1. Menene Matsakaicin Motsa Matsakaicin Mafi Karanci?

The Mafi Karancin Filaye motsi Average (LSMA), saboda haka aka sani da Matsakaicin Matsakaicin Ƙarshe, wani nau'i ne na matsakaita motsi wanda ke amfani da mafi ƙanƙanta hanyar koma bayan murabba'ai zuwa maƙallan bayanai na ƙarshe don tantance layin mafi dacewa. Ana amfani da wannan layin don yin hasashen ƙimar a lokaci na gaba. Ba kamar matsakaicin motsi na al'ada ba, LSMA tana jaddada ƙarshen saitin bayanai, wanda aka yi imanin ya fi dacewa don tsinkayar abubuwan da ke gaba.

Lissafin LSMA ya haɗa da gano layin koma baya wanda ke rage jimlar murabba'ai na nisa na tsaye na maki daga layin. Wannan hanya tana da tasiri musamman wajen rage larurar da aka saba danganta da matsakaita masu motsi. Ta hanyar mai da hankali kan rage nisan maki daga layin, LSMA tana ƙoƙarin samar da mafi daidaito kuma mai nuna alama na jagora da ƙarfin yanayi.

Traders sau da yawa yana fifita LSMA akan sauran matsakaita masu motsi don ikon sa na sa ido kan motsin farashin da samar da alamun farkon canje-canje. Yana da amfani musamman a ciki kasuwanni masu canzawa inda gano farkon da ƙarshen farashin farashi yana da mahimmanci don yanke shawara akan lokaci.

Daidaitawar LSMA yana ba da damar yin amfani da shi zuwa firam ɗin lokaci daban-daban, yana mai da shi kayan aiki iri-iri. traders waɗanda ke aiki akan yanayin ciniki daban-daban, daga intraday zuwa dabarun saka hannun jari na dogon lokaci. Koyaya, kamar duk alamun fasaha, yakamata a yi amfani da LSMA tare da wasu kayan aikin da hanyoyin bincike don tabbatar da sigina da haɓaka daidaiton ciniki.

2. Yadda ake ƙididdige Matsakaicin Motsawa Mafi Karanci?

Ƙididdigar Matsakaicin Matsakaicin Motsa Matsakaicin Mafi Karanci (LSMA) yana buƙatar matakai da yawa, waɗanda suka haɗa da hanyoyin ƙididdiga don dacewa da layin koma baya na layi zuwa farashin rufewar tsaro a kan ƙayyadadden lokaci. Dalili na layin koma baya na layi shine:

y = m x + b

inda:

- y yana wakiltar farashin da aka annabta,

- m shine gangaren layin,

- x shine canjin lokaci,

- b shine y- intercept.

Don ƙayyade ƙimar don m da kuma b, ana ɗaukar matakai masu zuwa:

- Sanya lambobi masu jere zuwa kowane lokaci (misali, 1, 2, 3, …, n) don x dabi'u.

- Yi amfani da farashin rufewa ga kowane lokaci kamar yadda y dabi'u.

- Yi lissafin gangara (m) na regression line ta amfani da dabara:

m = (N Σ (xy) – Σx Σy) / (N Σ(x^2) – (Σx)^2)

inda:

- N shine adadin lokuta,

- Σ yana nuna taƙaitawar lokutan da ake tambaya,

- x da kuma y Lambobin kowane lokaci ne da farashin rufewa bi da bi.

- Yi lissafin y-intercept (b) na layi tare da dabara:

b = (Σy – m Σx) / N

- Bayan ƙaddara m da kuma b, za ku iya hasashen ƙima ta gaba ta hanyar shigar da daidai x darajar (wanda zai zama N+1 na lokaci na gaba) a cikin ma'auni na koma baya y = m x + b.

Waɗannan ƙididdiga suna haifar da ƙarshen LSMA a halin yanzu, wanda za'a iya tsara shi azaman ci gaba da layi akan ginshiƙi farashin, ci gaba yayin da sabbin bayanai ke samuwa.

Don aikace-aikacen aikace-aikacen, yawancin dandamali na ciniki sun haɗa da LSMA azaman ingantacciyar alamar fasaha, sarrafa waɗannan ƙididdiga da haɓaka matsakaicin motsi a cikin ainihin-lokaci. Wannan saukaka damar traders don mayar da hankali kan nazarin kasuwa ba tare da buƙatar lissafin hannu ba.

2.1. Fahimtar Matsakaicin Matsakaicin Matsakaicin Filayen Filaye

Yin la'akari da gangara da tsangwama a cikin LSMA

Mahimman abubuwan LSMA dabarar, da gangara (m) da kuma y-intercept (b) suna da mahimmanci don fahimtar yanayin yanayin yanayin. Gudun daji yana nuna ƙimar da farashin tsaro ke canzawa akan lokaci. A tabbatacce gangara yana nuna haɓakawa, yana nuna cewa farashin yana ƙaruwa yayin da lokaci ya ci gaba. Akasin haka, a korau gangara yana nuna raguwa, tare da raguwar farashin akan lokutan da aka zaɓa.

y-intercept yana ba da hoton inda layin koma baya ya ketare y-axis. Wannan mahaɗin yana wakiltar farashin da aka annabta lokacin da canjin lokaci (x) ya zama sifili. A cikin mahallin ciniki, y-intercept ba shi da ƙasa game da madaidaicin madaidaicin madaidaicin kuma ƙari game da rawar da yake takawa tare da gangara don ƙididdige farashin gaba.

Lissafin Ƙimar Hasashen tare da LSMA

Da zarar an ƙaddara gangara da y-intercept, waɗannan ƙimar ana amfani da su don hasashen farashin nan gaba. The yanayin tsinkaya na LSMA an lullube shi a cikin ma'auni y = m x + b. Ana kimanta ƙimar kowane sabon zamani ta hanyar shigarwa N + 1 a cikin equation, inda N shine adadin lokacin da aka sani na ƙarshe. Wannan iyawar tsinkaya ita ce abin da ya bambanta LSMA daga matsakaicin motsi mai sauƙi, wanda matsakaicin farashin da ya wuce kawai ba tare da ɓangaren jagora ba.

Mayar da hankali na LSMA akan rage jimlar murabba'i na nisa na tsaye daga layin daidai yana rage amo kuma yana samar da wakilci mai laushi na yanayin farashin. Wannan sakamako mai laushi yana da fa'ida musamman a kasuwannin da ba su da ƙarfi, inda zai iya taimakawa traders gane abin da ke faruwa a tsakanin farashin farashi.

Aiwatar da Ayyuka na Ƙimar LSMA

Ma traders, aikace-aikace mai amfani na ƙimar LSMA yana nufin sa ido kan jagora da girman gangaren. Matsakaicin gangare yana nuna yanayin da ya fi ƙarfin, yayin da gangara mai faɗi yana nuna yuwuwar rauni ko juye yanayin yanayin. Bugu da ƙari, matsayin layin LSMA dangane da aikin farashi na iya zama sigina: farashin da ke sama da layin LSMA na iya nuna yanayin rashin ƙarfi, yayin da farashin da ke ƙasa zai iya ba da shawarar yanayin rashin ƙarfi.

Ƙarfin dabarar LSMA don daidaitawa zuwa sabbin bayanan kasuwa ya sa ya zama kayan aiki mai ƙarfi da hangen nesa. Yayin da sabbin bayanan farashin ke samuwa, ana sake ƙididdige layin LSMA, tabbatar da cewa matsakaicin motsi ya kasance mai dacewa da lokacin yanke shawara.

| bangaren | Matsayi a cikin LSMA | Tasiri don Kasuwanci |

|---|---|---|

| gangara (m) | Yawan canjin farashi | Yana nuna alkibla da ƙarfi |

| Y-intercept (b) | Farashin da aka annabta lokacin x=0 | An yi amfani da shi cikin dabara don ƙididdige farashin nan gaba |

| Hasashen Hasashen (y=mx+b) | Hasashen farashin nan gaba | Yana taimakawa tsinkayar ci gaba ko juyawa |

Ta hanyar fahimtar ginshiƙan ilimin lissafi da abubuwan da suka dace na dabarar LSMA, traders iya mafi alhẽri yin amfani da wannan nuna alama a cikin kasuwar bincike da kuma ciniki dabaru.

2.2. Aiwatar da Matsakaicin Matsakaicin Matsala mafi ƙanƙanta a cikin Python

Note: Wannan hanyar don ci gaba ne Traders wanda ya san Python Programming. Idan ba amanar ku ba zaku iya tsallakewa zuwa part 3.

Don aiwatar da Matsakaicin Matsakaicin Matsakaicin Maɗaukaki (LSMA) a Python, yawanci mutum zai yi amfani da dakunan karatu kamar Lambobi don lissafin lambobi da pandas don sarrafa bayanai. Aiwatar da aiwatarwa ya ƙunshi ƙirƙirar aikin da ke ɗaukar jerin farashin rufewa da tsawon matsakaicin matsakaita a matsayin abubuwan shigarwa.

Da fari dai, ana samar da jeri na ƙimar lokaci (x) don dacewa da farashin rufewa (y). The Lambobi ɗakin karatu yana ba da ayyuka kamar np.arange() don ƙirƙirar wannan jeri, wanda ke da mahimmanci don ƙididdige taƙaitaccen bayanin da ake buƙata don gangaren gangara da tsarin tsangwama.

Lambobi kuma yana bayar da np.polyfit() aiki, wanda ke ba da madaidaiciyar hanya don dacewa da mafi ƙarancin murabba'ai na ƙayyadaddun digiri ga bayanai. A cikin yanayin LSMA, digiri na farko na polynomial (daidaitaccen layi) ya dace. The np.polyfit() Aiki yana mayar da ma'auni na layin dawo da layi, wanda yayi daidai da gangara (m) da y-intercept (b) a cikin tsarin LSMA.

import numpy as np

import pandas as pd

def calculate_lsma(prices, period):

x = np.arange(period)

y = prices[-period:]

m, b = np.polyfit(x, y, 1)

return m * (period - 1) + b

Ana iya amfani da aikin da ke sama zuwa a pandas DataFrame dauke da farashin rufewa. Ta hanyar amfani da rolling hanya a hade tare da apply, LSMA za a iya ƙididdigewa ga kowane taga na ƙayyadadden lokacin a duk cikin bayanan.

df['LSMA'] = df['Close'].rolling(window=period).apply(calculate_lsma, args=(period,))

A cikin wannan aiwatarwa, da calculate_lsma An tsara aikin don a yi amfani da shi tare da apply Hanyar, ba da damar ƙididdige ƙididdiga na ƙimar LSMA. Sakamakon LSMA shafi a cikin DataFrame yana ba da jerin lokaci na ƙimar LSMA waɗanda za a iya ƙirƙira akan farashin rufewa don ganin yanayin yanayin.

Haɗa LSMA cikin rubutun ciniki na Python yana ba da izini traders don sarrafa sarrafa bincike na yanayin da yuwuwar haɓaka dabarun ciniki na algorithmic waɗanda ke amsa siginar da LSMA ke samarwa. Kamar yadda sabon bayanan farashin ke haɗawa zuwa DataFrame, LSMA za a iya sake ƙididdigewa, yana ba da ci gaba da bincike na ci gaba a cikin ainihin lokaci.

| aiki | amfani | description |

|---|---|---|

np.arange() |

Ƙirƙirar jeri | Yana ƙirƙira ƙimar lokaci don lissafin LSMA |

np.polyfit() |

Fit regression line | Yana ƙididdige gangara da tsangwama ga LSMA |

rolling() |

Aiwatar da aiki akan taga | Yana kunna lissafin LSMA a cikin pandas |

apply() |

Yi amfani da aikin al'ada | Yana amfani da lissafin LSMA zuwa kowace taga mai birgima |

3. Yadda Ake Sanya Matsakaicin Matsakaicin Matsala Mafi Girma?

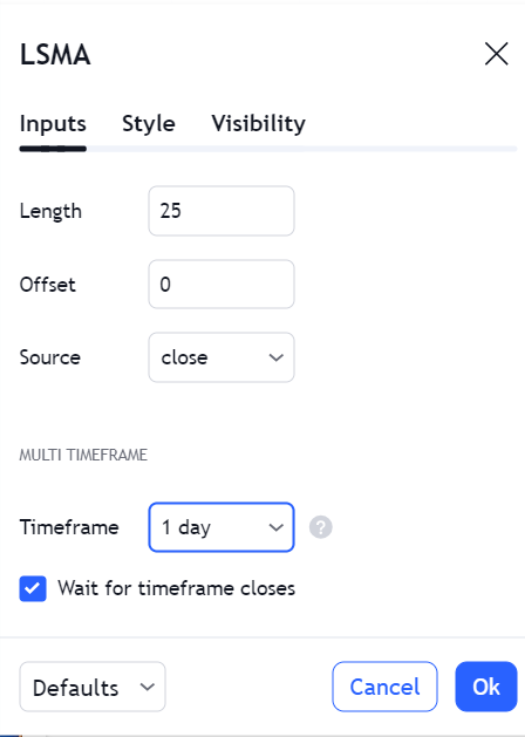

Haɓaka saitunan Matsakaicin Matsakaicin Matsakaici (LSMA) daidai yana da mahimmanci don amfani da cikakkiyar damarsa a cikin dabarun ciniki. Babban ma'aunin daidaitawa na LSMA shine tsawon lokaci, wanda ke nuna adadin bayanan bayanan da aka yi amfani da su a cikin nazarin sake dawowa. Wannan lokacin za a iya daidaita shi da kyau dangane da trader's mayar da hankali, ko ya zama gajeren lokaci farashin motsi ko dogon lokaci Trend bincike. Wani ɗan gajeren lokaci yana haifar da LSMA mai mahimmanci wanda ke amsawa da sauri ga canje-canjen farashin, yayin da lokaci mai tsawo yana ba da layi mai laushi mai sauƙi ga bulala.

Wani wuri mai mahimmanci shine farashin tushe. Ko da yake ana yawan amfani da farashin rufewa, traders suna da sassauci don amfani da LSMA don buɗewa, babba, ƙasa, ko ma matsakaicin waɗannan farashin. Zaɓin farashin tushen zai iya rinjayar hankalin LSMA kuma ya kamata ya daidaita tare da tradeHanyar nazari ta r.

Don ƙara tace LSMA, traders iya daidaita da biya diyya darajar, wanda ke motsa layin LSMA gaba ko baya akan ginshiƙi. Ragewa zai iya taimakawa wajen daidaita LSMA kusa da aikin farashin na yanzu ko samar da ƙarin haske na gani na jagorar yanayin.

Na'urorin haɓaka na iya haɗawa yin amfani da mai yawa zuwa gangara ko ƙirƙirar a tashar kusa da LSMA ta ƙarawa da rage ƙayyadadden ƙima ko kashi daga layin LSMA. Waɗannan gyare-gyare za su iya taimakawa wajen gano abubuwan da aka yi fiye da kima da kima.

| Kafa | description | Tasiri |

|---|---|---|

| Tsawon Lokacin | Adadin bayanai don koma baya | Yana rinjayar hankali da santsi |

| Farashin Source | Nau'in farashin da aka yi amfani da shi (kusa, buɗe, babba, ƙasa) | Yana shafar hankalin LSMA ga farashi |

| Offset | Yana canza layin LSMA akan ginshiƙi | Taimaka tare da daidaitawar gani da nunin yanayin |

| Multiplier/Channel | Yana daidaita gangara ko ƙirƙirar kewayo a kusa da LSMA | Taimakawa wajen gano iyakar kasuwa |

Ko da kuwa saitunan da aka zaɓa, yana da mahimmanci don sake gwadawa LSMA tare da bayanan tarihi don tabbatar da tasirin sa a cikin dabarun ciniki. Ci gaba da ingantawa na iya zama dole yayin da yanayin kasuwa ke tasowa, tabbatar da cewa saitunan LSMA sun kasance daidai da trader's manufofin da hadarin haƙuri.

3.1. Ƙayyade Mafi kyawun Tsawon Lokacin

Ƙayyade Mafi kyawun Tsawon Lokacin don LSMA

Madaidaicin tsawon lokaci don Matsakaicin Matsakaicin Matsakaici (LSMA) aiki ne na salon ciniki da kuzarin kasuwa. Rana traders na iya yin jajircewa zuwa ga ɗan gajeren lokaci, kamar kwanaki 5 zuwa 20, don ɗaukar sauri, manyan motsi. Da bambanci, lilo traders or masu zuba jari na iya yin la'akari da lokuta daga kwanaki 20 zuwa 200 don tace hayaniyar kasuwa da daidaitawa tare da yanayin dogon lokaci.

Zaɓin mafi kyawun lokacin yana buƙatar yin nazari akan trade-kashe tsakanin amsawa da kwanciyar hankali. Tsawon ɗan gajeren lokaci yana ƙaruwa da amsawa, yana samar da sigina na farko waɗanda zasu iya zama mahimmanci don cin gajiyar dama ta gajeren lokaci. Koyaya, wannan kuma na iya haifar da siginoni na ƙarya saboda haɓakar LSMA ga haɓakar farashin. A gefe guda, tsayin lokaci yana haɓaka kwanciyar hankali, yana haifar da ƴan kaɗan amma yuwuwar sigina masu dogaro, dacewa don tabbatar da ingantattun halaye.

Backtesting ba makawa ne don gano tsawon lokacin da ya yi daidai da aikin tarihi. Traders yakamata su gwada tsawon lokaci daban-daban don tabbatar da ingancin LSMA wajen samar da sigina masu fa'ida a cikin yanayin yanayin kasuwa da suka gabata. Wannan ƙwaƙƙwarar hanya tana taimakawa wajen auna ƙarfin tsinkayar mai nuni da daidaita tsawon lokacin daidai.

volatility wani muhimmin abu ne mai tasiri tsawon lokaci. Mahalli masu ƙarfi na iya samun fa'ida daga dogon lokaci don guje wa wulakanci, yayin da ƙananan yanayi zai iya zama mafi dacewa da ɗan gajeren lokaci, yana ƙyale. traders don amsa da sauri ga canje-canjen farashin da hankali.

| Yanayin Kasuwa | Tsawon Lokacin da aka Shawarta | Bayanin |

|---|---|---|

| Babban Volatility | Tsawon Lokaci | Yana rage hayaniya da siginar ƙarya |

| Voarancin Volatility | Gajeren lokaci | Yana ƙara azanci ga ƙungiyoyin farashi |

| Ciniki na gajeren lokaci | 5-20 Days | Yana ɗaukar saurin sauye-sauyen kasuwa |

| Ciniki na dogon lokaci | 20-200 Days | Tace juzu'i na gajeren lokaci |

Daga qarshe, mafi kyawun tsawon lokacin ba ya dace-duka-duka ba sai dai siga na keɓaɓɓen da ke buƙatar daidaitawa ga tradeƙayyadaddun bayanan haɗari na r, yanayin ciniki, da rashin daidaituwar kasuwa. Ci gaba da kimantawa da daidaita tsawon lokacin tabbatar da cewa LSMA ta kasance kayan aiki mai dacewa da inganci don nazarin kasuwa.

3.2. Daidaita don Canjin Kasuwa

Canje-canje na LSMA Daidaitacce

Daidaita Matsakaicin Matsakaicin Matsala (LSMA) don yin lissafi kasuwar volatility ya haɗa da daidaita tsayin lokaci don nuna yanayin kasuwa mai gudana. Ƙarfafawa, ma'aunin ƙididdiga na tarwatsawar da aka samu don wani tsaro da aka bayar ko fihirisar kasuwa, yana tasiri sosai ga halayen matsakaitan matsakaita. Kasuwanni masu saurin canzawa na iya sanya LSMAs na ɗan gajeren lokaci su zama marasa kuskure, suna haifar da hayaniyar da ta wuce kima wanda zai haifar da kuskuren fassarar siginonin yanayi. Akasin haka, in yanayin rashin ƙarfi, LSMA na dogon lokaci na iya zama sluggish, kasa ɗaukar ƙungiyoyi masu fa'ida da sauye-sauyen yanayi.

Don magance waɗannan matsalolin, traders iya aiki ma'aunin rashin ƙarfi, kamar su VIX, don jagorantar daidaitawa na lokacin LSMA. Babban karatu na VIX, mai nuni da haɓakar canjin kasuwa, na iya ba da shawarar tsawaita lokacin LSMA don rage tasirin hauhawar farashin da hayaniyar kasuwa. Lokacin da VIX ya yi ƙasa, yana nuna yanayin kasuwa mai kwantar da hankali, ɗan gajeren lokacin LSMA na iya zama tallavantageous, kyale don ƙarin agile martani ga farashin ƙungiyoyi.

Hada kan tsauri lokaci daidaita inji dangane da rashin ƙarfi na iya ƙara haɓaka aikin LSMA. Wannan hanya ta ƙunshi gyaggyara tsawon lokaci a cikin ainihin lokacin yayin da matakan canji suka canza. Misali, ƙa'idar daidaitawa mai sauƙi na iya ƙara lokacin LSMA da kaso daidai gwargwado ga tashin ma'aunin rashin ƙarfi da akasin haka.

Ƙwayoyin ƙarfi Hakanan za'a iya amfani dashi tare da LSMA don ƙirƙirar tashar daidaitacce. Faɗin waɗannan makada yana jujjuyawa tare da canje-canje a cikin sauye-sauye, yana ba da alamun gani don yuwuwar fashewa ko matakan haɓakawa. Wannan hanyar ba wai kawai tana sabunta siginonin shigarwa da fita ba har ma tana taimakawa wajen saiti tasha-hasara matakan da suka dace da rashin daidaituwar kasuwa na yanzu.

| Matsayin Karɓatawa | Daidaita LSMA | Nufa |

|---|---|---|

| high | Ƙara Lokacin | Rage hayaniya da siginar ƙarya |

| low | Lokacin Ragewa | Haɓaka amsa ga canje-canjen farashi |

Traders ya kamata a lura cewa yayin daidaitawa don rashin daidaituwa na iya inganta amfanin LSMA, ba panacea ba ne. Ci gaba da sa ido da goyan baya suna da mahimmanci don tabbatar da cewa gyare-gyaren sun yi daidai da dabarun ciniki gabaɗaya da tsarin sarrafa haɗari.

4. Menene Matsakaicin Dabaru Masu Motsa Mafi Karancin Muƙamai?

Dabarun Tabbatar da Trend

The Dabarun Tabbatar da Trend yana amfani da LSMA don inganta jagorancin yanayin kasuwa. Lokacin da gangaren LSMA ta tabbata kuma farashin yana sama da layin LSMA, traders na iya la'akari da wannan tabbaci na haɓakawa da kuma damar da za a bude dogon matsayi. Sabanin haka, mummunan gangara tare da farashin farashi a ƙasa da LSMA na iya sigina na raguwa, yana motsawa traders don bincika gajerun matsayi. Wannan dabarar tana jaddada mahimmancin jagorar gangara da matsayi na farashin dangi don yanke shawara na ciniki.

Ra'ayin Dabaru

a cikin Ra'ayin Dabaru, traders suna kallon motsin farashin da ke ƙetare layin LSMA tare da mahimmanci lokacinta, wanda zai iya nuna farkon sabon yanayin. Ana iya fassara fashewa a sama da LSMA a matsayin sigina mai ban tsoro, yayin da za a iya ganin raguwa a ƙasa da layi a matsayin bearish. Traders sau da yawa suna haɗa wannan dabarar tare da nazarin ƙara don tabbatar da ƙarfin fashewa da kuma tace siginar ƙarya.

Matsakaicin Dabarun Crossover Motsi

The Matsakaicin Dabarun Crossover Motsi ya ƙunshi amfani da LSMA guda biyu na lokuta daban-daban. Saitin gama gari ya haɗa da LSMA na ɗan gajeren lokaci da LSMA na dogon lokaci. Juyewar LSMA na ɗan gajeren lokaci sama da LSMA na dogon lokaci ana ɗaukarsa azaman siginar siye, yana nuna haɓakar haɓakawa. Sabanin haka, giciye da ke ƙasa na iya haifar da siginar siyarwa, yana nuna yiwuwar raguwa. Wannan tsarin LSMA biyu yana ba da izini traders don kama sauye-sauyen sauye-sauye kuma zai iya zama tasiri musamman a kasuwanni masu tasowa.

Ma'anar Juya Dabarun

Traders amfani da Ma'anar Juya Dabarun yi amfani da LSMA azaman layin tsakiya don gano yuwuwar motsin farashin da ya wuce gona da iri daga yanayin. Lokacin da farashin ya bambanta sosai daga LSMA sannan ya fara komawa, traders na iya tunanin shiga trades a cikin hanyar ma'ana. Wannan dabarar ta dogara ne akan jigo cewa farashin yakan koma matsakaicin lokaci, kuma LSMA tana aiki azaman ma'auni mai ƙarfi don komawa baya.

| Strategy | description | Sigina don Dogon Matsayi | Sigina don Gajeren Matsayi |

|---|---|---|---|

| Tabbatar da Trend | Yana tabbatar da alkibla ta amfani da gangaren LSMA da matsayin farashi | Kyakkyawan gangara tare da farashi sama da LSMA | Mara kyau gangara tare da farashi ƙasa da LSMA |

| breakout | Gano sabbin abubuwa ta hanyar ƙetare layin LSMA | Farashin ya karye kuma yana riƙe sama da LSMA | Farashin ya karya kuma yana riƙe ƙasa da LSMA |

| Matsakaicin Matsakaici Crossover | Yana amfani da LSMA guda biyu don gano sauye-sauyen lokaci | LSMA na ɗan gajeren lokaci ya haye sama da LSMA na dogon lokaci | LSMA na ɗan gajeren lokaci ya ketare ƙasa na dogon lokaci LSMA |

| Ma'anar Juyawa | Yana ba da jari kan juyar da farashi zuwa LSMA | Farashin ya karkata daga nan ya koma LSMA | Farashin ya karkata daga nan ya koma LSMA |

Waɗannan dabarun suna wakiltar ɗan juzu'in yuwuwar aikace-aikacen LSMA a cikin ciniki. Ana iya keɓance kowace dabara don dacewa da salon ciniki da yanayin kasuwa. Yana da mahimmanci don gudanar da cikakken gwaji na baya da kuma amfani da ingantaccen tsarin kula da haɗari yayin haɗa waɗannan dabarun LSMA cikin tsarin ciniki.

4.1. Trend Following tare da LSMA

Trend Following tare da LSMA

A cikin yanayin yanayin da ya biyo baya, Matsakaicin Matsakaicin Matsakaicin Matsala (LSMA) yana aiki azaman mai nuna ƙarfi don auna alkibla da ƙarfin yanayin kasuwa. Trend mabiya dogara ga LSMA don gano motsin farashi mai dorewa wanda zai iya nuna ingantaccen wurin shigarwa. Ta hanyar lura da kwana da shugabanci da LSMA, traders na iya tabbatar da ƙarfin halin yanzu. Haɓaka LSMA yana nuna haɓakar haɓakawa kuma, sabili da haka, yuwuwar kafa ko kula da dogon matsayi. Sabanin haka, LSMA mai saukowa yana nuna alamar ci gaba da ƙasa, yana nuna dama ga ɗan siyar.

Ƙwarewar LSMA a cikin yanayin da ke biye ba kawai yana da alaƙa da jagorancinsa ba amma har da matsayinsa dangane da farashi. Farashin ya ci gaba da kasancewa sama da tashin LSMA shi ne tabbatar da bacin rai, yayin da Farashin ci gaba ƙasa da raguwar LSMA yana jaddada ra'ayin bearish. Traders sau da yawa suna neman waɗannan sharuɗɗan don tabbatar da ra'ayinsu mai zuwa kafin aiwatarwa trades.

Fitowa daga matakan ƙarfafawa cikin sababbin abubuwan da ke faruwa suna da mahimmanci musamman lokacin da LSMA ke tare da su. Rashin fashewa tare da LSMA yana tafiya a hanya ɗaya na iya ƙarfafa yuwuwar sabon yanayin tasowa. Traders na iya saka idanu kan gangaren LSMA don haɓakawa ko raguwa don yin hukunci da yuwuwar ci gaba ko gajiyar yanayin.

| Halin LSMA | Trend Implication | Yiwuwar Aiki |

|---|---|---|

| Farashin LSMA | Matsayin Sama | Yi la'akari da Dogayen Matsayi |

| Farashin LSMA | Ƙarƙashin Ƙarƙashin Ƙaƙwalwar Ƙasa | Yi la'akari da Gajerun Matsayi |

| Farashin Sama da Tashin LSMA | Tabbatar da Bullish Trend | Rike/Fara Dogayen Matsayi |

| Farashin da ke ƙasa Faɗuwar LSMA | Tabbatar da Trend Bearish | Rike/Fara Gajerun Matsayi |

kunsawa bayanan girma na iya haɓaka yanayin da ke biyo baya tare da LSMA, kamar yadda ƙarar ƙara yayin tabbatarwar yanayin zai iya ƙara yanke hukunci ga trade. Hakazalika, bambance-bambance tsakanin girma da gangaren LSMA na iya zama alamar faɗakarwa na yanayin rauni.

Halin biye tare da LSMA ba dabara ba ce; yana buƙatar ci gaba da lura da yanayin kasuwa da kuma halayen LSMA. Kamar yadda LSMA ke sake ƙididdigewa tare da kowane sabon bayanan bayanai, yana nuna sabon motsin farashi, yana ba da izini traders don ci gaba da daidaitawa da yanayin kasuwa na yanzu.

4.2. Ma'anar Juyawa da LSMA

Ma'anar Juyawa da LSMA

Ma'anar komawa baya yana nuna cewa farashi da dawowa daga ƙarshe suna komawa zuwa matsakaici ko matsakaici. Ana iya amfani da wannan ƙa'idar ta amfani da LSMA, wanda ke aiki azaman layin tsakiya mai ƙarfi wanda ke wakiltar ƙimar matakin ma'auni ana tsammanin komawa zuwa. Ma'anar dabarun juyawa yawanci suna yin amfani da matsananciyar sabawa daga LSMA, suna tsammanin cewa farashin zai koma wannan matsakaicin motsi na tsawon lokaci.

Domin aikace-aikacen aikace-aikace, traders na iya kafa ƙofofin ga abin da ya ƙunshi karkatacciyar 'mafi girman'. Ana iya saita waɗannan ƙofofin ta amfani da daidaitattun ma'aunin karkacewa ko kashi nesa da LSMA. TradeAna ƙaddamar da s lokacin da farashin ya haye kan kofa zuwa LSMA, yana nuna farkon komawa baya.

Saita Tsayawa-Asara da Abubuwan Riba yana da mahimmanci yayin amfani da dabarun juyawa tare da LSMA. Hasara-asara yawanci ana sanyawa fiye da kafaffen ƙofa don rage haɗari a yayin ci gaba maimakon komawa baya. Ana iya saita wuraren cin riba kusa da LSMA, inda ake sa ran farashin zai daidaita.

| Nau'in Ƙarfi | description | Aikace-aikace |

|---|---|---|

| Daidaitaccen Karkatawa | Yana auna adadin bambancin daga LSMA | Yana kafa iyakoki don matsananciyar karkatar da farashi |

| kashi | Kafaffen kashi nesa da LSMA | Yana bayyana yanayin farashin wuce gona da iri |

Halin ƙarfin hali na LSMA ya sa ya dace don daidaitawa ga canza yanayin kasuwa, wanda ke da amfani a cikin ma'anar juyawa. Yayin da matsakaicin matakin farashin ke motsawa, LSMA tana sake daidaitawa, tana samar da ci gaba da sabunta ma'anar tunani don gano ma'anar damar juyawa.

Yana da mahimmanci ga traders don gane cewa ma'anar jujjuyawar dabarun amfani da LSMA ba su da hankali. Yanayin kasuwa na iya canzawa, kuma ƙila farashin ba zai koma kamar yadda ake tsammani ba. Saboda haka, hadarin hadarin da kuma baya ba makawa ne don tabbatar da tasirin dabarun akan zagayen kasuwa da yanayi daban-daban.

4.3. Haɗa LSMA tare da Wasu Manufofin Fasaha

RSI da LSMA: Tabbatar da Lokacin Lokaci

Haɗa Matsakaicin Motsawa Mafi Karanci (LSMA) tare da Dangi Ƙarfin Index (RSI) yana ba da ra'ayi mai yawa game da ra'ayin kasuwa. RSI, oscillator mai motsi, yana auna saurin gudu da canjin motsin farashi, yawanci akan sikelin 0 zuwa 100. Ƙimar RSI a sama da 70 yana nuna yanayin da aka yi fiye da kima, yayin da ƙasa da 30 ke nuna yanayin da aka sayar. Lokacin da yanayin LSMA ya yarda da alamun RSI, traders samun kwarin gwiwa a cikin ci gaban da ake samu. Misali, tsallakewar RSI sama da 70 haɗe tare da LSMA mai gangara sama na iya ƙarfafa hangen nesa.

MACD da LSMA: Ƙarfin Ƙarfi da Juyawa

The Matsakaicin Matsakaicin Canzawa (MACD) wani kayan aiki ne mai ƙarfi don amfani tare da LSMA. MACD yana auna dangantakar tsakanin matsakaita motsi biyu na farashin tsaro. Traders neman layin MACD da ke ƙetare sama da siginar siginar azaman siginar siginar mai yuwuwar siyayya, da giciye a ƙasa azaman siginar siyarwa. Lokacin da waɗannan MACD crossovers suka zo daidai da LSMA suna nuna wani yanayi a cikin hanya guda, yana ba da shawara mai ƙarfi. Sabanin haka, idan MACD ta bambanta daga yanayin LSMA, yana iya nuna alamar yuwuwar juyewar yanayin.

Ƙungiyoyin Bollinger da LSMA: Ƙarfafawa da Nazarin Trend

Bollinger makada ƙara girman juzu'i zuwa nazarin yanayin LSMA. Wannan ma'auni ya ƙunshi saitin layin da aka ƙirƙira daidaitattun ma'auni guda biyu (tabbatacce da mara kyau) nesa da a sauƙi mai sauƙi a matsakaici (SMA) na farashin tsaro. Lokacin da LSMA ke zaune a cikin Ƙungiyoyin Bollinger, yana tabbatar da halin da ake ciki a cikin iyakoki na yau da kullun. Idan LSMA ta keta makada, yana iya nuna rashin ƙarfi da ƙarfi da ƙarfi ko yuwuwar juyewa idan ya faru a kishiyar yanayin da ke gudana.

Haɗa Alamun Fasaha tare da LSMA

| nuna alama | Yi amfani da LSMA | Nufa |

|---|---|---|

| RSI | Tabbatar da ƙarfi | Tabbatar da yawan siyayyar da aka yi da siyar da kaya tare da yanayin LSMA |

| MACD | Yi la'akari da ƙarfin halin da ake ciki da yuwuwar juyawa | Tsare-tsare na sigina da rarrabuwar kawuna |

| Bollinger makada | Ma'auni na ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun ƙayyadaddun yanayi da tabbatarwa | Gano ɓarnar rashin ƙarfi kuma tabbatar da ƙarfin yanayi a cikin ƙa'idodin rashin ƙarfi |

Haɗa waɗannan alamomi tare da LSMA na iya ba da cikakkiyar hanyar ciniki, ba da damar ƙarin ƙididdiga masu ƙima da yuwuwar saitin ciniki mai yiwuwa. Yana da mahimmanci, duk da haka, a tuna cewa babu alamar da ba ta kuskure. Kowane ƙarin mai nuna alama yana gabatar da sababbin sigogi da yuwuwar rikitarwa, don haka traders dole ne su tabbatar da cikakkiyar fahimta da gwada waɗannan haɗuwa a cikin dabarun su.

5. Abin da za a yi la'akari da shi lokacin amfani da Matsakaicin Matsakaicin Matsakaicin Filayen Filaye?

Tantance Matsayin Kasuwa da Aikace-aikacen LSMA

Lokacin amfani da Matsakaicin Matsakaicin Matsala (LSMA), traders dole ne ya fara gane lokacin kasuwa-ko yana canzawa ko kuma ya bambanta-kamar yadda tasirin LSMA ya bambanta daidai. A lokacin trending matakai, LSMA na iya taimakawa ganowa da tabbatar da alkiblar yanayin. Koyaya, a cikin kewayon kasuwa, LSMA na iya samar da sigina marasa inganci, saboda matsakaita baya fifita ko wanne bangare da ƙarfi. Traders yakamata su dace da LSMA tare da wasu alamomin da suka dace da yanayin kasuwa na yanzu don haɓaka daidaiton yanke shawara.

Hankalin LSMA da Hayaniyar Bayanai

Hankalin LSMA zuwa canje-canjen farashin kwanan nan na iya zama duka tallavantage da kuma drawback. Amsawarsa yana ba da damar gano canje-canjen da wuri, amma kuma yana iya amsawa raguwar farashin ɗan gajeren lokaci ko faɗuwa, yana haifar da sigina masu ɓarna. Don rage wannan, traders kamata yayi la'akari da mahallin farashin gabaɗaya da kuma ko ƙungiyoyin baya-bayan nan suna nuna canji na gaske ko kuma sauyin ɗan lokaci.

Keɓancewa da Tsawon Lokacin

Keɓance tsawon lokacin LSMA yana da mahimmanci, saboda babu wani saiti na duniya wanda ya dace da duk kasuwanni ko salon ciniki. Ya kamata lokacin da aka zaɓa ya daidaita tare da tradedabarun r, tare da gajeren lokaci ga masu neman gaggawa trades da tsayin lokaci ga waɗanda ke neman kama mafi mahimmancin ƙungiyoyi masu tasowa. Yana da mahimmanci don sake gwadawa Tsawon lokaci daban-daban don tabbatar da an inganta saitunan LSMA don takamaiman kayan aiki da tsarin lokaci traded.

Haɗin Gudanar da Hadarin

Haɗa gudanar da haɗari cikin dabarun tushen LSMA ba za a iya wuce gona da iri ba. Bai kamata LSMA ta kasance ita kaɗai ce ke tantancewa ba trade shigarwa ko fita. Maimakon haka, ya kamata ya zama wani ɓangare na tsarin da ya fi girma wanda ya haɗa da ƙayyadaddun sigogin haɗari da kuma umarnin dakatarwa. LSMA na iya taimakawa wajen saita matakan asara mai tsauri wanda ya dace da yanayin kasuwa na yanzu da ƙarfin yanayin, amma yakamata a saita waɗannan koyaushe cikin iyakokin trader's hadarin haƙuri.

Ci gaba da Koyo da daidaitawa

A ƙarshe, traders yakamata su rungumi ci gaba ilmantarwa da daidaitawa lokacin amfani da LSMA. Kamar yadda yanayin kasuwa ke tasowa, haka ya kamata a yi amfani da LSMA a cikin dabarun ciniki. Yin bita akai-akai game da ayyukan LSMA bisa la'akari da bayanan kasuwa na kwanan nan na iya bayyana gyare-gyaren da suka dace ga aikace-aikacen sa, tabbatar da cewa mai nuna alama ya kasance kayan aiki mai mahimmanci a cikin tradear arsenal.

| shawara | Nufa |

|---|---|

| Ƙididdigar Matsayin Kasuwa | Daidaita amfani da LSMA tare da kasuwanni masu tasowa ko jeri |

| Hannun LSMA | Daidaita amsa tare da yuwuwar sigina mai haifar da amo |

| Keɓancewa da Bayarwa | Haɓaka tsawon lokaci don dacewa da manufofin ciniki da halayen kasuwa |

| hadarin Management | Haɗa umarni na asarar tasha da sigogin haɗari don kiyayewa daga siginar ƙarya |

| Cigaba da Ilmantarwa | Daidaita amfani da LSMA don canza yanayin kasuwa don dorewar tasiri |

5.1. Nazarin Ribobi da Fursunoni

Abubuwan da aka bayar na LSMA

LSMA tana ba da talla da yawavantages za traders. Nasa hanyar lissafi, wanda ke rage jimlar murabba'i na karkatattun, yawanci yana ba da a layi mai santsi idan aka kwatanta da matsakaicin motsi na gargajiya. Wannan santsi na iya taimakawa wajen ganowa m Trend tare da raguwar raguwa, bayarwa traders yuwuwar kama abubuwan da suka faru a baya. Hakanan, daidaitawar LSMA zuwa rashin daidaituwa yana ba da damar daidaitawa zuwa yanayi daban-daban na kasuwa, yana ƙara yawan amfanin sa a cikin manyan mahalli masu ƙarfi da ƙarancin ƙarfi.

| Advantage | description |

|---|---|

| Sannu | Yana rage hayaniyar kasuwa kuma yana ba da ƙarin haske game da yanayin. |

| Farkon Trend Identification | Yana rage jinkirin gano canje-canjen yanayi, yana ba da yuwuwar shigarwa da siginonin fita da wuri. |

| Gyaran Sauyi | An daidaita shi zuwa yanayin kasuwa, yana haɓaka amsawa da daidaito. |

Fursunoni na LSMA

Duk da haka, LSMA ba ta da lahani. Hankalinsa, yayin da yake da fa'ida a cikin gano yanayin, yana iya haifar da hakan alamun karya a lokutan haɓaka kasuwa ko lokacin da ake mayar da martani ga farashin farashi. Bugu da ƙari, LSMA ba ta ba da haske sosai a lokacin ba jere kasuwanni, kamar yadda zai iya haifar da yawa crossovers ba tare da bayyananne alkibla. Bukatar mai yawa baya da gyare-gyare don lokuta daban-daban da kadarori kuma na iya ɗaukar lokaci, mai yuwuwar haifar da haɓakawa fiye da kima ko al'amurran da suka dace.

| Rasavantage | description |

|---|---|

| Alamomin karya | Hankali ga canje-canjen farashi na iya haifar da sigina masu ɓarna. |

| Rashin tasiri a cikin Kasuwannin Rage | Sau da yawa crossovers ba tare da bayyananniyar yanayin ba na iya faruwa a kasuwannin gefe. |

| Bukatar Bayarwa | Yana buƙatar gwaji mai mahimmanci don daidaita shi zuwa takamaiman yanayin kasuwa, wanda zai iya zama mai amfani da albarkatu. |

A zahiri, yayin da LSMA na iya zama kayan aiki mai ƙarfi a cikin a trader's arsenal, ya kamata a yi amfani da shi tare da cikakkiyar fahimtar halayensa kuma tare da sauran nau'o'in bincike da ayyukan gudanarwa na haɗari don rage iyakokinsa.

5.2. Gudanar da Hadarin tare da LSMA

Wurin Tsayawa Tsayawa-Asara

Ƙarfin LSMA don daidaitawa ga ƙungiyoyin farashi ya sa ya dace da saiti matakan hasarar tasha mai ƙarfi. Ta hanyar sanya odar tasha-asara kaɗan ƙasa da LSMA don dogon matsayi, ko sama da shi don gajerun matsayi, traders na iya daidaita gudanar da haɗarin su tare da haɓakar yanayin da ke faruwa. Wannan hanyar tana tabbatar da hakan traders fita matsayi lokacin da yanayin da ya haifar da shigar su na iya komawa baya, don haka yana kare babban birnin daga manyan abubuwan da za a iya gani. Makullin shine saita hasarar tasha a nesa wanda ke yin lissafin ƙimar kadari na yau da kullun don gujewa dakatar da shi da wuri.

Girman Matsayi Bisa Ƙarfafawa

Traders na iya amfani da LSMA don sanar da girman matsayi ta hanyar ƙididdige canjin kasuwa na yanzu. Ƙarin kasuwa mai canzawa, wanda aka ba da shawara ta hanyar sauye-sauye masu yawa a kusa da LSMA, yana buƙatar ƙananan matsayi don kiyaye daidaitaccen matakin haɗari. Sabanin haka, a cikin ƙananan yanayi marasa ƙarfi. traders na iya ƙara girman matsayi. Wannan hanyar da ta dogara da rashin daidaituwa ta tabbatar da cewa yuwuwar lalacewar kowane trade ya yi daidai da babban kasuwancin ciniki gaba ɗaya, yana manne da ƙa'idodin sarrafa haɗarin haɗari.

| Yanayin Kasuwa | Dabarar Girman Matsayi |

|---|---|

| Babban Volatility | Rage girman matsayi don sarrafa haɗari |

| Voarancin Volatility | Yi la'akari da ƙara girman matsayi a cikin haƙurin haɗari |

Daidaita Ma'aunin Haɗari

Daidaita sigogin haɗari don amsa canje-canje a cikin gangaren LSMA na iya tace a tradedabarun sarrafa hadarin r. Matsakaicin gangaren LSMA na iya nuna haɓakar ƙarfin haɓakawa, wanda zai iya ba da hujjar ƙarancin tsayawa-asara don ɗaukar ƙarin riba. Akasin haka, gangara mai lanƙwasa na iya nuna alamar rauni, yana haifar da hasarar tsayawa mai faɗi don gujewa fita kan ƙananan koma baya. Wadannan gyare-gyare ya kamata a koyaushe a yi su a cikin mahallin trader gabaɗayan tsarin kula da haɗarin haɗari da haƙurin haɗari.

Haɗa LSMA tare da Sauran Alamun Hadarin

Yayin da LSMA na iya zama tsakiya don saita tsayuwa mai ƙarfi da daidaita haɗari, haɗa shi tare da sauran alamun haɗari, kamar Matsakaicin Gaskiya Range (ATR), na iya ba da cikakkiyar tsarin kula da haɗari. ATR na iya taimakawa wajen ƙayyade jeri tasha-asara ta hanyar samar da ma'auni na matsakaicin ƙimar kadari a cikin wani lokaci da aka ba. Yin amfani da ATR tare da LSMA na iya taimakawa wajen saita ƙarin umarni na asarar tasha waɗanda suka dace da al'amuran al'ada da kuma canjin kasuwa.

| Alamar Haɗari | Manufar Gudanar da Hadarin |

|---|---|

| LSMA | Yana daidaita umarni na asarar-asara tare da alƙawarin da ya dace da ci gaba |

| ATR | Yana ba da sanarwar jeri tasha-asara dangane da sauyin kasuwa |

Ci gaba da Ƙimar Haɗari

Amsar LSMA ga canje-canjen farashin yana buƙatar ci gaba da kimanta haɗarin. Kamar yadda mai nuna alama ke sabuntawa tare da kowane sabon wurin bayanai, traders ya kamata su sake kimanta umarnin asarar su na tsayawa da girman matsayi don tabbatar da cewa har yanzu sun dace da yanayin kasuwa na yanzu. Wannan kimantawa ya kamata ya zama wani ɓangare na yau da kullun na kasuwancin yau da kullun, tabbatar da cewa dabarun gudanar da haɗari sun kasance masu tasiri yayin da kasuwancin kasuwa ke tasowa.

5.3. Tasirin Yanayin Kasuwa akan Ayyukan LSMA

Canjin Kasuwa da Amsar LSMA

Canjin kasuwa yana tasiri sosai akan aikin LSMA. A ciki kasuwanni masu saurin canzawa, LSMA na iya nuna sauye-sauye masu girma, wanda zai iya haifar da ƙara yawan siginar ƙarya. Traders dole ne su yi taka tsantsan, saboda waɗannan sharuɗɗan na iya sa LSMA ta yi martani ga hayaniyar farashi maimakon canje-canje na gaskiya. Sabanin haka, a cikin kasuwannin nuni ƙananan rashin ƙarfi, LSMA yana kula da samar da sigina masu dogara, kamar yadda tasirin sa ya fi bayyana lokacin da farashin farashin ya kasance mai sauƙi.

Ƙarfin Trend da Alamomin LSMA

Ƙarfin yanayin wani muhimmin abu ne mai tasiri da tasiri na LSMA. Ƙarfafa, abubuwan ci gaba suna dacewa da LSMA's Trend-biye damar iya yin komai, ba da damar ƙarin sigina masu fa'ida da aiki. Lokacin da yanayin ya kasance mai rauni ko yanayin kasuwa ya yi zafi, LSMA na iya samarwa m sigina, yin shi da kalubale ga traders don gane alkiblar yanayin da tabbaci.

Matsayin Kasuwa da Amfanin LSMA

Fahimtar yanayin kasuwa yana da mahimmanci yayin amfani da LSMA. Lokacin trending matakai, An haɓaka amfanin LSMA saboda yana iya bin diddigin yadda ya kamata da tabbatar da alkiblar yanayin. Duk da haka, a lokacin zangon-daure, Ayyukan LSMA suna raguwa, sau da yawa yana haifar da layi a kwance wanda ke ba da ɗan ƙaramin haske mai aiki, mai yuwuwar haifar da shigarwar ƙarya da fita da yawa.

Daidaitawa da LSMA Keɓancewa

Daidaitawar LSMA zuwa yanayin kasuwa daban-daban takobi ne mai kaifi biyu. Duk da yake yana ba da damar gyare-gyare don dacewa da matakan canzawa daban-daban da ƙarfin yanayi daban-daban, yana kuma buƙatar ci gaba da daidaitawa da haɓakawa. Traders dole ne ya kware wajen daidaita saitunan LSMA, kamar tsawon lokaci, don kiyaye tasirin sa a cikin yanayin kasuwa daban-daban.

| Yanayin Kasuwa | Tasirin Ayyuka na LSMA | TradeTunanin r |

|---|---|---|

| Babban Volatility | Ƙara siginar ƙarya | Yi amfani da ƙarin masu tacewa |

| Voarancin Volatility | Ƙarin amintattun sigina | Amincewa a cikin abubuwan da ke biyo baya |

| Trend mai ƙarfi | Sigina masu haske | Yi amfani da LSMA don shigarwa/fita |

| Trend mai rauni/Rauni | Sigina marasa fahimta | Rage dogaro ga LSMA |

| Kasuwar Trending | Ingantattun kayan amfani | Daida trades tare da hanyar LSMA |

| Kasuwar Kasuwa | Iyakance mai amfani | Nemi madadin alamomi |

Traders dole ne su kasance masu hankali a tsarin su, suna ci gaba da tantance yanayin kasuwa don sanin ayyukan LSMA na yanzu da kuma yuwuwar tasirinsu akan shawarar kasuwancin su.

FAQ:

Meta Bayanin: