1. Bayyani na Bollinger Bands Width

1.1 Gabatarwa zuwa Ƙungiyoyin Bollinger

Bollinger Makada shahararru ne fasaha analysis kayan aikin da John Bollinger ya haɓaka a cikin 1980s. Ana amfani da wannan kayan aiki da farko don aunawa kasuwar volatility da kuma gano yanayin da aka yi fiye da kima ko aka yi yawa a cikin cinikin kayan aikin kuɗi. Ƙungiyoyin Bollinger sun ƙunshi layi uku: layin tsakiya shine a sauƙi mai sauƙi a matsakaici (SMA), yawanci sama da lokutan 20, kuma manyan makada na sama da na ƙasa sune daidaitattun karkatattun sama da ƙasa da wannan. motsi matsakaici.

1.2 Ma'anar da Manufar Bollinger Bands Nisa

Bollinger Bands Width (BBW) alama ce da aka samo wanda ke ƙididdige nisa, ko faɗi, tsakanin babba da ƙananan Ƙungiyoyin Bollinger. BBW yana da mahimmanci traders kamar yadda yake ba da ƙimar ƙima ga ra'ayi na rashin daidaituwa na kasuwa. Maɗaukaki mai faɗi yana nuna haɓakar kasuwa mafi girma, yayin da ɗimbin maɗaukaki yana nuna ƙananan rashin ƙarfi. Nisa na Bollinger Bands yana taimakawa traders ta hanyoyi da yawa:

- Gano Canje-canje na Sauyawa: Babban canji a cikin nisa na makada na iya sigina canjin canji na kasuwa, sau da yawa yana gaba da manyan motsin farashi.

- Binciken Trend: Lokuttan ƙananan juzu'i, waɗanda ƙunƙunrun makada ke nunawa, galibi suna faruwa yayin haɓakawa a cikin yanayin kasuwa, mai yuwuwar haifar da fashewa.

- Gane Matsalolin Kasuwa: A wasu yanayin kasuwa, maɗaukaki masu faɗi ko kunkuntar makada na iya nuna ƙaƙƙarfan motsin farashi, wanda zai iya juyawa ko ƙarfafawa.

| Aspect | description |

|---|---|

| Origin | John Bollinger ne ya haɓaka a cikin 1980s. |

| Aka gyara | Ƙungiyoyin Ƙungiyoyin Sama da Ƙarƙashin Ƙaƙwalwar Ƙaƙwalwar Ƙaƙwalwar Ƙaƙwalwar Ƙarƙashin Ƙarƙashin Ƙarƙashin Ƙarƙashin Ƙarƙashin Ƙarƙashin Ƙarƙashin Ƙarƙashin Ƙarƙashin Ƙarƙashin Ƙarƙashin Ƙarƙashin Ƙarƙashin Ƙarƙashin Ƙarƙashin Ƙasa (SMA). |

| Ma'anar BBW | Yana auna nisa tsakanin manyan Makada na Bollinger na babba da na ƙasa. |

| Nufa | Yana nuna rashin daidaituwar kasuwa, yana taimakawa wajen nazarin yanayin da kuma gano iyakar kasuwa. |

| Anfani | Gano sauye-sauyen canji, nazarin yanayin kasuwa, nuna alamar yuwuwar motsin farashin. |

2. Tsari na Lissafi na Faɗin Makada na Bollinger

2.1 Bayanin Formula

Bollinger Bands Width (BBW) ana ƙididdige su ta amfani da dabara mai sauƙi. Ana ƙididdige faɗin ta hanyar cire ƙimar ƙananan Bollinger Band daga babban ƙungiyar Bollinger. Tsarin tsari shine kamar haka:

BBW=Upper Bollinger Band-Ƙasa Bollinger Band

inda:

- The Babban Bollinger Band ana lissafta kamar: Ƙungiya ta Tsakiya+ (Madaidaicin Bayyana ×2).

- The Ƙarshen Bollinger Band ana lissafta kamar: Tsakanin Band-(Standard Saɓani ×2).

- The tsakiyar-band yawanci matsakaicin Motsi Mai Sauƙi na tsawon lokaci 20 (SMA).

- Daidaitaccen Karkatawa ana ƙididdige su bisa ga lokutan 20 iri ɗaya da aka yi amfani da su don SMA.

2.2 Lissafin mataki-mataki

Don kwatanta lissafin Bollinger Bands Width, bari mu yi la'akari da misali mataki-mataki:

Ƙididdigar Ƙirar Tsakiya (SMA):

- Ƙara farashin rufewa na lokuta 20 na ƙarshe.

- Raba wannan adadin da 20.

2. Kididdige Madaidaicin Bambancin:

- Nemo bambanci tsakanin farashin rufe kowane lokaci da Ƙungiyar Tsakiya.

- Sanya waɗannan bambance-bambance.

- Takaita waɗannan bambance-bambance masu murabba'i.

- Raba wannan jimlar da adadin lokuta (20 a wannan yanayin).

- Ɗauki tushen murabba'in wannan sakamakon.

3. Ƙididdige Ƙungiyoyin Sama da Ƙasa:

- Babban Band: Ƙara (Standard Deviation × 2) zuwa Ƙungiya ta Tsakiya.

- Ƙananan Ƙungiya: Rage (Standard Deviation × 2) daga Tsakanin Makada.

3. Ƙayyade Faɗin Ƙwayoyin Bollinger:

- Rage ƙimar Ƙarƙashin Ƙarƙashin Ƙimar Ƙimar Ƙimar Ƙimar Ƙirar Ƙimar.

Wannan tsarin lissafin yana ba da haske game da yanayin ƙarfin Bollinger Bands Width, yayin da yake jujjuyawa tare da canje-canje a ƙimar farashi. Madaidaicin ɓangaren karkatacciyar hanya yana tabbatar da cewa makada ta faɗaɗa lokacin da kasuwa ta kasance mara ƙarfi da kwangila a lokacin ƙarancin rashin ƙarfi.

| Mataki | tsari |

|---|---|

| 1 | Ƙirƙiri Ƙirar Tsakiya (SMA-lokaci 20). |

| 2 | Yi ƙididdige Madaidaicin Bambancin bisa ga lokuta 20 iri ɗaya. |

| 3 | Ƙayyade Ƙungiyoyin Ƙungiyoyin Sama da Ƙarƙasa (Maɗaukaki na Tsakiya ± Madaidaicin Ƙarfafa × 2). |

| 4 | Yi lissafin BBW (Babban Band - Ƙarƙashin Ƙungiya). |

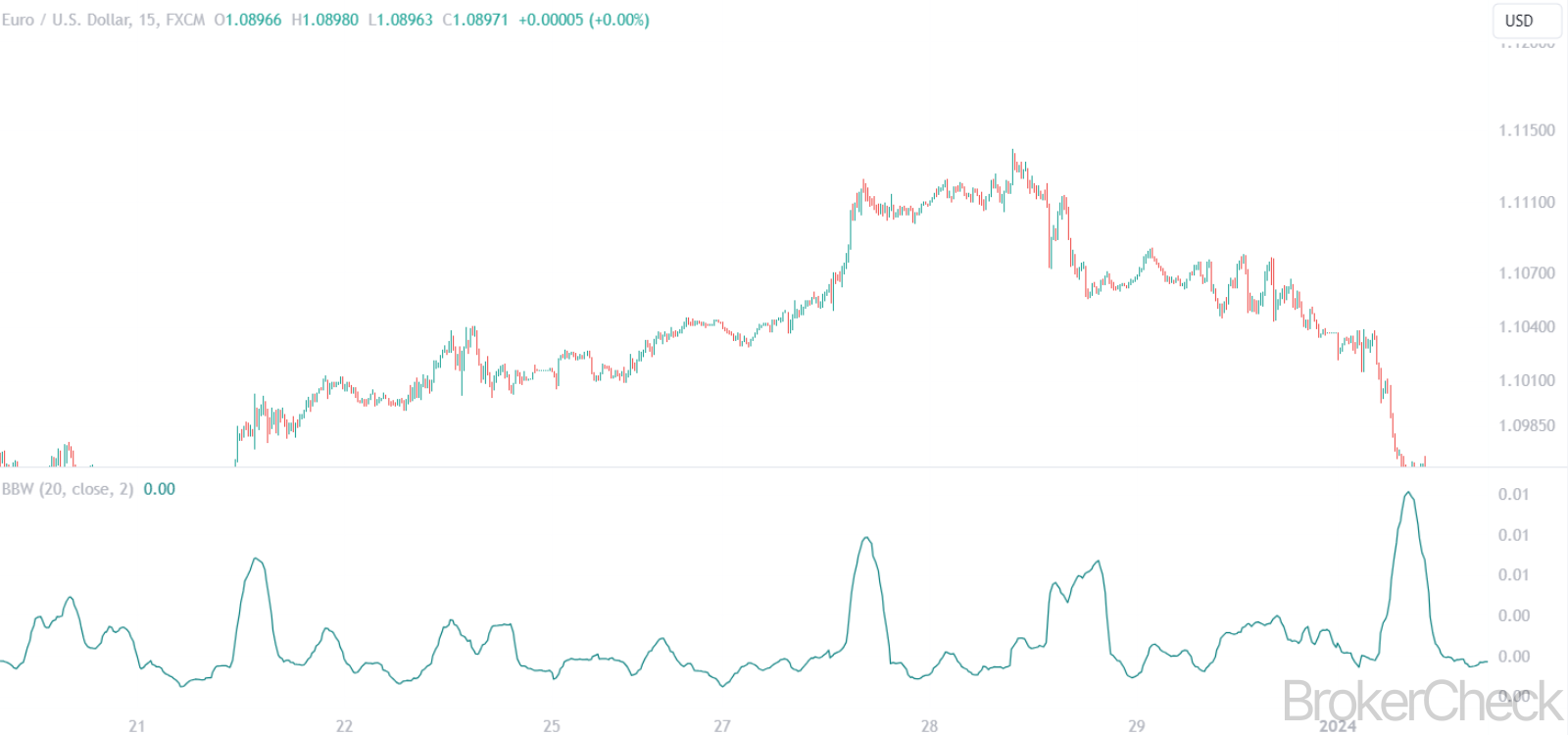

3. Ingantattun Darajoji don Saita a cikin Tsarukan Lokaci daban-daban

3.1 Ciniki na gajeren lokaci

Don ciniki na ɗan gajeren lokaci, kamar ciniki na rana ko fatar fata, traders yawanci suna amfani da Bollinger Bands Width tare da gajeriyar matsakaicin lokacin motsi da ƙaramin ƙayyadadden ƙima. Wannan saitin yana ba da damar makada don amsawa da sauri ga canje-canjen farashin, wanda ke da mahimmanci a cikin yanayin ciniki mai sauri.

Mafi kyawun Saita:

- Matsakaicin Lokacin Motsawa: 10-15 lokuta.

- Madaidaicin Maɓalli Mai Rarraba: 1 zuwa 1.5.

- Fassara: Ƙaƙƙarfan makada suna nuna ƙarancin rashin ƙarfi na ɗan gajeren lokaci, yana ba da shawarar ƙarfafawa ko fashewar farashin da ake jira. Ƙungiyoyi masu faɗi suna nuna rashin ƙarfi mafi girma, sau da yawa hade da ƙaƙƙarfan motsin farashi.

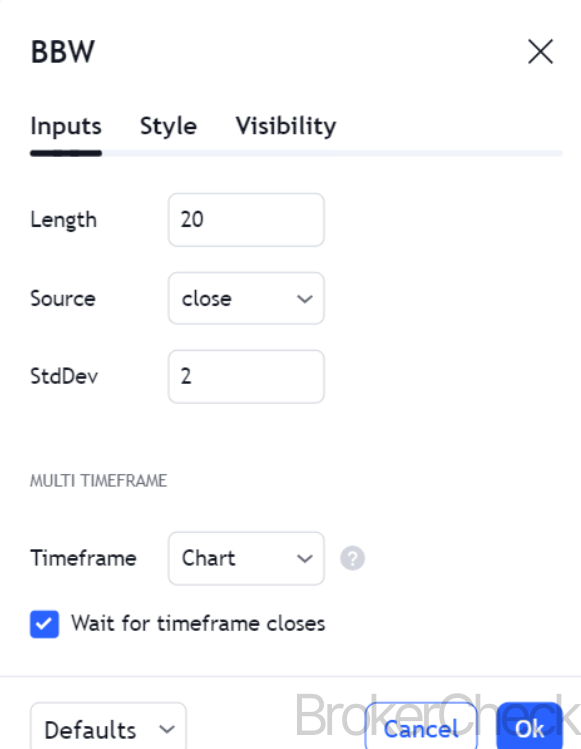

3.2 Cinikin Matsakaici

Matsakaici-lokaci traders, ciki har da lilo traders, sau da yawa sun fi son ma'auni tsakanin hankali da lag a cikin alamun su. Daidaitaccen saitin don Bollinger Bands Width yana aiki da kyau a wannan lokacin.

Mafi kyawun Saita:

- Matsakaicin Lokacin Motsawa: 20 lokuta (misali).

- Madaidaicin Maɓalli Mai Rarraba: 2 (misali).

- Fassara: Saitunan daidaitattun suna ba da madaidaicin ra'ayi na matsakaicin matsakaicin kasuwa. Ƙaruwa ba zato ba tsammani a cikin nisa na band zai iya nuna alamar farkon sabbin abubuwa ko ƙarfafa waɗanda suke da su.

3.3 Ciniki na dogon lokaci

Don ciniki na dogon lokaci, kamar ciniki na matsayi, matsakaicin matsakaicin lokaci mai tsayi mai tsayi da mafi girman daidaitattun ƙima ana amfani da su. Wannan saitin yana rage amo da santsi mai nuna alama, yana sa ya fi dacewa don gano abubuwan da ke faruwa na dogon lokaci da sauye-sauyen rashin ƙarfi.

Mafi kyawun Saita:

- Matsakaicin Lokacin Motsawa: 50-100 lokuta.

- Madaidaicin Maɓalli Mai Rarraba: 2.5 zuwa 3.

- Fassara: A cikin wannan saitin, haɓaka sannu-sannu a cikin faɗin band na iya nuna ci gaba a cikin rashin daidaituwar kasuwa na dogon lokaci, yayin da raguwa ke nuna kasuwa mai daidaitawa ko ƙasa da ƙasa.

| Lokaci | Matsakaicin Lokacin Motsawa | Daidaitaccen Maɓalli Multiplier | Interpretation |

|---|---|---|---|

| Ciniki na gajeren lokaci | 10-15 lokuta | 1 to 1.5 | Saurin amsawa ga canje-canjen kasuwa, mai amfani don gano rashin ƙarfi na ɗan gajeren lokaci da yuwuwar fashewa. |

| Ciniki na matsakaicin lokaci | Lokaci 20 (misali) | 2 (misali) | Madaidaicin hankali, dacewa da ciniki na lilo da bincike na yau da kullun. |

| Ciniki na dogon lokaci | 50-100 lokuta | 2.5 to 3 | Yana sassauƙa sauye-sauye na ɗan gajeren lokaci, manufa don yanayin dogon lokaci da kuma nazarin rashin ƙarfi. |

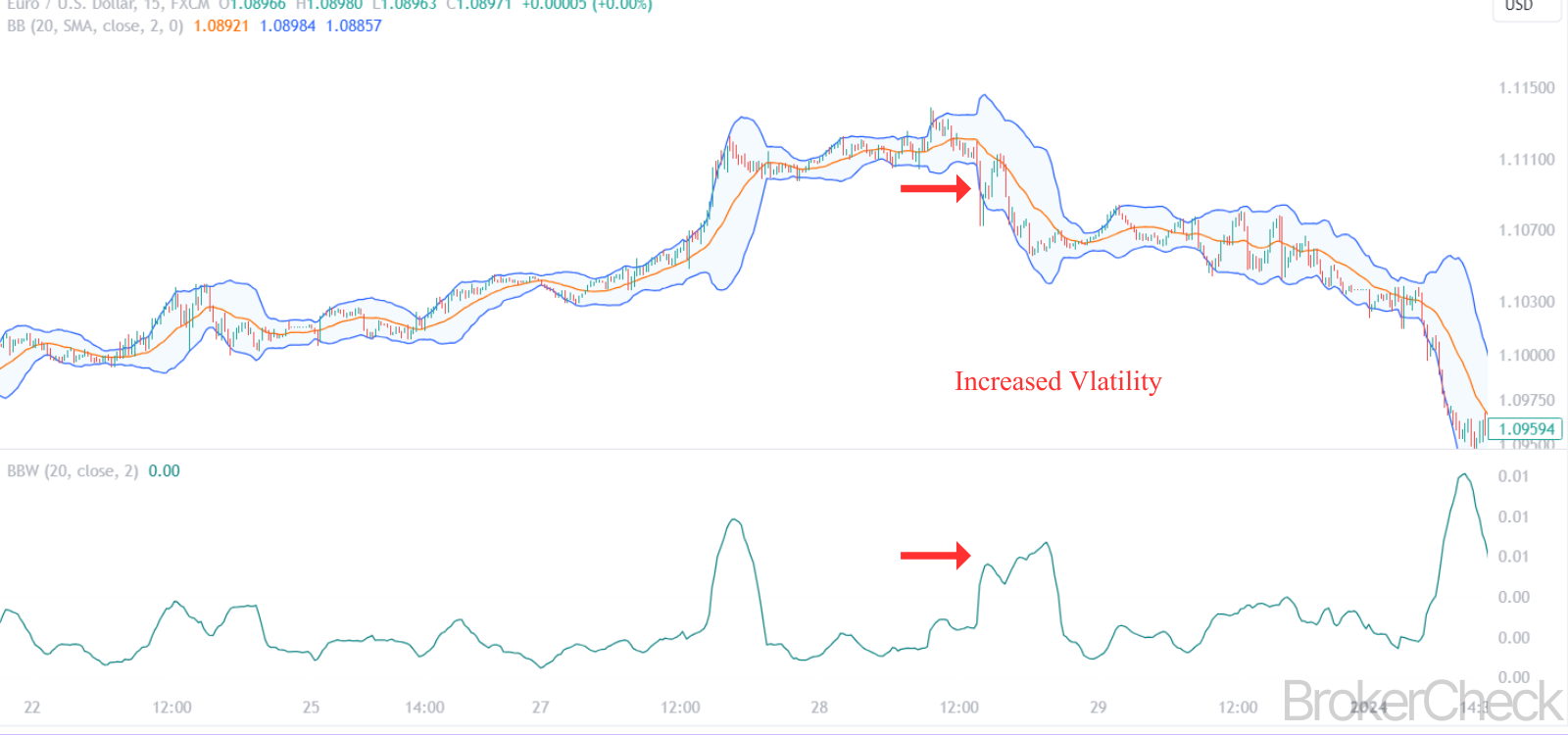

4. Fassarar Bollinger Bands Width

4.1 Fahimtar Ƙwayoyin Bollinger Nisa

Width na Bollinger Bands (BBW) kayan aikin bincike ne na fasaha wanda aka samo daga Bollinger Bands, wanda kansa alama ce ta rashin ƙarfi. BBW musamman yana auna bambanci tsakanin manyan ƙungiyoyin Bollinger na sama da na ƙasa. Wannan ma'aunin yana da mahimmanci ga traders saboda yana ba da haske game da canjin kasuwa. Maɗaukaki mai faɗi yana nuna ƙaƙƙarfan juzu'i, yayin da ɗimbin maɗaukaki yana nuna rashin ƙarfi.

4.2 Karatun Sigina

- Babban Darajojin BBW: Lokacin da BBW ya yi girma, yana nuna cewa akwai tazara mai mahimmanci tsakanin manyan ƙungiyoyin Bollinger na sama da na ƙasa. Wannan yanayin sau da yawa yana faruwa a lokacin babban canjin kasuwa, kamar a kusa da manyan labaran labarai ko sakin tattalin arziki. Traders suna fassara maɗaukakin ƙimar BBW a matsayin yuwuwar mafari don haɓaka kasuwa ko juyewa, saboda kasuwanni ba za su iya ɗaukar matakan rashin ƙarfi ba har abada.

- Ƙananan Ƙimar BBW: Sabanin haka, ƙananan ƙimar BBW yana nuna cewa kasuwa tana cikin lokacin ƙarancin rashin ƙarfi, tare da manyan makada na sama da na ƙasa kusa. Yawancin lokaci ana danganta wannan yanayin tare da lokacin ƙarfafa kasuwa, inda farashin farashin ke iyakance. Traders na iya kallon wannan azaman lokacin tarawa ko rarrabawa kafin gagarumin motsi farashin.

- Ƙara BBW: Ƙimar BBW mai girma na iya sigina cewa rashin ƙarfi yana tashi. Traders sau da yawa kallon wannan canji a matsayin mafari ga yuwuwar fashewa. Ƙarawa a hankali yana iya nuna ci gaba da haɓaka sha'awar kasuwa da sa hannu.

- Ragewar BBW: Ragewar BBW, a gefe guda, yana nuna raguwar canjin kasuwa. Wannan yanayin na iya faruwa bayan ƙaƙƙarfan motsin farashi yayin da kasuwa ta fara daidaitawa.

4.3 Zagayowar Canjin

Fahimtar zagayowar canzawa shine mabuɗin don fassara BBW yadda ya kamata. Kasuwanni sau da yawa suna wucewa ta lokutan babban rashin ƙarfi (faɗaɗɗen) tare da ƙarancin haɓaka (kwagi). BBW yana taimakawa wajen gano waɗannan matakan. Mai gwaninta traders amfani da wannan bayanin don daidaita su ciniki dabaru bisa ga haka, kamar yin amfani da dabarun da ke da iyaka a lokacin ƙarancin rashin ƙarfi da dabarun fashewa a lokacin babban lokacin rashin ƙarfi.

4.4 Muhimmancin Magana

Fassarar BBW ya kamata a koyaushe a yi ta cikin yanayin yanayin kasuwa da ake ciki kuma tare da sauran alamomi. Misali, a lokacin haɓaka mai ƙarfi ko ƙasa mai ƙarfi, faɗaɗa BBW na iya tabbatar da ƙarfin yanayin kawai, maimakon bayar da shawarar juyawa.

4.5 Misali Yanayi

Ka yi tunanin yanayin da BBW yake a matakin ƙasa na tarihi. Wannan yanayin zai iya nuna cewa kasuwa ta cika da yawa kuma yana iya zama saboda fashewa. Idan BBW ya fara faɗaɗa cikin sauri bayan wannan lokacin, zai iya zama sigina don ƙaƙƙarfan motsin farashi a kowane bangare.

| Yanayin BBW | Tasirin Kasuwa | Damar Trader Aiki |

|---|---|---|

| Babban darajar BBW | Babban rashin ƙarfi, yuwuwar juyewar kasuwa ko haɓakawa | Saka idanu don yuwuwar alamun juyewa, la'akari da matakan kariya kamar tasha-hasara umarni |

| Low BBW | Ƙananan rashin ƙarfi, haɓaka kasuwa | Nemo tarawa ko rarrabawa, shirya don fashewa |

| Ƙara BBW | Ƙunƙarar tashin hankali, yiwuwar farawa na yanayi ko fashewa | Kula da alamun fashewa, daidaita dabaru don kama abubuwan da za su iya faruwa |

| Ragewar BBW | Rage rashin ƙarfi, daidaita kasuwa bayan motsi | Yiwuwar ciniki-daure, rage tsammanin manyan motsin farashi |

5. Haɗa Faɗin Makada na Bollinger tare da Wasu Manuniya

5.1 Haɗin kai tare da Sauran Kayan Aikin Fasaha

Yayin da Bollinger Bands Width (BBW) alama ce mai ƙarfi da kanta, ana iya haɓaka tasirin sa sosai idan aka yi amfani da shi tare da sauran kayan aikin bincike na fasaha. Wannan hanya mai nuni da yawa tana ba da ƙarin cikakkiyar ra'ayi game da kasuwa, yana taimakawa cikin ingantattun yanke shawara na ciniki.

5.2 Haɗa tare da Matsakaicin Motsawa

- Matsakaicin Motsi Mai Sauƙi (SMA): Dabarar gama gari ita ce amfani da BBW tare da Matsakaicin Motsi Mai Sauƙi. Misali, a trader na iya neman BBW mai kunkuntar (yana nuna ƙarancin rashin ƙarfi) wanda ya yi daidai da ƙimar da ke ƙarfafawa a kusa da matakin SMA mai mahimmanci. Wannan na iya sau da yawa kafin fashewa.

- Matsayin Juyawa na Musamman (EMA): Amfani da EMA tare da BBW na iya taimakawa wajen gano ƙarfin yanayi. Misali, idan BBW yana faɗaɗa kuma farashin yana kan EMA na ɗan gajeren lokaci, yana iya ba da shawarar haɓaka mai ƙarfi.

5.3 Haɗa Manunonin Lokaci

- Dangi Ƙarfin Index (RSI): Ana iya amfani da RSI don tabbatar da siginar da BBW ya ba da shawara. Misali, idan BBW yana faɗaɗa kuma RSI yana nuna yanayin da aka yi fiye da kima, yana iya nuna yuwuwar juyewa a cikin haɓakawa.

- Matsakaicin Matsakaicin Canzawa (MACD): MACD, kasancewa mai biyo baya nuna alama, na iya haɗawa da BBW ta hanyar tabbatar da farkon sabbin abubuwa ko ci gaba da waɗanda suke. Lokacin da alamun MACD da BBW suka daidaita, yuwuwar samun nasara trade iya karuwa.

5.4 Manufofin Ƙara

Ƙarar yana taka muhimmiyar rawa wajen tabbatar da siginar da BBW ke bayarwa. Ƙara ƙarar da ke tare da faɗaɗa BBW na iya tabbatar da ƙarfin fashewa. Akasin haka, fashewa tare da ƙaramin ƙara bazai dawwama ba, yana nuna siginar ƙarya.

5.5 Oscillators don Kasuwannin Rage-Bound

A cikin ƙananan lokuttan rashin ƙarfi da aka nuna ta kunkuntar BBW, oscillators kamar Stochastic Oscillator ko da Commodity Channel Index (CCI) na iya yin tasiri musamman. Waɗannan kayan aikin suna taimakawa gano abubuwan da aka yi fiye da kima ko fiye da kima a cikin kewayon, samarwa trade dama a kasuwa ta gefe.

5.6 Misalin Dabarun Ciniki

Yi la'akari da yanayin inda BBW ya fara faɗaɗa bayan ɗan lokaci na ƙanƙancewa, yana nuna yuwuwar haɓakawa. A trader zai iya amfani da RSI don bincika yanayin da aka yi yawa ko aka yi. A lokaci guda, duban MACD don tabbatar da canjin yanayi na iya samar da sigina mafi ƙarfi. Wannan hanya mai nuni da yawa tana rage yuwuwar siginar ƙarya.

| Haɗin Nuni | Nufa | Yi amfani da BBW |

|---|---|---|

| BBW + SMA/EMA | Tabbatar da Trend | Gano yuwuwar fashewa a kusa da matsakaicin matakan maɓalli masu motsi |

| BBW + RSI | Tabbatar da Lokacin Lokaci | Yi amfani da RSI don tabbatar da yanayin da aka yi sama da fadi/sayi yayin canje-canjen rashin ƙarfi |

| BBW + MACD | Tabbatar da Trend da Momentum | Tabbatar da farkon ko ci gaba da al'amura |

| BBW + Alamar Ƙarar | Ƙarfin Motsi | Tabbatar da ƙarfin fashewa tare da nazarin ƙara |

| BBW + Oscillators (misali, Stochastic, CCI) | Kasuwanci a cikin Ranges | Gano trade shigarwa da fita a cikin kasuwanni masu iyaka |

6. Gudanar da Haɗari tare da Faɗin Makada na Bollinger

6.1 Matsayin BBW a Gudanar da Hadari

hadarin gudanarwa wani muhimmin al'amari ne na ciniki, kuma Bollinger Bands Width (BBW) na iya taka muhimmiyar rawa a ciki. Ko da yake BBW da farko alama ce ta canzawa, fahimtar abubuwan da ke tattare da shi yana taimakawa traders suna sarrafa haɗari yadda ya kamata ta hanyar daidaita dabarun su bisa ga yanayin kasuwa.

6.2 Saitin Tsayawa-Asara da Riba

- Umarnin Tsaida-Asara: Lokacin amfani da BBW, ana iya sanya odar tasha-asara bisa dabara. Misali, a cikin yanayi mai girma wanda babban BBW ya nuna, mafi fa'ida tasha-asara na iya zama dole don gujewa tsayawa da wuri.

- Umarnin Cin Riba: Akasin haka, a cikin ƙananan yanayin rashin ƙarfi (ƙunƙuntaccen BBW), traders zai iya saita maƙasudin riba na kusa, yana tsammanin ƙaramin motsin farashi.

6.3 Girman Matsayi

Ana iya daidaita girman matsayi bisa ga karatun BBW. A lokacin lokuta na babban rashin ƙarfi, yana iya zama mai hankali don rage girman matsayi don rage haɗari, yayin da a lokutan rashin ƙarfi, traders na iya zama mafi dacewa da manyan matsayi.

6.4 Daidaita Dabarun Ciniki

- Babban Haɓakawa (BBBW mai faɗi): A irin waɗannan lokatai, dabarun ƙaddamarwa na iya zama mafi inganci. Duk da haka, haɗarin karya karya kuma yana ƙaruwa, don haka traders yakamata suyi amfani da ƙarin siginonin tabbatarwa (kamar ƙarar ƙara ko nuna alama tabbata).

- Ƙarƙashin Ƙarfafawa (Ƙarancin BBW): A cikin waɗannan matakan, dabarun da ke da iyaka sun fi dacewa. Traders zai iya nemo tsarin oscillating a cikin makada da trade tsakanin matakan tallafi da juriya.

6.5 Amfani da Tashoshin Biyu

Tsayawar bin diddigi na iya zama da amfani musamman tare da BBW. Yayin da makada ke fadada kuma kasuwa ta zama mai canzawa, tsayawar bin diddigin na iya taimakawa wajen kulle ribar yayin da ke ba da daki don trade numfashi.

6.6 Daidaita Haɗari da Sakamako

Wani muhimmin al'amari na amfani da BBW don gudanar da haɗari shine daidaitawa hadari da sakamako. Wannan ya haɗa da fahimtar yuwuwar rashin ƙarfi da daidaita ƙimar ladan haɗari daidai da haka. Alal misali, a cikin yanayi mai girma, neman lada mafi girma don rama ƙarin haɗari na iya zama hanya ta hankali.

6.7 Misali Yanayi

Ace a trader ya shiga matsayi mai tsawo yayin lokacin haɓaka haɓaka (fadada BBW). Za su iya sanya odar tasha-asara a ƙasan ƙaramin Bollinger Band kuma saita tasha tasha don kare riba idan farashin ya ci gaba da hauhawa. The trader kuma yana daidaita girman matsayi don yin la'akari da haɓakar haɗari saboda haɓakawa mafi girma.

| Yanayin BBW | Dabarun Gudanar da Hadarin | aiwatarwa |

|---|---|---|

| Babban BBW (Maɗaukaki masu faɗi) | Faɗin Tsayawa-Asara Margins, Rage Girman Matsayi | Daidaita asarar tasha don ɗaukar juzu'i, sarrafa trade girman don sarrafa haɗari |

| Ƙananan BBW (Maɗaukakiyar Ƙunƙara) | Maƙasudin Riba Na Kusa, Girman Matsayi mafi Girma | Saita riba a cikin ƙaramin kewayo, ƙara girman matsayi idan rashin ƙarfi ya yi ƙasa |

| Canza BBW (Faɗawa ko Kwangila) | Amfani da Tashoshin Biyu | Aiwatar da tsayawar bin diddigin samun riba yayin ba da izinin motsin kasuwa |

| Daidaita Haɗari da Sakamako | Daidaita Rabon Lada-Haɗari | Nemi lada mafi girma a cikin babban canji da akasin haka |

7. Advantages da Iyakokin Bollinger Bands Width

7.1 Advantages na Bollinger Bands Width

- Nuna Ƙarfafawar Kasuwa: BBW babban kayan aiki ne don auna canjin kasuwa. Ƙarfinsa don auna nisa tsakanin babba da ƙananan Bollinger Bands yana taimakawa traders fahimtar yanayin yanayin rashin ƙarfi, wanda ke da mahimmanci don zaɓin dabarun.

- Gane Matakan Kasuwa: BBW yana taimakawa wajen gano nau'ikan kasuwa daban-daban, kamar babban rashin ƙarfi (kasuwannin da ke faruwa ko karyewa) da ƙarancin ƙasƙanci (kasuwa mai iyaka ko haɓaka kasuwanni).

- Sassauci Tsakanin Tsawon Lokaci: Ana iya amfani da BBW zuwa lokuta daban-daban, yana mai da shi dacewa don nau'ikan ciniki daban-daban, daga ciniki na rana zuwa lilo da matsayi ciniki.

- Daidaitawa tare da Wasu Manufofin: BBW yana aiki da kyau tare da sauran alamun fasaha, yana haɓaka tasirin sa wajen samar da ingantaccen dabarun ciniki.

- Amfani a cikin Gudanar da Hadarin: Ta hanyar ba da haske game da canjin kasuwa, BBW yana taimakawa traders a cikin aiwatar da ingantattun dabarun sarrafa haɗari, kamar daidaita odar asarar tasha da girman matsayi.

7.2 Iyakance na Bollinger Bands Nisa

- Yanayin Lagging: Kamar yadda tare da yawancin alamun fasaha, BBW yana raguwa. Ya dogara da bayanan farashin da ya gabata, ma'ana yana iya ba koyaushe hasashen motsin kasuwa na gaba daidai ba.

- Hadarin Alamomin Karya: A yayin yanayin kasuwa mai saurin canzawa, BBW na iya faɗaɗa, yana ba da shawarar fashewa ko yanayi mai ƙarfi, wanda zai iya zama siginar ƙarya.

- Fassarar Dogara-Mai-Tsarki: Fassarar siginar BBW na iya bambanta dangane da mahallin kasuwa da sauran alamomi. Yana buƙatar fahimta mai zurfi kuma bai kamata a yi amfani da shi a keɓe don yanke shawara ba.

- Babu Son Zuciya: BBW baya bada bayanai game da alkiblar kasuwancin kasuwa. Yana nuni ne kawai da girman juzu'i.

- Batun Hayaniyar Kasuwa: A cikin gajeren lokaci, BBW na iya zama mai saurin kamuwa da hayaniyar kasuwa, yana haifar da alamun ɓata na sauye-sauye.

| Aspect | Advantages | gazawar |

|---|---|---|

| Karɓar Kasuwa | Madalla don auna matakan volatility | Lagging, maiyuwa baya hasashen motsi na gaba |

| Matakan Kasuwa | Yana gano manyan juzu'i masu ƙarfi da ƙarancin ƙarfi | Zai iya ba da sigina na ƙarya yayin matsanancin rashin ƙarfi |

| Sassaucin Lokaci | Mai amfani a cikin lokaci daban-daban | Fassarar ta bambanta ta hanyar lokaci; karin hayaniya a cikin guntu |

| karfinsu | Yana aiki da kyau tare da sauran alamomi | Yana buƙatar takamaiman fassarar mahallin |

| hadarin Management | Taimako wajen saita hasara tasha da girman matsayi | Baya nuna alamar kasuwa |