shine jimlar ma'auni na lokutan lokutan uku.

Ingantacciyar amfani da Ultimate Oscillator ya haɗa da ba wai kawai sanin abubuwan da aka yi fiye da kima ko aka yi yawa ba, har ma da fahimtar yadda oscillator ke aiki dangane da farashin. Misali, idan kasuwa tana yin sabbin abubuwa amma Ultimate Oscillator ba haka bane, yana iya zama alamar cewa kasuwa tana ƙarewa da tururi.

Bugu da ƙari, traders na iya amfani da wasu fasaha analysis kayan aiki tare da Ultimate Oscillator don tabbatar da sigina. Misali, yin amfani da layukan yanayi, matakan tallafi da juriya, da ƙididdigar girma na iya samar da dabarun ciniki mai ƙarfi.

Mabuɗin mahimmanci don tunawa lokacin amfani da Ultimate Oscillator sun hada da:

- Saka idanu don bambance-bambance tsakanin oscillator da farashi don gano yuwuwar juyawa.

- Yi la'akari da oversold (>70) da oversold (<30) matakan ƙofa azaman faɗakarwa maimakon cikakken sigina ko siyarwa.

- Yi amfani da kayan aikin bincike da yawa don tabbatar da siginonin da Ultimate Oscillator ya bayar don ƙarin aminci.

- Kula da mahallin kasuwa kuma tabbatar da cewa sigina daga oscillator sun yi daidai da yanayin kasuwa mafi girma.

Ta hanyar la'akari da waɗannan abubuwan. traders na iya yin amfani da Ultimate Oscillator don samun fahimta game da yanayin kasuwa da kuma yin ƙarin yanke shawara na ciniki.

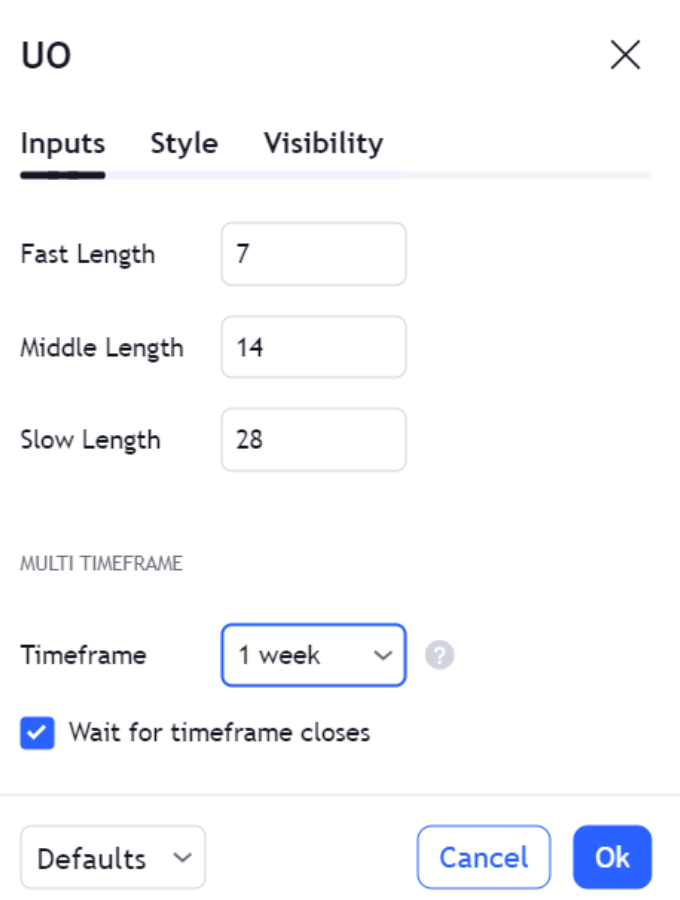

2. Yadda ake saita Ultimate Oscillator?

Ƙirƙirar Ƙarshen Oscillator don Ingantaccen Ayyuka

Lokacin saita Ultimate Oscillator, yana da mahimmanci don daidaita shi zuwa dabarun kasuwancin ku da kuma halin musamman na kasuwa da kuke nazari. Ga jagorar mataki-mataki kan yadda ake keɓance wannan kayan aiki mai ƙarfi:

- Zaɓi Filayen Lokaci:

- Lokacin gajeren lokaci: 7 kwana

- Tsakanin lokaci: 14 kwana

- Tsawon lokaci: 28 kwana

Ana iya daidaita waɗannan lokutan bisa la'akari da rashin daidaituwar kadari da kuma tradefifikon r don ƙarin ko žasa hankali.

- Daidaita Wuraren Siyayya/Yuyawa:

- Saitunan tsoho:

- Matsayin da aka yi yawa: 70

- Oversold matakin: 30

- Saitunan da aka daidaita don babban rashin ƙarfi:

- Matsayin da aka yi yawa: 80

- Oversold matakin: 20

Gyara waɗannan matakan na iya taimakawa wajen daidaitawa da yanayin kasuwa daban-daban da rage siginar ƙarya.

- Saitunan tsoho:

- Kyawawan-Tuning da Bayarwa:

- Yi amfani da bayanan tarihi zuwa sake gwadawa saituna daban-daban.

- Yi nazarin mita da daidaiton siginar da aka haifar.

- Daidaita lokutan lokaci da ƙofofin don nemo mafi dacewa da salon kasuwancin ku.

Muhimmin La'akari:

- Kewayen Kasuwa: Tabbatar cewa zaɓaɓɓen lokutan lokaci sun dace da wakilci daban-daban na hawan keke a kasuwa.

- Halayen Kadara: Yi la'akari da ƙirar farashi na musamman da rashin daidaituwa na kadari.

- hadarin Haƙuri: Daidaita saitunan oscillator tare da dabarun sarrafa haɗarin ku.

Ta hanyar daidaitawa da kyau Ultimate Oscillator, traders na iya haɓaka tasirin sa, yana haifar da ƙarin yanke shawara na ciniki. Ka tuna, makasudin shine haɗa oscillator cikin gabaɗayan ku tsarin ciniki, complementing sauran bincike dabaru da Manuniya.

| Lokaci | Saitunan tsoho | Daidaita Saitin (Babban Ƙarfafawa) |

|---|---|---|

| Lokacin gajere | 7 days | Mai iya daidaitawa bisa kadara |

| Intermediate | 14 days | Mai iya daidaitawa bisa kadara |

| Dogon lokacin | 28 days | Mai iya daidaitawa bisa kadara |

| Matsakaicin Sayi | 70 | 80 |

| Matsayin oversold | 30 | 20 |

Yana da mahimmanci don dubawa akai-akai da daidaita saitunan saitunan Ultimate Oscillator yayin da yanayin kasuwa ya canza. Ci gaba da gyare-gyare zai taimaka kiyaye dacewa da daidaiton siginar da yake bayarwa.

2.1. Zaɓin Matsalolin Lokaci

A cikin duniyar ciniki mai ƙarfi, da Ultimate Oscillator ya yi fice a matsayin kayan aiki dabam-dabam don ƙididdige ƙarfin kasuwa ta hanyar bincike na lokaci da yawa. Don yin amfani da cikakkiyar damarsa, traders dole daidaita saitunan oscillator don daidaitawa da dabarun kasuwancin su da halaye na kasuwa.

Rana traders, neman cin riba akan ƙungiyoyi masu sauri na kasuwa, na iya samun madaidaitan saitunan sun yi kasala sosai. Ta hanyar daidaita lokutan zuwa 5, 10, da 15, za su iya haɓaka ƙwarewar oscillator zuwa canje-canjen farashin nan da nan, ta haka ne za su sami sigina na lokaci wanda ke da mahimmanci ga wannan salon ciniki mai girma.

A wannan bangaren, lilo traders yawanci suna aiki akan sararin lokaci mai faɗi, da nufin kama manyan sauye-sauyen kasuwa. A gare su, ƙayyadaddun tsari na 10, 20, da 40 lokuta zai iya zama mafi dacewa. Wannan gyare-gyare yana taimakawa wajen daidaita yanayin ɗan gajeren lokaci, yana ba da ra'ayi mai haske game da yanayin da ake ciki.

Tsarin calibrating Ultimate Oscillator yakamata ya haɗa da baya, Hanyar yin amfani da oscillator zuwa bayanan kasuwa na baya don tantance tasirinsa. Wannan matakin yana da mahimmanci don gano mafi kyawun saituna don tradetakamaiman manufofin r.

| Salon Ciniki | Gajeren lokaci | Tsakanin Zamani | Tsawon Lokaci |

|---|---|---|---|

| Day Trading | 5 | 10 | 15 |

| Swing Trading | 10 | 20 | 40 |

Sakamakon baya shiryar traders a cikin tace lokutan, tabbatar da cewa siginar oscillator sun dace da yanayin kasuwa. Ba wai kawai don nemo wuri guda ɗaya ba amma game da gano haɗe-haɗe na musamman wanda ya dace da bugun jini na kasuwa.

Sakamakon baya shiryar traders a cikin tace lokutan, tabbatar da cewa siginar oscillator sun dace da yanayin kasuwa. Ba wai kawai don nemo wuri guda ɗaya ba amma game da gano haɗe-haɗe na musamman wanda ya dace da bugun jini na kasuwa.

Ƙirƙirar Ƙarshen Oscillator zuwa rage siginar ƙarya yana da fa'ida musamman a kasuwannin da ba su da ƙarfi. Ta hanyar haɗa sigina daga ɓangarorin lokaci da yawa, yana ba da cikakkiyar ra'ayi, yana rage yuwuwar ruɗe ta hanyar canjin farashin bazuwar.

A ƙarshe, ingantaccen amfani da Ultimate Oscillator yana jingina akan a tradeiya r daidaita da canza yanayin kasuwa. Yin bita akai-akai da daidaita lokutan lokaci na iya taimakawa wajen kiyaye dacewa da daidaiton siginar da yake bayarwa. Wannan ci gaba da aiwatar da gyare-gyare shine abin da ke ba da izini traders don ci gaba da daidaitawa tare da ɓarkewar kasuwa, yin yanke shawara mai fa'ida waɗanda ke da tushe a cikin cikakken nazarin abubuwan da ke faruwa.

2.2. Daidaita Matsakaicin Sayi da Matsakaicin Matsayi

Daidaita matakan da aka yi fiye da kima da kima akan Ultimate Oscillator na iya samar da a mafi dacewa da tsarin samarwa trade sakonni. Saitunan tsoho bazai dace koyaushe tare da keɓaɓɓun halaye na kayan aikin ciniki daban-daban ko yanayin canjin kasuwa na yanzu ba.

A cikin kasuwanni masu saurin canzawa, yuwuwar saurin sauye-sauyen farashin ya fi girma, wanda zai iya haifar da siginar karya tare da daidaitattun madaidaitan ma'auni. By daidaita matakan oversold da oversold, traders na iya rage waɗannan sigina na ƙarya:

- Ƙofar da aka yi yawa: Kasa zuwa 65

- Ƙofar da aka yi yawa: Ƙara zuwa 35

Wannan daidaitawar yana taimakawa wajen tace amo da mai da hankali kan sigina masu ƙarfi.

Don ƙananan kasuwannin da ba su da ƙarfi, inda farashin farashi ya fi ƙasƙanci, ana iya daidaita ƙofofin don ɗaukar tsayin daka ba tare da mayar da martani ga ƙananan farashin farashi ba:

- Ƙofar da aka yi yawa: Tashi zuwa 75

- Ƙofar da aka yi yawa: Kasa zuwa 25

Wannan ya bada damar traders yi advantage na cikakken kewayon motsi kafin a haifar da sigina.

Gwajin baya muhimmin mataki ne a cikin wannan tsari. Ta hanyar nazarin yadda saitunan daban-daban zasu yi a baya, traders na iya auna yuwuwar tasirin gyare-gyaren su. Yana da mahimmanci ga ci gaba da tace waɗannan saitunan, kamar yadda yanayin kasuwa zai iya canzawa, yana mayar da mafi kyawun matakan baya tasiri.

Muhimman Abubuwan La'akari don Daidaitawa:

- Karɓar Kasuwa: Maɗaukakiyar rashin ƙarfi na iya buƙatar ƙara matsa lamba don guje wa siginar ƙarya.

- Haƙurin Haƙuri: Mai ra'ayin mazan jiya traders na iya fifita manyan makada don tabbatar da sigina masu ƙarfi.

- Kayan aiki: Wasu na'urori na iya kasancewa suna da bayanan martaba daban-daban masu buƙatar saituna na musamman.

- Sakamakon Gwajin Baya: Ayyukan tarihi na iya jagorantar daidaita matakan don gaba trades.

- Yanayin Kasuwa: Daidaitawa da yanayin kasuwa na yanzu na iya haɓaka dacewar sigina.

Ta hanyar keɓance matakan da aka yi fiye da kima da kima na Ultimate Oscillator, traders iya inganta ingancin su trade sakonni, mai yuwuwar haifar da kyakkyawan sakamako na ciniki. Duk da haka, yana da mahimmanci don kusanci wannan gyare-gyare tare da tunani mai mahimmanci, la'akari da abubuwa daban-daban waɗanda ke tasiri tasirin waɗannan alamun fasaha.

3. Yadda ake lissafta Ultimate Oscillator?

Lokacin amfani da Ultimate Oscillator in ciniki dabaru, yana da mahimmanci don fahimtar ba kawai lissafin ba amma har ma da nuances na yadda zai iya nuna yiwuwar damar ciniki. bambanta rarrabuwar yana taka muhimmiyar rawa a nan; idan farashin kadari ya yi sabon tsayi ko ƙananan wanda ba a nuna shi a cikin oscillator ba, wannan na iya nuna rashin ƙarfi da kuma yiwuwar juyawa.

Anan ga ɓarkewar mataki-mataki na tsarin lissafin:

- Ƙaddara Ƙarƙashin Gaskiya na Gaskiya (TL):

- TL = Ƙananan Ƙasashen Yau ko Ƙarshen Jiya

- Ƙididdige Matsi na Siyan (BP):

- BP = Yau Kusa - TL

- Kafa Gaskiyar Range (TR):

- TR = Mafi Girma na Yau - Ƙarƙashin Yau, Ƙarƙashin Yau - Ƙarshen Jiya, Ko Ƙarshen Jiya - Ƙarƙashin Yau

- Yi lissafin Matsakaicin Rabo ga kowane lokaci:

- Matsakaicin7 = (Jimillar BP na tsawon lokuta 7) / (Jimillar TR na lokuta 7)

- Matsakaicin14 = (Jimillar BP na tsawon lokuta 14) / (Jimillar TR na lokuta 14)

- Matsakaicin28 = (Jimillar BP na tsawon lokuta 28) / (Jimillar TR na lokuta 28)

- Aiwatar da Nauyin:

- Matsakaicin Nauyi = (4 x Matsakaici7 + 2 x Matsakaici14 + Matsakaici28)

- Daidaita Oscillator:

- UO = 100 x (Matsakaicin Nauyi / 7)

Fassarar Ultimate Oscillator ya ƙunshi neman takamaiman alamu da sigina:

- Yawan Siyayya da Yawaita Yanayi: Kamar yadda aka ambata, karatun sama da 70 da ƙasa 30 na iya nuna yanayin da aka yi fiye da kima da kima, bi da bi.

- bambanta rarrabuwar: Lokacin da farashin ya yi sabon girma ko ƙananan wanda ba a tabbatar da shi ta hanyar oscillator ba, yana nuna yiwuwar sake dawowa farashin.

- Matsakaicin Ƙarfi: Yunkurin da ke sama da babban kofa na iya sigina farkon lokacin tashin hankali, yayin da hutun da ke ƙasa da ƙananan kofa zai iya nuna farkon lokaci na bearish.

Abubuwan da suka dace don traders sun hada da:

- Daidaita Ƙaddara: Dangane da rashin daidaituwar kadari, traders na iya buƙatar daidaita ƙofofin da aka yi fiye da kima da sayar da su don dacewa da halayen kasuwa.

- Tabbacin: Yin amfani da Ƙarshen Oscillator tare da sauran kayan aikin bincike na fasaha na iya ba da tabbaci mai ƙarfi na siginar ciniki.

- Hankalin Tsararren Lokaci: Ana iya amfani da oscillator zuwa firam ɗin lokaci daban-daban, amma traders ya kamata ya sani cewa hankalinsa da sigina na iya bambanta daidai da haka.

Ta hanyar haɗa Ultimate Oscillator zuwa cikakkiyar dabarun ciniki, traders zai iya fi dacewa a auna ƙarfin ƙarfi da yuwuwar juyi a kasuwa. Kayan aiki ne wanda ke ƙara zurfin bincike na fasaha kuma zai iya taimakawa wajen yin ƙarin yanke shawara na ciniki.

3.1. Fahimtar Matsi na Siyan

Lokacin tantance yanayin kasuwa, traders sau da yawa suna neman alamu wajen siyan matsin lamba don sanar da dabarun su. Misali, karuwar siyan matsa lamba Tsawon lokaci a jere na iya ba da shawarar bacin rai mai ƙarfi, mai yuwuwar haifar da fashewa. Akasin haka, rage karfin sayayya na iya yin nuni ga yanayin rauni ko gyara farashi mai zuwa.

Maɓalli masu mahimmanci na siyan matsa lamba sun hada da:

- Mafi Girma: Lokacin da farashi akai-akai yana rufewa a matakai mafi girma fiye da zaman da suka gabata.

- Ƙarar Ƙarfafawa: Haɓaka ƙarar ciniki na iya rakiyar ƙara matsa lamba na siye, yana ƙarfafa yanayin.

- Tsarin Farashin: Halayen ƙyalli kamar 'kofin da rike' ko 'alwati mai hawa' na iya nuna matsi na siyan gini.

Traders sau da yawa yana cika Ultimate Oscillator tare da wasu kayan aikin don tabbatar da siginar matsa lamba:

| Alamar fasaha | Nufa |

|---|---|

| motsi Averages | Don gano alkiblar yanayin |

| Oscillator girma | Don auna canje-canje a cikin ƙara, wanda zai iya tabbatar da matsa lamba |

| RSI (Dangi Ƙarfin Index) | Don auna ƙarfin matsi na siyan |

| MACD (Matsakaicin Matsakaicin Canzawa) | Don tabbatar da ƙarfin da ke bayan matsin siyan |

Ingantacciyar amfani da Ultimate Oscillator ya haɗa da neman bambance-bambance tsakanin oscillator da aikin farashi. Idan oscillator yana yin haɓaka mafi girma yayin da farashin ba haka yake ba, yana iya nuna ƙarfin da zai iya haifar da motsin farashin sama.

Traders ya kamata koyaushe su kasance suna sane da mahallin kasuwa lokacin fassara matsa lamba. Abubuwan da suka faru na labarai, sakin bayanan tattalin arziki, da ra'ayin kasuwa duk na iya rinjayar matsa lamba na siyan kuma, ta tsawo, amincin sigina daga Ultimate Oscillator. Ana ba da shawarar yin amfani da haɗin gwiwar bincike na fasaha, muhimmin bincike, da kuma dabarun gudanar da haɗari don yin yanke shawara na ciniki da aka sani.

3.2. Takaita Matsakaicin Riba da Asara

Lokacin amfani da Ultimate Oscillator, tsarin tattara matsakaicin riba da asara yana taka muhimmiyar rawa wajen samar da amintattun sigina. albashi faruwa lokacin da farashin rufewar lokacin ya fi na lokutan baya, kuma hasarori ana yin rikodin lokacin da farashin rufewar lokacin ya yi ƙasa.

Traders jimlar ribar da asara a kan ƙayyadaddun lokaci, yawanci ta yin amfani da ƙayyadaddun lokaci na 7, 14, Da kuma 28 lokuta. Waɗannan suna wakiltar ɗan gajeren lokaci, tsaka-tsakin lokaci, da yanayin kasuwa na dogon lokaci, bi da bi. Hanya don ƙididdige matsakaita ita ce madaidaiciya: tara riba ko asara na kowane lokaci sannan a raba da adadin lokuta.

Ga yadda lissafin ke rushe kowane lokaci:

| Tsawon lokaci (Lokaci) | Lissafin Matsakaicin Riba ko Asara |

|---|---|

| 7 | (Jimillar Riba ko Asara) / 7 |

| 14 | (Jimillar Riba ko Asara) / 14 |

| 28 | (Jimillar Riba ko Asara) / 28 |

Wadannan matsakaita ana auna su kuma an haɗa su cikin dabarar Ultimate Oscillator, suna ba da ƙimar da ke canzawa tsakanin 0 da 100. Yana da mahimmanci don traders don sabunta waɗannan matsakaita tare da kowane sabon lokaci don kiyaye daidaiton oscillator. Ta hanyar taƙaita matsakaicin riba da asara, Ultimate Oscillator ya kasance ingantaccen kayan aiki don gano yuwuwar siye ko siyar da maki a cikin yanayin ciniki.

3.3. Aiwatar da Formula

Lokacin amfani da Ultimate Oscillator a cikin dabarun ciniki, yana da mahimmanci a gane bambance-bambance tsakanin oscillator da aikin farashin. A banbance-banbance yana faruwa lokacin da farashin ya yi ƙasa da ƙasa, amma oscillator yana yin ƙasa mafi girma, yana nuna yuwuwar komawar farashin sama. Akasin haka, a rabuwa shine lokacin da farashin ya hau sama mafi girma yayin da oscillator ke samar da ƙaramin tsayi, yana nuna yiwuwar motsin farashin ƙasa.

Yanayin da aka yi fiye da kima da siyayya sigina ne masu mahimmanci waɗanda Ultimate Oscillator ke bayarwa. Traders sau da yawa nema:

- Yanayin da aka yi yawa (UO> 70): Wannan na iya nuna cewa za a iya yin kima da kimar kadarar, kuma gyara farashin yana nan kusa.

- Yanayin da aka yi yawa (UO <30): Wannan na iya nuna cewa kadarar ba ta da kima, kuma ƙarin farashi na iya kasancewa a kan gaba.

Tabbatarwa tare da aikin farashi hanya ce mai hankali. Traders ya kamata ya kalli farashin don karya ta hanyar layi ko juriya / matakin tallafi bayan oscillator ya nuna alamar yuwuwar juyawa.

Daidaita lokaci shi ma muhimmin al'amari ne. Daidaita siginar oscillator tare da mafi girman yanayin kasuwa na iya ƙara amincin siginar ciniki.

| Nau'in Sigina | Yanayin Oscillator | price Action | Mahimman Ayyukan Kasuwanci |

|---|---|---|---|

| Banbancin Bullish | Mafi Girma a cikin UO | Ƙananan Ƙananan a Farashin | Yi la'akari da Dogon Matsayi |

| Bambancin Bambanci | Babban darajar UO | Mafi Girma a Farashin | Yi la'akari da Gajeren Matsayi |

| Mai wuce gona da iri | UO> 70 | - | Saka idanu don Siginonin Siyarwa |

| Rarrabawa | UO <30 | - | Saka idanu don Siginonin Sayi |

hadarin management ya kamata koyaushe ya kasance tare da amfani da Ultimate Oscillator. Saita tasha-hasara umarni da karɓar riba a matakan da aka ƙayyade na iya taimakawa wajen sarrafa hasara mai yuwuwa da kulle ribar.

Haɗa Ultimate Oscillator tare da sauran alamomi zai iya samar da ƙarin matakan tabbatarwa. Misali, yin amfani da matsakaita masu motsi, ƙara, ko ma alamu akan ginshiƙi farashin na iya haɓaka tasirin siginonin da Ultimate Oscillator ya haifar.

Haɗa Ƙarshen Oscillator a cikin tsarin ciniki yana buƙatar aiki da hankali ga nuances na kasuwa. Kamar yadda yake tare da kowane mai nuna fasaha, ba rashin hankali ba ne kuma ya kamata a yi amfani da shi tare da tsarin ciniki mai kyau.

4. Menene Mafi kyawun Dabaru don Amfani da Ƙarshen Oscillator?

Saita madaidaitan ƙofofin yana da mahimmanci yayin aiki tare da Ultimate Oscillator. Yayin da aka saita matakan gama gari a 70 don oversold da 30 don oversold, daidaita waɗannan ƙofofin don dacewa da juzu'in kadari na iya inganta daidaiton sigina. Ƙarin kadari mai canzawa na iya buƙatar mafi girma kofa don guje wa siginar ƙarya, yayin da mai ƙarancin ƙarfi zai iya buƙatar ƙaramin ƙofa don ya kasance mai hankali don gano motsi masu ma'ana.

Shigarwar lokaci da fita wani bangare ne inda Ultimate Oscillator zai iya zama babban taimako. Traders ya kamata ya nemi lokutan lokacin da oscillator ya fita daga yankin da aka yi yawa ko aka yi masa yawa, wanda zai iya nuna motsi mai sauri. Shigar a trade kamar yadda oscillator ke ƙetare baya ta matakin 70 ko 30 na iya zama dabara don kama farkon yuwuwar yanayin.

Madaidaitan Oscillator na ƙarshe:

| siga | description |

|---|---|

| Tsawon Lokaci | Yawanci lokuta 7 |

| Tsakanin Zamani | Yawancin lokaci 14 |

| Tsawon Lokaci | Yawancin lokaci ana saita zuwa lokuta 28 |

| Ƙofar da aka yi yawa | Yawancin lokaci 70 (daidaitacce) |

| Matsakaicin Matsakaici | Yawanci 30 (mai daidaitawa) |

hadarin management yana da mahimmanci lokacin amfani da Ultimate Oscillator. Traders ya kamata koyaushe saita odar tsayawa-asara don karewa daga jujjuyawar kasuwa wanda zai iya faruwa koda bayan an ba da sigina. Ta hanyar sarrafa kasada da adana jari, traders na iya tabbatar da cewa sun ci gaba da kasancewa a wasan ko da a trade baya tafiya yadda aka tsara.

Haɗa Ultimate Oscillator zuwa cikin wani m ciniki shirin cewa asusun ga mutum haƙuri haƙuri da ciniki style ne mafi muhimmanci. Traders yakamata su gwada dabarun su ta amfani da bayanan tarihi don fahimtar yadda oscillator ke aiki a ƙarƙashin yanayin kasuwa daban-daban. Wannan aikin zai iya taimakawa wajen daidaita amfani da Ultimate Oscillator da daidaita shi zuwa ga trader ta musamman bukatun.

Yin amfani da Ultimate Oscillator don tabbatar da yanayin iya samar da ƙarin Layer na tabbatarwa don traders. Lokacin da kasuwa ke tasowa, oscillator ya kamata gabaɗaya yayi tafiya a hanya ɗaya. Idan oscillator ya fara bambanta daga yanayin farashin, yana iya nuna alamar cewa yanayin yana raunana kuma ana iya komawa baya.

4.1. Gano Siginonin Banbanci

Lokacin shigar da siginar bambance-bambance a cikin dabarun ciniki, yana da mahimmanci saka idanu mahallin kasuwa. Bambance-bambancen kawai bazai zama isasshiyar alamar koma-baya ba, domin wani lokaci yana iya kaiwa ga siginar karya. Traders yakamata suyi la'akari da waɗannan abubuwan don haɓaka amincin rarrabuwa:

- Ƙara: Ƙarfin ciniki mafi girma akan kyandir tabbacin jujjuyawar yanayin zai iya ƙarfafa siginar bambance-bambance.

- Matakan Taimako da Juriya: Bambance-bambancen da ya zo daidai da maɓalli na tallafi ko matakin juriya na iya ba da ƙarin tabbaci.

- Tsawon Lokaci: Bambance-bambancen da ke faruwa bayan dogon yanayi na iya zama mafi mahimmanci fiye da waɗanda ke bayyana bayan yanayin ɗan gajeren lokaci.

Traders na iya amfani da wasu alamun fasaha kamar matsakaicin motsi, Bollinger Makada, ko Ƙarfin Ƙarfi (RSI) don tabbatar da siginar da aka ba da shawara ta hanyar rarrabuwa tare da Ultimate Oscillator.

| Nau'in Banbanci | price Action | Ultimate Oscillator Action | Siginar Tabbatarwa |

|---|---|---|---|

| Bulgariya | Sabon Kasa | Mafi Girma | Oscillator Ya Haura Sama da Ƙwararrun Kwanan nan |

| Bearish | Sabon High | Ƙananan High | Oscillator Faɗuwar Ƙarƙashin Ruwa na Kwanan nan |

hadarin management Abu ne mai mahimmanci lokacin ciniki akan sigina daban-daban. Saita odar asarar-asara a matakan dabaru na iya taimakawa rage yuwuwar asara idan kasuwa ba ta motsawa kamar yadda ake tsammani. Bugu da kari, traders yakamata suyi girman matsayinsu daidai kuma su guji wuce gona da iri zuwa guda ɗaya trade.

Ta hanyar haɗa siginar bambance-bambance tare da sauran kayan aikin bincike na fasaha da ayyukan sarrafa haɗarin sauti, traders na iya haɓaka tsarin yanke shawara kuma suyi ƙoƙari don daidaita tsarin ciniki.

4.2. Ciniki da Breakout

Lokacin haɗawa da Ultimate Oscillator a cikin tsarin da aka tsara, traders yakamata su saka idanu sosai akan halayen oscillator dangane da motsin farashi. Ƙarshen Oscillator ya haɗu da gajeren lokaci, tsaka-tsaki, da matsakaitan matsakaita na dogon lokaci don samar da cikakkiyar siginar motsi.

| price Action | Ultimate Oscillator | Interpretation |

|---|---|---|

| Farashin ya karye sama da juriya | Oscillator yana karya sama da tsayinsa | Tabbatarwa mai girma |

| Farashin karya ƙasa tallafi | Oscillator yana karya ƙasa da ƙarancinsa | Tabbatacce |

| Farashin yana fuskantar juriya | Oscillator yana kusa da tsayi ba tare da fashewa ba | Mai yuwuwar tashin hankali |

| Farashin hanyoyin tallafi | Oscillator yana kusa da ƙasa ba tare da fashewa ba | Mai yuwuwar bugun beari |

bambanta rarrabuwar yana taka muhimmiyar rawa wajen tantance ingancin fashewar. Lokacin da farashin ya fashe amma Ultimate Oscillator bai tabbatar da motsi ba, yana iya zama alamar a raunin rauni ko a siginar ƙarya. Bambance-bambancen inda farashin ke yin sabon girma ko ƙasa, amma oscillator ba ya yi, alama ce ta ja. traders.

Makin shiga ya kamata a zaba tare da kulawa, da kyau bayan Ultimate Oscillator ya tabbatar da fashewa. Traders na iya neman oscillator ya wuce iyakarsa na baya-bayan nan a matsayin alama mai ƙarfi mai ƙarfi.

| Yanayin Shiga | Action |

|---|---|

| An tabbatar da fashewa tare da yarjejeniyar oscillator | Yi la'akari da shiga trade |

| Breakout ba tare da tabbacin oscillator ba | Yi taka tsantsan ko kaucewa trade |

| Bambancin Oscillator | Sake kimantawa trade amincin |

hadarin management yana da mahimmanci, kuma kyakkyawan tanadin tsayawa-asara zai iya taimakawa rage yuwuwar asara. Traders na iya saita asarar tasha a ƙasa da matakin fashewa don dogon matsayi ko sama sama don gajerun matsayi.

The lokaci don Ultimate Oscillator yakamata ya daidaita tare da tradedabarun r. Gajeren lokaci na iya zama mafi kula da canje-canjen farashi, yayin da tsayin lokaci zai iya tace amo.

| Lokaci | Sanin | Cancanta |

|---|---|---|

| Lokacin gajere | high | Ciniki mai tsanani |

| Dogon lokacin | low | Ciniki mai ra'ayin mazan jiya |

Haɗa Ƙarshen Oscillator a cikin kasuwancin karya zai iya samarwa traders da a kayan aiki mai karfi don ganowa da kuma tabbatar da abubuwan da ke faruwa. Ta hanyar kula da tabbatarwa da bambance-bambancen oscillator, da kuma haɗa shi tare da nazarin girma. traders na iya aiwatar da ƙarin sanar da dabara trades.

4.3. Haɗuwa da Sauran Manufofin Fasaha

Ultimate Oscillator + Matsakaicin Motsi

| Yanayin Kasuwa | motsi Average | Ultimate Oscillator Signal | Yiwuwar Aiki |

|---|---|---|---|

| Mara kyau | Farashin sama da MA | Mai wuce gona da iri | Saka idanu don yuwuwar siyarwa |

| Faduwa | Farashin da ke ƙasa MA | Rarrabawa | Saka idanu don yuwuwar siye |

| Taya | Farashin yana yawo a kusa da MA | bambanta rarrabuwar | Yi la'akari da siye/sayar bisa ga bambance-bambance |

Ultimate Oscillator + RSI

| Ultimate Oscillator | RSI | Yanayin Kasuwa | Yiwuwar Aiki |

|---|---|---|---|

| Mai wuce gona da iri | Mai wuce gona da iri | Yiwuwar Juya Juya Hali | Yi la'akari da siyarwa |

| Rarrabawa | Rarrabawa | Yiwuwar Juyar da Hankali | Yi la'akari da siye |

| bambanta rarrabuwar | bambanta rarrabuwar | Mai yuwuwar Juyawa Juyawa | Tabbatar da sauran alamomi |

Ultimate Oscillator + Bollinger Bands

| Ultimate Oscillator Signal | Bollinger Band Interaction | volatility | Yiwuwar Aiki |

|---|---|---|---|

| Fita Oversyi | Farashin ya taɓa babban bandeji | high | Yiwuwar siyarwa akan juyawa |

| Fita Oversold | Farashin ya taɓa ƙananan band | high | Yiwuwar siya akan juyawa |

| baruwan | Farashin a cikin makada | Al'ada | Jira ƙarin sigina |

Ultimate Oscillator + Stochastic Oscillator

| Ultimate Oscillator | stochastic Oscillator | Lokacin Kasuwa | Yiwuwar Aiki |

|---|---|---|---|

| Matsalolin Bullish | Bullish Crossover | Ƙarawa | Yi la'akari da siye |

| Yanayin Bearish | Bearish Crossover | Ragewa | Yi la'akari da siyarwa |

| bambanta rarrabuwar | bambanta rarrabuwar | Rashin tabbas | Yi amfani da ƙarin bincike |

Ultimate Oscillator + MACD

| Ultimate Oscillator | MACD | Tabbatar da Trend | Yiwuwar Aiki |

|---|---|---|---|

| Bullish Crossover | MACD sama da Layin Sigina | Tabbatar da Uptrend | Yi la'akari da siye |

| Bearish Crossover | MACD kasa Layin Sigina | Tabbatar Downtrend | Yi la'akari da siyarwa |

| bambanta rarrabuwar | bambanta rarrabuwar | Trend Rauni | Sake kimanta matsayi |

Muhimmin La'akari:

- Ruɗani tsakanin alamomi yana ƙarfafawa trade sigina.

- bambanta rarrabuwar na iya zama gargaɗin farko na yuwuwar koma baya.

- volatility kimantawa yana da mahimmanci don tantance wuraren shiga da fita.

- hadarin management yana da mahimmanci, gami da yin amfani da odar tasha-asara.

- Kada a yi amfani da oscillators a ware; mahallin kasuwa yana da muhimmanci.

- Regular baya na dabarun taimaka wajen tace tasirin su.