1. Menene Matsakaicin Ribbon Motsawa?

A motsi Average Kintinkiri ne mai fasaha analysis kayan aiki wanda ya ƙunshi matsakaicin motsi masu yawa na tsayi daban-daban da aka tsara akan ginshiƙi ɗaya. Wannan dabarar hangen nesa tana nuna jerin layin da ke haifar da kamannin kintinkiri, wanda traders suna amfani da su don gano alkibla da ƙarfi.

Rubutun ya ƙunshi matsakaita masu motsi waɗanda aka ƙididdige su akan gajeru, matsakaita, da dogon lokaci. Waɗannan na iya kewayo daga matsakaicin ɗan gajeren lokaci kamar kwanaki 5 zuwa matsakaicin lokaci mai tsayi kamar kwanaki 200. Lokacin da matsakaicin motsi na gajeren lokaci ya kasance sama da matsakaicin lokaci mai tsawo, yana nuna wani uptrend. Sabanin haka, idan matsakaicin gajeren lokaci ya kasance ƙasa, yana nuna a downtrend.

Traders lura da rabuwa ko hadewar layin da ke cikin kintinkiri. A ribbon mai fadi yana nuna yanayi mai ƙarfi, yayin da a kunkuntar kintinkiri ko wanda ya fara shiga tsakani yana nuna alamar rauni ko yuwuwar juyewar yanayin. Matsakaicin Ribbon Motsawa ana iya keɓance shi ta zaɓar lokutan lokuta daban-daban da nau'ikan matsakaicin motsi, kamar su sauƙi, maɗaukaki, ko nauyi, don dacewa da dabarun ciniki daban-daban.

Matsakaicin Matsakaicin Ribbon ba kawai alama ce mai zuwa ba; Hakanan zai iya ba da tallafi mai ƙarfi da matakan juriya. Traders na iya neman hulɗar farashi tare da layin ribbon don yanke shawarar yanke shawara game da shigarwa da wuraren fita, da kuma saitawa. tasha-hasara umarni.

2. Yadda Ake Saita Matsakaicin Dabarun Ribbon Mai Motsawa?

Zaɓin Matsakaicin Matsakaicin Dama

Kafa Matsakaicin Matsakaicin dabarar Ribbon yana farawa tare da zabar madaidaicin matsakaitan motsi don haɗawa a cikin kintinkiri. Ya kamata zaɓin ya ƙunshi kewayon firam ɗin lokaci waɗanda ke nuna trader ta musamman salon ciniki da kuma lokacin sararin samaniya na su trades. Hanyar gama gari ita ce a yi amfani da jeri na matsakaita motsi a cikin ƙarin lokuta, kamar 5, 10, 20, 30, 40, 50, da 60 lokuta. Matsakaicin motsi mai tsayi (EMAs) galibi ana fifita su akan matsakaicin motsi mai sauƙi (SMAs) yayin da suke ba da ƙarin nauyi ga ayyukan farashin kwanan nan kuma suna iya amsawa da sauri ga canje-canjen farashin.

Ana saita Chart

Da zarar an zaɓi matsakaita masu motsi, mataki na gaba shine a yi amfani da waɗannan zuwa ginshiƙi farashin. Yawancin dandamali na ciniki na iya ƙara matsakaita masu motsi da yawa kuma su tsara sigogin su. Tabbatar cewa kowane matsakaita motsi an saita shi zuwa daidaitaccen nau'in (mai sauƙi, ma'auni, ko ma'auni) da lokaci. Hakanan yana da amfani don sanya launuka daban-daban ga kowane matsakaicin motsi don tsabta.

Tafsirin Ribbon

Bayan an yi amfani da matsakaita masu motsi, ribbon zai yi girma. Traders yakamata su saka idanu akan daidaitawa da tsari na matsakaicin motsi. Za a sigina mai girma, Matsakaicin motsi mafi guntu ya kamata ya kasance a saman ribbon, tare da mafi tsayi a ƙasa, kuma layin ya kamata ya kasance a layi daya ko fandewa. Za a bearish siginar, Matsakaicin motsi mafi tsayi ya kamata ya kasance a saman tare da mafi guntu a ƙasa, sake tare da layin layi ɗaya ko fanning ciki.

Shigarwa da Fitowa

Ana gano wuraren shigarwa lokacin da farashin ke motsawa sama ko ƙasa da kintinkiri, ko lokacin da matsakaita masu motsi suka daidaita ta hanyar da ke nuna farkon yanayin. Ana iya saita wuraren fita ko odar asarar tsayawa a kusa da matakan kintinkiri, musamman idan farashin ya fara karya matsakaicin matsakaita a kishiyar yanayin halin da ake ciki.

| Yanayin | Action |

|---|---|

| Farashin yana motsawa sama da kintinkiri | Yi la'akari da matsayi mai tsawo |

| Farashin yana motsawa ƙasa da kintinkiri | Yi la'akari da ɗan gajeren matsayi |

| Matsar da matsakaita fan fita | Trend ƙarfi yana ƙaruwa |

| Matsakaicin matsakaita tsakanin juna | Juyawa mai yiwuwa |

Bi wadannan ka'idoji, traders na iya saitawa da amfani da dabarun Ribbon Matsakaicin Motsi yadda ya kamata. Kamar yadda yake tare da duk dabarun ciniki, hada Ribbon Matsakaici na Motsawa tare da wasu alamomi da hanyoyin bincike yana da mahimmanci don tabbatar da sigina da sarrafawa. hadarin.

2.1. Zaɓan Matsakaicin Matsakaicin Matsala

Kewaya zuwa Yanayin Kasuwa

Tasirin Matsakaicin Ribbon Motsawa ya dogara sosai kan zaɓin matsakaicin da ya dace da yanayin kasuwa na yanzu. Kasuwar da ba ta da ƙarfi wacce ke da saurin haɓakar farashi, na iya buƙatar gajeriyar matsakaicin motsi don ɗaukar ainihin yanayin. Sabanin haka, matsakaicin matsakaita masu tsayi na iya samar da hoto mai haske a cikin kasuwa wanda ke nuna ƙarancin juzu'i da ƙarin fa'ida, tace hayaniya da gajarta na ɗan lokaci.

Daidaitawa da Salon Ciniki

The tradesalon mutum na r yana tasiri sosai ga zaɓin matsakaicin motsi. Rana traders zai iya karkata zuwa ga kintinkiri wanda ya ƙunshi matsakaicin matsakaicin motsi na ɗan gajeren lokaci, kamar lokutan 5, 10, da 15, don gano sauye-sauye masu saurin gaske. Swing traders, neman kama abubuwan da ke faruwa a cikin kwanaki da yawa ko makonni, na iya zaɓar gauraya wanda ya haɗa da matsakaita daga lokuta 30 zuwa 60. Matsayi traders, tare da hangen nesa na dogon lokaci, zai iya samun ƙima wajen haɗa matsakaicin motsi daga lokaci 100 zuwa 200 don tabbatar da tsayin daka na lokaci.

La'akari da Hankalin Farashin

Hankali na matsakaita matsakaita zuwa ƙungiyoyin farashi wani muhimmin al'amari ne. EMAs sun fi damuwa saboda mayar da hankali ga farashin kwanan nan, wanda ya sa su dace da su traders waɗanda ke buƙatar alamun alamun hanzari. Koyaya, wannan azancin kuma na iya haifar da siginar karya a cikin kasuwanni masu tsinke. Akasin haka, SMAs samar da saitin bayanai masu santsi, wanda zai iya zama tallavantageza mu traders neman kauce wa karya karya.

Haɗin kai tare da Kayayyakin Kasuwa

Kayan aikin kuɗi daban-daban kuma na iya ba da amsa mafi kyau ga takamaiman lokuta. A waje biyu tare da high liquidity, kamar EUR / USD, na iya yin waƙa da kyau tare da gajeriyar matsakaicin motsi. A lokaci guda, a kayayyaki tare da yanayin yanayi, kamar ɗanyen mai, na iya daidaitawa da kyau tare da tsawon lokaci. Traders kamata sake gwadawa Matsakaicin zaɓaɓɓen da suka zaɓa akan bayanan tarihi don takamaiman kasuwar su don daidaita zaɓin su.

Ta hanyar zabar matsakaita masu motsi da kyau waɗanda suka yi daidai da yanayin kasuwa, salon ciniki, ƙimar farashi, da halayen kayan aikin kuɗi da aka zaɓa, traders na iya haɓaka tasirin dabarun Ribbon Matsakaicinsu na Motsi. Yana da mahimmanci a tuna cewa babu wani haɗuwa guda ɗaya na matsakaicin motsi da zai zama mafi kyau duka a duniya; ci gaba da kimantawa da daidaitawa sune mahimmanci don kiyaye dacewa da wannan kayan aikin bincike na fasaha.

2.2. Keɓance Matsakaicin Motsawa akan TradingView

Keɓance Matsakaicin Motsawa akan TradingView

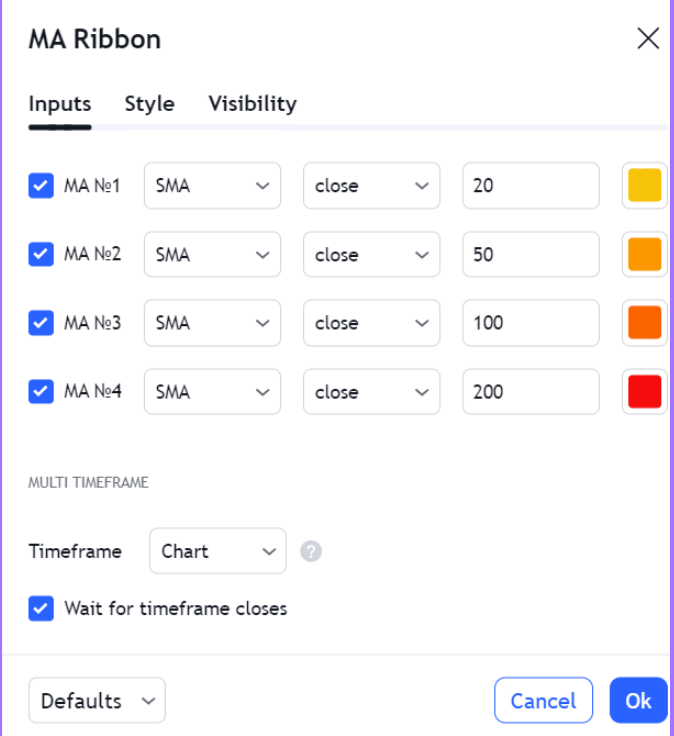

TradingView yana ba da dandamali mai ƙarfi don traders suna neman yin amfani da dabarar Ribbon Matsakaici na Motsawa tare da keɓancewar mai amfani don daidaita matsakaicin motsi. Don farawa, shiga cikin Manuniya menu kuma zaɓi motsi Average sau da yawa don ƙara tsayi daban-daban. Kowane misali ana iya keɓance shi daban-daban ta danna maɓallin saitunan kusa da sunan mai nuna alama akan ginshiƙi.

a cikin bayanai tab, ƙayyade lokacin kowane matsakaicin motsi, tabbatar da jerin suna nuna tradeabubuwan da ake so na lokacin r. The style shafin yana ba da damar gyare-gyaren kowane matsakaicin launi da kauri mai motsi, yana sauƙaƙe rarrabewa tsakanin lokuta daban-daban. Don ƙarin ribbon mai amsawa, traders iya zabar EMAs cikin Hanyar MA jerin menu.

Don gyare-gyare na ci gaba, traders na iya amfani da dandamali Rubutun Pine edita don ƙirƙirar alamar Matsakaicin Matsakaicin Ribbon. Wannan yaren rubutun yana ba da damar ma'anar takamaiman sigogi da yanayi, kamar inuwa ta atomatik tsakanin matsakaita masu motsi don ganin ƙarfin yanayin gani.

| Feature | Zabi na Musamman |

|---|---|

| Zaɓin Nuni | Ƙara matsakaicin motsi masu yawa |

| Saitunan Lokaci | Ƙayyade tsayin kowane MA |

| Daidaita Salo | Daidaita launi da kauri na layi |

| Hanyar MA | Zaɓi tsakanin SMA, Ema, WMA, da dai sauransu. |

| Rubutun Pine | Rubuta rubutun al'ada don buƙatu na musamman |

Ta hanyar amfani da waɗannan fasalulluka, traders na iya saita Matsakaicin Ribbon ɗin su don dacewa da tsarin kasuwancin su da daidaito. Yana da mahimmanci don bita lokaci-lokaci da daidaita waɗannan saitunan don daidaitawa da canza yanayin kasuwa da kiyaye tasirin dabarun.

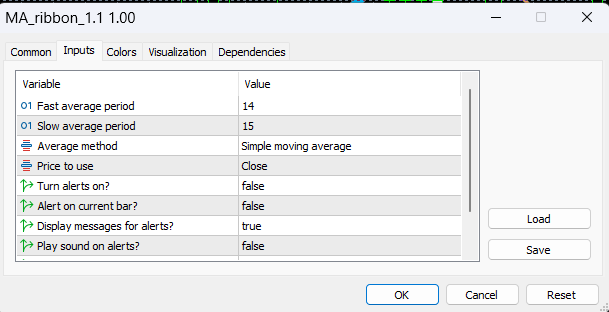

2.3. Daidaita Saituna akan MetaTrader

Daidaita Saituna akan MetaTrader

MetaTrader, dandamali da aka yi amfani da shi sosai tsakanin traders, yana ɗaukar daidaitawar Matsakaicin Ribbon Motsi tare da sauƙin dangi. Don daidaita saitunan, buɗe Navigator taga ya ja motsi Average mai nuna alama akan ginshiƙi na kowane lokacin da ake so. Danna dama na gaba akan kowane layin MA kuma zaɓi Properties yana buɗe taga gyare-gyare.

A cikin wannan taga, traders na iya canza yanayin Period, Motsi, Hanyar MA, Da kuma Aiwatar da zuwa sigogi. The Hanyar MA yana ba da zaɓuɓɓuka irin su Sauƙaƙe, Ƙarfafawa, Smoothed, da Ma'auni na Linear. Kowane hanyar amsawa ga aikin farashi ya bambanta, tare da Musamman ana fifita su don ingantacciyar hanya mai ƙarfi. The Aiwatar da zuwa saitin yana ƙayyade wane bayanan farashin-kusa, buɗe, babba, ƙasa, matsakaici, na yau da kullun, ko ma'auni na kusa-an ƙididdige su cikin lissafin MA.

Ana sauƙaƙe bambance-bambancen gani ta hanyar Colors shafin, inda za a iya sanya launuka na musamman ga kowane matsakaicin layi mai motsi. Bugu da ƙari, da matakan shafin yana ba da damar ƙara layin kwance a ƙayyadaddun farashin, wanda zai iya zama alamomi don tallafi ko juriya.

Ga waɗanda ke neman ingantaccen tsari, ana samun alamun al'ada don zazzagewa ko ana iya yin lamba a cikin yaren MQL4. Waɗannan masu nuna alama na iya ɗaukan kowane kintinkiri tare da saitunan da aka riga aka saita, rage lokacin saiti da yuwuwar kuskure.

| siga | Zabuka | Nufa |

|---|---|---|

| Period | customizable | Yana saita adadin sanduna don lissafin MA |

| Motsi | customizable | Yana daidaita madaidaicin MA dangane da mashaya na yanzu |

| Hanyar MA | SMA, EMA, SMMA, LWMA | Yana ƙayyade nau'in matsakaicin motsi |

| Aiwatar da zuwa | Bayanan farashi daban-daban | Yana zaɓar wurin farashi don lissafin MA |

| Colors | customizable | Yana ba da damar bambancin gani tsakanin layukan MA |

Ta hanyar daidaita waɗannan saitunan, MetaTrader masu amfani za su iya keɓance Matsakaicin Ribbon Motsi don daidaitawa da abubuwan da suke so na ciniki, yanayin kasuwa, da halayen kayan aikin da suke nazari. Kamar yadda yanayin kasuwa ke tasowa, sake dubawa lokaci-lokaci da daidaita waɗannan sigogi suna da mahimmanci don dorewar tasirin dabarun.

3. Yadda Ake Amfani da Matsakaici Matsakaicin Ribbon don Dabarun Shigarwa?

Gano Tabbacin Trend

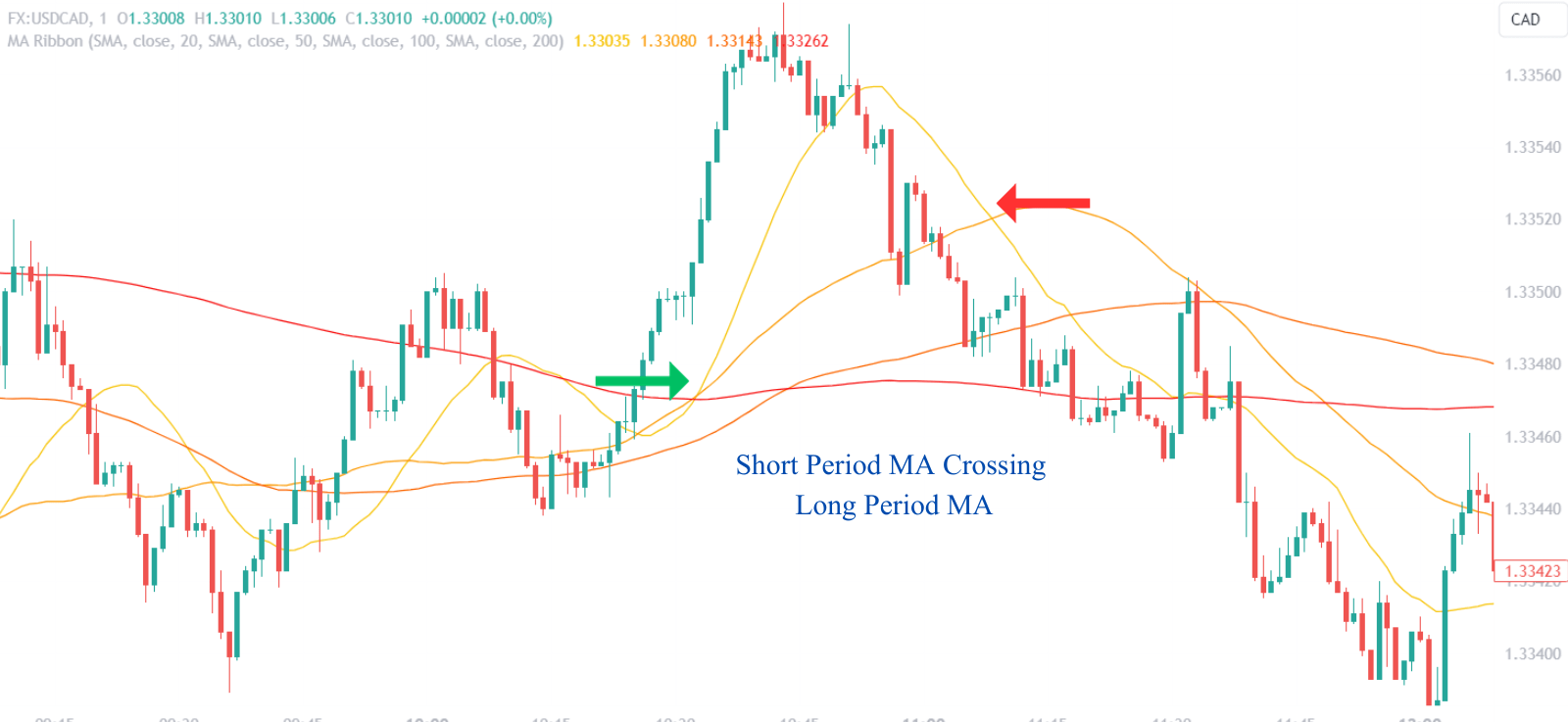

Traders yi amfani da Matsakaicin Ribbon Motsawa don nuna alamun shigarwa ta gano abubuwan tabbatarwa. An hawan ribbon, inda matsakaicin matsakaicin motsi na ɗan gajeren lokaci ya kasance sama da na dogon lokaci, sigina yana ƙaruwa. Akasin haka, a ribbon mai saukowa yana nuna yanayin bearish. Ana la'akari da shigarwa lokacin da farashin farashin ya tabbatar da alkiblar da aka nuna ta hanyar kintinkiri.

Misali, a trader na iya shiga dogon matsayi lokacin da farashin farashin ya rufe sama da kintinkiri, musamman idan matsakaicin motsi na gajeren lokaci kwanan nan sun haye sama da matsakaicin lokaci mai tsayi. Ana iya ganin wannan ƙetare a matsayin tabbaci na haɓakar haɓakawa. A m tsayawa-asara sau da yawa ana sanya shi a ƙasan kintinkiri ko matsakaicin layi mai motsi na baya-bayan nan a cikin kintinkiri wanda ya zama tallafi.

Yin Amfani da Faɗin Ribbon

Faɗawar ribbon, inda nisa tsakanin matsakaita masu motsi ke faɗaɗa, yana nuna haɓakar ƙarfin yanayi. Traders kallon waɗannan faɗaɗawa azaman alamar shiga trades a cikin shugabanci na Trend. Faɗawa bayan wani lokaci na ƙarfafawa ko haɗin ribbon na iya ba da siginar shigarwa musamman mai ƙarfi, kamar yadda yake ba da shawarar fashewa daga rashin yanke hukunci zuwa sabon yanayin.

| Yanayin Ribbon | Tasiri | Yiwuwar Aiki |

|---|---|---|

| Ribbon hawan hawan | Tabbatar da Bullish Trend | Fara Dogon Matsayi |

| Saukowa Ribbon | Tabbatar da Trend Bearish | Fara Short Matsayi |

| Fadada Ribbon | Ƙarfafa Ƙarfin Ƙarfi | Shiga cikin Hanyar Trend |

Yin Amfani da Jawo Farashin

Juyin farashi zuwa kintinkiri na iya zama madaidaicin wuraren shigarwa, musamman ma lokacin da ja baya ya faru akan ƙaramin ƙara, yana nuna rashin tabbas a cikin sake dawo da farashin. Traders na iya neman shigar da matsayi lokacin da farashin ya taɓa ko ɗan ɗan ratsa kintinkiri amma ya sami goyan baya, yana nuna yanayin farko har yanzu yana nan.

Kulawa da Matsakaicin Matsakaicin Ƙira

Matsakaicin matsakaitan matsuguni a cikin kintinkiri yana ba da ƙarin alamun shigarwa. A matsakaicin matsakaicin motsi na gajeren lokaci sama da matsakaicin lokaci mai tsayi a cikin kintinkiri na iya zama abin shigar da hankali, musamman idan ya faru bayan lokacin ƙarfafa farashin. Akasin haka, matsakaicin matsakaicin ɗan gajeren lokaci a ƙasa yana nuna yuwuwar gajeriyar shigarwa. Waɗannan ƙetare sun fi mahimmanci yayin da suke tare da ƙara yawan kasuwancin ciniki, haɓaka amincin siginar.

Raddi ga Juyin Halitta

A karshe, traders ya kamata ya zama mai amsawa ga sauye-sauyen sauye-sauyen da aka nuna ta hanyar sauri da yanayin sauye-sauyen daidaitawar matsakaicin motsi. Saurin jeri na gajeriyar matsakaita masu motsi zuwa saman kintinkiri na iya gaba da ƙaƙƙarfan motsin farashi, yana bada garantin shigarwar akan lokaci. Akasin haka, raguwar jujjuyawar jeri ko juyowa domin na iya buƙatar yin taka tsantsan ko sake tantance dabarun shiga.

A aikace, ya kamata a yi amfani da Matsakaicin Matsakaicin Ribbon tare da wasu alamomi da hanyoyin bincike don tace sigina da rage yuwuwar shigar da karya. Ya kamata a yi la'akari da mahallin kasuwa da rashin daidaituwa, saboda za su iya tasiri tasiri tasiri na kintinkiri a matsayin kayan aiki na shigarwa.

3.1. Gano Hanyar Hanya

Tantance Ribbon fuskantarwa

Matsakaicin Matsakaicin Ribbon Motsawa yana da kayan aiki don tantance alkiblar da ke gudana. A ribbon ku matsakaicin matsawa na gajeren lokaci an sanya su sama da na dogon lokaci yana nuni da hauhawar farashin farashi. Wannan tsari yana nuna cewa matakin farashin kwanan nan ya fi ƙarfin aikin da ya gabata, yawanci yana haifar da hangen nesa.

Sabanin haka, lokacin matsakaicin motsi na dogon lokaci yana tashi zuwa saman kintinkiri, yana nuna rinjayen ra'ayin bearish. Anan, farashin yana faɗuwa, ko aƙalla ƙarancin aiki idan aka kwatanta da matsakaicin matsakaicin tarihinsa, yana nuna yiwuwar raguwa.

Ana kimanta Halayen Ribbon

Halin kintinkiri na tsawon lokaci yana ba da mahimman bayanai game da dorewar yanayin. A m, kintinkiri mai gangara sama wanda ke kula da matakan da aka ba da umarni na matsakaita masu motsi yana nuna ingantaccen haɓakawa. A daya bangaren kuma, a kintinkiri mai gangarawa zuwa ƙasa wanda ke kiyaye tsarinsa daidai yana nuna ci gaba da raguwa.

Yin nazarin Haɗin Ribbon da Bambance-bambance

haduwa na matsakaita masu motsi a cikin kintinkiri, inda layukan ke zuwa kusa da juna, galibi suna gaba da yanayin rauni ko yuwuwar canjin shugabanci. Da bambanci, bambanta ko rabuwa da matsakaita masu motsi suna sigina ƙarfin halin da ake ciki. Matsakaicin bambance-bambance na iya ba da haske game da yanayin yanayin yanayin, tare da rata mai fa'ida yana nuna haɓaka mai ƙarfi.

| Siffar Ribbon | Bayyanawa |

|---|---|

| An yi oda, zuwa sama | Tsayayyen haɓakawa |

| An yi oda, mai gangara ƙasa | m downtrend |

| Haɗin kai MAs | Yanayin rauni ko juyawa |

| Bambance-bambancen MAs | Trend mai ƙarfi tare da ƙarfi |

Ribbon a matsayin Tace mai Trend

Ribon yana aiki azaman tacewa, yana taimakawa wajen bambancewa tsakanin ingantattun abubuwan da ke faruwa da hayaniyar kasuwa. Traders na iya yin watsi da jujjuyawar farashin ɗan gajeren lokaci wanda baya rushe tsarin kintinkiri gabaɗaya, yana mai da hankali a maimakon ƙungiyoyi masu ɗorewa waɗanda ke canza tsarin kintinkiri. Wannan hanya tana taimakawa wajen rage tasirin rashin daidaituwa da ƙananan koma baya akan nazarin yanayin.

3.2. Wuraren Shigar Hange

Tantance Matsakaicin Matsayi

Wani muhimmin al'amari na hange wuraren shigarwa ta amfani da Matsakaicin Ribbon Motsi shine lura da matsayi na matsakaita masu motsi dangane da juna da aikin farashin. Crossovers musamman abin lura; matsakaicin matsakaicin motsi na ɗan gajeren lokaci sama da dogon lokaci na iya sigina lokacin da ya dace don shiga matsayi mai tsawo, yayin da yanayin juzu'i zai iya ba da shawarar gajeriyar shigarwa. Muhimmancin waɗannan giciye yana ƙaruwa lokacin da suka faru tare da ƙarar ƙara, suna samar da siginar shigarwa mai ƙarfi.

Gane Ma'amalar Farashi tare da Ribbon

Traders ya kamata a kula sosai ga yadda farashin ke hulɗa tare da Matsakaicin Ribbon Motsi. Farashin da ya kasance koyaushe a gefe ɗaya na kintinkiri yana jaddada alkiblar yanayin. Ana gano wurin shigarwa sau da yawa lokacin da farashin, bayan ja da baya, ya taɓa ko ɗan karya ribbon duk da haka bai rufe a gefe ɗaya ba, yana nuna cewa yanayin da ake ciki zai iya ci gaba.

Amfani da Faɗin Ribbon don Lokacin Shigarwa

Nisa Matsakaicin Ribbon Motsawa na iya zama alama mai ƙarfi don wuraren shigar lokaci. Ƙunƙarar ribbon yana ba da shawarar ƙarfafawa da yuwuwar fashewa, yayin da shimfidar ribbon nuna ƙãra halin da ake ciki. Traders na iya amfani da faɗaɗawa azaman alamar shiga a trade a cikin shugabanci na fadadawa, yana tsammanin yanayin ya tashi.

Aiwatar da Ƙaƙwalwar Ƙaƙwalwar Tabbaci

Ƙarar yana aiki azaman kayan aiki mai tabbatarwa lokacin gano wuraren shigarwa. Ƙaruwar ƙarar da ke rakiyar farashin motsi ta cikin kintinkiri ko ketare a cikin kintinkiri yana ƙara tabbatar da siginar. Sabanin haka, motsin farashi tare da ƙaramar ƙarar ƙila na iya rasa hukunci don haka yana buƙatar ƙarin bincike kafin ƙaddamar da shigarwa.

Kula da Alamomin Karya

Yin taka tsantsan game da siginar ƙarya yana da mahimmanci. Ba kowace hulɗa tare da Matsakaicin Ribbon Motsawa ke ba da garantin shigarwa ba, musamman a kasuwanni masu tsinke inda farashi kan iya ketare kintinkiri akai-akai ba tare da wani ci gaba mai dorewa ba. Ƙarin alamomi, kamar su Dangi Ƙarfin Index (RSI) ko Matsakaicin Matsakaicin Canzawa (MACD), za a iya amfani da su tare don tace sigina marasa inganci.

| Nau'in Sigina | Yanayin | Tabbatar da ƙara | Action |

|---|---|---|---|

| Shigar Crossover | Short MA ya haye sama da tsayi MA | Babban girma | Yi la'akari da matsayi mai tsawo |

| Shigar Crossover | Short MA ya ketare ƙasa mai tsayi MA | Babban girma | Yi la'akari da ɗan gajeren matsayi |

| Sadarwar Farashin | Farashin ya taɓa/sake shiga ribbon | Volumeara girma | Yi taka tsantsan |

| Tabbatar da Trend | Farashin yana tsayawa a gefe ɗaya na kintinkiri | Ƙarfin da ya dace | Tabbatar da alkibla |

| Fadada Ribbon | MAs fan fitar da nuna ci gaba | Ƙara girma | Shigar lokaci tare da Trend |

Ta hanyar tantance waɗannan abubuwan cikin tsari, traders na iya gano wuraren shigarwa tare da babban ƙarfin gwiwa, daidaita su trades tare da ci gaban kasuwa da kuma rage fallasa ga ɓarnawar karya ko rarraunan yanayi.

3.3. Tabbatar da Shiga tare da Ƙarin Manuniya

Amfani da RSI don Tabbatar da Trend

The Abokin Harkokin Fassara (RSI) Oscillator ne mai ɗan lokaci wanda zai iya inganta wuraren shigarwa da Matsakaicin Ribbon Motsi ya yi alama. Ta hanyar kwatanta girman nasarorin da aka samu na baya-bayan nan zuwa hasara na baya-bayan nan, RSI na taimakawa wajen gano yanayin da aka yi fiye da kima ko aka yi. Karatun RSI da ke sama da 70 yana nuna kasuwar da aka yi fiye da kima, yayin da karatun da ke ƙasa da 30 ke nuna kasuwar da ta yi yawa. Lokacin da Matsakaicin Ribbon Motsi ya ba da shawarar shigarwa, tabbatar da shi tare da ƙimar RSI waɗanda suka daidaita tare da alkiblar yanayin ba tare da nuna matsananciyar yanayi ba. Misali, ya kamata RSI ya goyi bayan shigarwar bullish a sama da madaidaicin siyar, zai fi dacewa ya tashi zuwa tsakiyar maki (50), wanda ke nuna karuwar buguwa.

Haɗa MACD don Tabbatar da Shiga

The Musayar rarraba na ƙididdigar ƙaura (MACD) wani kayan aiki ne wanda ya dace da Matsakaicin Ribbon Motsi. Ya ƙunshi ma'auni guda biyu masu motsi (mai sauri da a hankali) da kuma lissafin lissafi wanda ke auna tazarar da ke tsakaninsu. Ana ƙarfafa siginar ƙararrawa lokacin da layin MACD (mai sauri MA) ya haye sama da layin siginar (jinkirin MA), musamman idan wannan giciye ya faru a sama da tushen tarihin tarihi, yana nuna ingantaccen lokaci. Sabanin haka, don siginar bearish, layin MACD yana ƙetare ƙasa da siginar siginar yayin da sandunan histogram suna saukowa ƙasa da tushe suna ƙarfafa ingancin ƙasa.

Aiwatar da Ƙungiyoyin Bollinger don Fahimtar Ƙarfafa Kasuwa

Bollinger makada bayar da haske a cikin kasuwar volatility da matakan farashi dangane da matsakaita masu motsi. Ƙungiyoyin suna faɗaɗa a lokacin lokutan babban rashin ƙarfi da kwangila a lokacin ƙarancin rashin ƙarfi. Rushewar farashi a sama da Babban Bandungiyar Bollinger na iya nuna ƙaƙƙarfan motsi na sama, musamman idan Matsakaicin Ribbon Motsi ya daidaita. Hakazalika, tsoma farashin da ke ƙasa da ƙananan band ɗin zai iya tabbatar da shigarwar bearish, muddin ribbon ɗin ya karkata zuwa ƙasa. Tsakanin layin Bollinger Bands, yawanci a sauƙi mai sauƙi a matsakaici, Har ila yau yana aiki azaman ƙarin ma'anar tunani don siginar Matsakaicin Ribbon.

Yin Amfani da Ma'anoni na Tushen Ƙarar don Tabbatarwa

Alamun tushen ƙara kamar su Ƙarar Ma'auni (OBV) or Matsakaicin Matsakaicin Ma'aunin Girma (VWAP) zai iya tabbatar da sigina daga Matsakaicin Ribbon Motsi. OBV yana ƙara ƙara a cikin kwanakin da aka haɓaka kuma yana rage shi a cikin kwanakin ƙasa, yana ba da ma'auni mai ƙima wanda zai iya tabbatar da ƙarfin yanayin. Hawan OBV tare da kintinkiri mai hawa yana ƙarfafa shigar da hankali. VWAP yana ba da matsakaicin matsakaicin girma na rana, yana aiki azaman ma'auni. Lokacin da farashin ke sama da VWAP a haɗin gwiwa tare da kintinkiri mai ban sha'awa, yana nuna haɓaka mai ƙarfi, yana fifita dogon shigarwar.

| nuna alama | Tabbatar da Trend | Ingantacciyar Sharadi |

|---|---|---|

| RSI | Daidaita da Hanyar Ribbon | Yana Gujewa Karatun Manyan Abubuwan Da Aka Ci Gaba Da Siya/Yuyawa |

| MACD | Crossover Yana Goyan bayan Siginar Ribbon | Histogram Yana Tabbatar da Jagorancin Lokaci |

| Bollinger makada | Rage Farashin Haɗawa tare da Ribbon | Makada Sun Yarda da Ƙimar Ƙarfafawa |

| O.B.V. | Girman Trend Matches Ribbon | Ƙarar Tari Girma yana Goyan bayan Trend |

| VWAP | Farashin Dangin VWAP Matches Ribbon | Farashin Sama/A ƙasa VWAP Tabbatar da Trend |

Ta hanyar haɗa waɗannan alamomi cikin bincike, traders na iya samun ra'ayi mai nau'i-nau'i na kasuwa, yana haɓaka amincin abubuwan shigarwar da aka ƙaddara akan Matsakaicin Matsakaicin Ribbon. Kowane mai nuna alama yana ƙara ƙirar tabbatarwa, yana rage haɗarin haɓakar ƙirƙira da ba da damar ƙarin dabarun yanke shawara.

4. Menene Mafi kyawun Ayyuka don Motsa Matsakaicin Dabarun Ribbon?

Inganta Saitunan Lokaci don Yanayin Kasuwa

Mafi kyawun ayyuka don Matsakaicin dabarun Ribbon Motsi sun haɗa da haɓaka saitunan lokaci don takamaiman yanayin kasuwa. Ƙananan lokaci na iya zama mai amsa ga canje-canjen farashi, yana ba da sigina na lokaci a cikin kasuwanni masu canzawa. Sabanin haka, tsawon lokaci na iya zama mafi dacewa a cikin kasuwanni masu tasowa don guje wa hayaniyar kasuwa da saurin ɗan gajeren lokaci. Traders ya kamata a kai a kai don gwada haɗakar lokaci daban-daban don ƙayyade saitunan mafi kyau don salon kasuwancin su da yanayin kasuwa na yanzu.

Ma'auni Tsakanin Amsa da Amincewa

Samun daidaito tsakanin amsawa da aminci shine mabuɗin. Yi amfani da matsakaicin matsakaicin motsi iri-iri don ƙirƙirar ƙaƙƙarfan kintinkiri wanda zai iya yin daidai daidai gwargwado daban-daban kuzarin kasuwa. Hanyar gama gari ita ce haɗa haɗin gajerun matsakaici, matsakaita, da tsayin lokaci. Wannan saitin yana ba da damar gano ƙungiyoyin farashin nan da nan da ƙarin ingantattun abubuwan da suka faru, suna ba da ra'ayi mai faɗi kan saurin kasuwa.

Aiwatar da Daidaitaccen Binciken Kayayyakin gani

Daidaitaccen bincike na gani yana da mahimmanci yayin fassara Matsakaicin Ribbon Motsi. Kula da rabuwa da tsari na matsakaicin motsi. Tsarin tsari mai kyau, mai kama da fan yawanci yana nuna yanayin daɗaɗɗen yanayi, yayin da ruɗaɗɗen layi ko haɗaɗɗiyar layi na iya nuna alamar yanayin da ke rasa ƙarfinsa ko kasuwa cikin haɓakawa. Yakamata a tantance alamun gani koyaushe a cikin mahallin aikin farashin kwanan nan don guje wa kuskuren fassara.

Haɗa tare da Wasu Manufofin Fasaha

Haɗa wasu alamun fasaha don tabbatar da sigina. Yayin da Matsakaicin Ribbon Motsawa kayan aiki ne mai ƙarfi da kansa, yana da inganci idan aka yi amfani da shi tare da wasu alamomi kamar RSI, MACD, ko Bollinger Bands. Waɗannan ƙarin kayan aikin na iya taimakawa tabbatar da ƙarfin yanayi, kuzari, da yuwuwar juyewa, yana haifar da ƙarin yanke shawara na ciniki.

Kula da Maganar Kasuwa kuma Daidaita Haka

Koyaushe la'akari da faɗin mahallin kasuwa. Fitar da bayanan tattalin arziki, abubuwan da suka faru na geopolitical, da ra'ayin kasuwa duk na iya yin tasiri akan aikin farashi da ingancin dabarun Motsi Matsakaicin Ribbon. Kasance da masaniya game da mafi girman yanayin kasuwa kuma ku kasance cikin shiri don daidaita dabarun daidai. Wannan na iya haɗawa da tsaurara odar asarar-asara gabanin manyan sanarwa ko sake tantance zaɓaɓɓen matsakaicin lokacin motsi don mayar da martani ga sauyin kasuwa.

Ta hanyar bin waɗannan kyawawan ayyuka, traders na iya haɓaka ingantaccen dabarun Motsi Matsakaicin Ribbon, mai yuwuwar haifar da ƙarin sakamako na ciniki mai nasara.

4.1. La'akarin Tsararren Lokaci

La'akarin Tsararren Lokaci

Lokacin haɗa Matsakaicin Ribbon Motsawa cikin dabarun ciniki, zaɓin firam ɗin lokaci yana da mahimmanci. Matsalolin lokaci daban-daban na iya tasiri sosai ga fassarar yanayin kasuwa da sakamakon yanke shawara na ciniki. Gajeren lokaci, kamar ginshiƙi na minti 1 zuwa 15, yawanci ana amfani da su rana traders waɗanda ke neman kama sauri, motsin farashin cikin rana. Wadannan traders dogara ga kintinkiri don gano abubuwan da ke faruwa nan da nan da saurin shigarwa da wuraren fita. Duk da haka, wannan yana zuwa tare da ƙarar hayaniyar kasuwa, wanda zai iya haifar da mafi girma na siginar ƙarya.

Tsawon lokaci mai tsayi, kamar ginshiƙi na awa 4, yau da kullun, ko mako-mako, ana son su lilo da matsayi traders. wadannan traders ba su da damuwa da sauye-sauye na gajeren lokaci kuma sun fi mayar da hankali kan ɗaukar manyan ƙungiyoyin kasuwa a cikin kwanaki, makonni, ko ma watanni. A kan waɗannan firam ɗin lokaci, Matsakaicin Ribbon Motsawa yana taimakawa wajen tace ƙananan canje-canjen farashi kuma yana ba da ƙarin haske game da yanayin da ake ciki. Dogayen firam ɗin lokaci suna ba da ƙarin amintattun sigina, saboda suna nuna ƙarin mahimman canje-canje a tunanin kasuwa.

| Lokaci | Salon Ciniki | Halayen Ribbon | Amincewar siginar |

|---|---|---|---|

| Gajere (minti 1-15) | Day Trading | Gane mai saurin faruwa | Ƙananan (ƙarin hayaniya) |

| Dogon (4H-Kullum) | Swing/Mataki | Tace qananan canjin farashi | Mafi girma (ƙasa amo) |

Hakanan yana da mahimmanci don traders don daidaita tsarin lokaci tare da salon kasuwancin su na kowane mutum da haƙurin haɗari. Rashin daidaituwa na iya haifar da rashin jin daɗi da rashin daidaituwa trades. Alal misali, rashin haɗari trader na iya samun gyare-gyare akai-akai da ake buƙata ta ɗan gajeren lokaci dabarun yana da matsi sosai, yayin aiki trader na iya samun firam ɗin lokaci masu tsayi da yawa a hankali kuma ba su amsa bukatunsu.

Matsakaicin Matsakaicin Matsakaicin Ribbon yakamata a daidaita shi don dacewa da tsarin lokacin da aka zaɓa. Gajeren matsakaicin lokacin motsi gabaɗaya sun fi kyau ga guntun lokaci, yayin da tsawon lokaci sun fi dacewa da firam ɗin lokaci mai tsayi. Wannan gyare-gyaren yana tabbatar da cewa kintinkiri ya kasance mai kula da ƙayyadaddun yanayin kasuwa a wasa a cikin lokacin da aka zaɓa, yana haɓaka haɓakawa. tradeiyawar r don yanke shawara mai kyau.

4.2. Dabarun Gudanar da Hadarin

Girman Matsayi

Matsayin matsayi dabara ce mai mahimmanci ta sarrafa haɗari. Ya ƙunshi ƙayyade adadin babban birnin da za a ware wa a trade bisa ga tradeHaƙurin haɗarin r da girman asusun. Hanyar gama gari ita ce a yi kasada karamin kaso na asusun akan guda trade, yawanci tsakanin 1% da 2%. Wannan dabarar tana tabbatar da cewa jerin asara ba za su jawo asusu ba sosai, ba da damar trader don ci gaba da aiki ko da a lokacin asara.

Dokokin Tsayawa-Asara

Umarni-asarar umarni suna da mahimmanci don sarrafa hasara mai yuwuwa. An saita waɗannan umarni a matakin da aka riga aka ƙaddara kuma za su rufe wuri ta atomatik lokacin da farashin ya kai wannan batu. A cikin mahallin Matsakaicin Ribbon Motsawa, za a iya sanya asarar tasha a ƙasan madaidaicin maɓalli mai motsi a cikin kintinkiri ko kuma ƙarƙashin ƙaramar juyawa ta baya-bayan nan a cikin dogon matsayi. Don ɗan gajeren matsayi, za a iya sanya asarar tasha sama da madaidaicin maɓalli mai motsi ko babban motsi na kwanan nan.

Umarni na Riba

Hakanan mahimmanci suna odar riba, wanda ke kulle riba ta hanyar rufe matsayi da zarar an kai farashin da aka yi niyya. Ƙirƙirar waɗannan umarni yana buƙatar fahimtar yanayin kasuwa da matsakaicin farashin farashin. Lokacin amfani da Matsakaicin Ribbon Motsawa, matakan riba na iya daidaitawa tare da matakan juriya na maɓalli a cikin haɓakawa ko matakan tallafi a cikin ƙasa.

Tsayawa Masu Tafiya

trailing Tashoshi bayar da tsayayyen tsarin kula da haɗari. Suna daidaitawa yayin da farashin ke motsawa cikin ni'imar trade, adana wani yanki na ribar idan kasuwa ta koma. Za'a iya saita tasha tazara azaman tsayayyen nisa daga farashin kasuwa ko bisa ma'aunin fasaha, kamar matsakaicin motsi daga kintinkiri.

diversification

A ƙarshe, rarrabuwa daban-daban azuzuwan kadara ko sassan kasuwa na iya rage haɗari mara tsari. Ta hanyar rashin wuce gona da iri ga kasuwa guda, traders na iya rage tasirin faɗuwar fage na musamman. Haɗa Matsakaicin Dabarun Ribbon Motsi tare da rarrabuwa yana taimakawa daidaita fayil ɗin, mai yuwuwar daidaita dawowa akan lokaci.

| Dabarun Gudanar da Hadarin | Nufa | Aiwatar da Matsakaicin Ribbon Motsi |

|---|---|---|

| Girman Matsayi | Iyakance fallasa kowane trade | Ware ƙaramin kaso na asusun |

| Dokokin Tsayawa-Asara | Sarrafa yuwuwar asara | Saita ƙasa/sama maɓalli MAs ko wuraren lilo |

| Umarni na Riba | Amintaccen riba | Daidaita tare da matakan juriya / tallafi |

| Tsayawa Masu Tafiya | Ajiye riba yayin da farashin ke motsawa cikin ni'ima | Daidaita dangane da canje-canjen farashi ko MAs |

| diversification | Rage haɗarin takamaiman yanki | yada trades a fadin daban-daban dukiya |

Ta hanyar amfani da waɗannan dabarun sarrafa haɗari, traders na iya taimakawa kare babban birninsu yayin amfani da dabarun Ribbon Motsi don kewaya kasuwanni.

4.3. Haɗuwa da Sauran Dabarun Kasuwanci

Daidaitawa tare da Dabarun Ayyukan Farashi

Haɗa Matsakaicin Ribbon Motsi da dabarun aikin farashi inganta da tradeiyawar r don gane wuraren shigarwa masu inganci. Ayyukan farashi yana mayar da hankali kan nazarin motsin farashi mai tsafta, tsari, da gyare-gyare ba tare da dogara ga ƙarin alamu ba. Lokacin da Matsakaicin Matsakaicin Ribbon ya nuna yuwuwar shigarwa, tabbatarwa ta hanyar aiwatar da farashi-kamar ƙirar ƙima ko hutun matakin juriya mai mahimmanci-na iya ba da babban matakin yanke hukunci a cikin trade.

Haɗin kai tare da Tsari

Samfurin ginshiƙi, kamar kai da kafadu, triangles, or tutoci, Hakanan ana iya haɗa shi tare da Matsakaicin Ribbon Motsi. Wadannan alamu sukan nuna alamar ci gaba ko juyewa, kuma idan suka daidaita da alkiblar da kintinkiri ke nunawa, yuwuwar samun nasara. trade iya karuwa. Misali, samuwar tuta da ke faruwa sama da Matsakaicin Ribbon Matsakaicin Matsakaici na iya ƙarfafa yuwuwar fashewar sama.

Haɗin Dabaru tare da Fibonacci Retracements

Fibonacci retracements sanannen kayan aiki ne don gano yuwuwar tallafi da matakan juriya dangane da sauye-sauyen kasuwa na baya. Lokacin da kintinkiri ya ba da shawarar yanayin haɓaka kuma farashin ya sake komawa zuwa matakin Fibonacci mai mahimmanci, kamar 61.8% retracement, kuma yana riƙewa, haɗuwa da waɗannan sigina na iya zama madaidaicin shigarwa na matsayi mai tsayi. Sabanin haka, a cikin ɓacin rai, sake komawa zuwa matakin juriya na Fibonacci wanda ya dace da jagorar kintinkiri na iya zama mafi kyawun ma'ana don fara ɗan gajeren lokaci.

Haɗin kai tare da Elliott Wave Theory

Ka'idodin Ka'idar Elliott Wave ana iya haɗa shi tare da Matsakaicin Ribbon Motsawa don tsammanin ci gaba ko juyawa. Idan kintinkiri ya gano wani yanayi mai ƙarfi kuma bincike na Elliott Wave yana nuna ƙarshen gyaran igiyar ruwa, shigar a farkon igiyar motsi na gaba ya yi daidai da ƙarfin da ake da shi, mai yuwuwar haifar da sakamako mai fa'ida.

Haɗuwa da Tsarin Candlestick

A ƙarshe, tsarin kyandir kamar guduma, taurarin harbi, ko doji na iya yin ƙarfi idan aka haɗa su da kintinkiri. Doji kyandir ɗin da ke tasowa a gefen kintinkiri yayin ja da baya na iya nuna rashin yanke hukunci da yuwuwar sake dawowar yanayin. Lokacin da waɗannan sigina na alkukin suka bayyana a daidaita tare da alkiblar ribbon, za su iya aiki a matsayin mai ƙara kuzari don shiga ko fita. trades.

Ta hanyar haɗa madaidaicin Ribbon na Motsi tare da waɗannan dabarun ciniki iri-iri, traders na iya gina wata hanya mai ban sha'awa wacce ke ba da damar ƙarfin hanyoyin bincike da yawa. Wannan haɗin kai zai iya haifar da ƙarin fahimtar kasuwa, yana ba da damar traders don yanke shawara tare da ƙarin tabbaci da daidaito.

5. Abin da za a yi la'akari kafin amfani da Matsakaicin Ribbon Mai Motsawa?

Tantance Nau'in Kasuwa da Yanayi

Kafin aiwatar da Matsakaicin Ribbon Motsawa, gano nau'in kasuwa-mai canzawa ko canzawa-kamar yadda wannan ke shafar ingancin mai nuna alama. A cikin a kasuwa mai karfi mai tasowa, kintinkiri yana ba da sigina bayyanannu kuma madaidaicin motsinsa yana ba da tallafi mai ƙarfi ko matakan juriya. Duk da haka, a cikin a kasuwar kasuwa, Matsakaicin motsi na iya haifar da ƙetare da yawa, wanda ke haifar da siginar ƙarya da hasara mai yuwuwa.

Keɓance Matsakaicin Lokacin Motsawa

Daidaita matsakaita masu motsi a cikin kintinkiri yana da mahimmanci don daidaitawa tare da manufofin ciniki da takamaiman halayen kadari. Kasuwanni masu saurin canzawa na iya buƙatar gajeriyar matsakaicin motsi don saurin amsawa, alhali ƙananan kasuwanni amfanuwa da tsawon lokaci masu tace hayaniya. Ci gaba da gwadawa da daidaitawa suna tabbatar da lokutan kintinkiri sun kasance masu dacewa da yanayin kasuwa na yanzu.

Daidaita da Dabarun Kasuwanci

Tabbatar Matsakaicin Ribbon Motsi ya yi daidai da dabarun kasuwancin ku gaba ɗaya. Ya kamata ya dace da salon kasuwancin ku, haƙurin haɗari, da fifikon lokaci. Misali, scalpers da rana traders zai iya amfani da madaidaicin kintinkiri don sigina na gajeren lokaci, yayin da lilo traders na iya fi son kintinkiri mai faɗi don tabbatar da yanayin dogon lokaci.

Haɗin kai tare da Sauran Kayan Aikin Fasaha

Yayin da Matsakaicin Ribbon Motsi babban kayan aiki ne, bai kamata a yi amfani da shi a keɓe ba. Haɗa shi tare da sauran kayan aikin bincike na fasaha yana haɓaka daidaiton sigina. Tabbatar cewa waɗannan kayan aikin ba su ba da ƙarin bayani ba amma suna ba da ra'ayoyi daban-daban, kamar ƙara, ƙarfi, ko rashin ƙarfi.

Sanin Al'amuran Tattalin Arziki da Fitowar Labarai

Kasance da sane da abubuwan da suka faru na tattalin arziki da fitar da labarai, saboda waɗannan na iya yin tasiri sosai ga yanayin kasuwa da aiwatar da alamun fasaha kamar Matsakaicin Ribbon Motsawa. Ƙwararrun kasuwar kwatsam da abubuwan da suka faru na labarai ke haifar da ƙila ba za a nuna su daidai ta hanyar mai nuna alama ba, wanda zai iya haifar da sigina masu ɓarna. Yana da kyawawa don kauce wa ciniki a lokacin manyan labaran labarai ko don daidaita dabarun don lissafin karuwar rashin daidaituwa.

Ta hanyar la'akari da waɗannan abubuwan. traders na iya haɓaka amfani da Matsakaicin Ribbon Motsawa a cikin arsenal ɗin kasuwancin su, haɓaka ikon su na kewaya yanayin kasuwa daban-daban yadda ya kamata.

5.1. Yanayin Kasuwa da Ƙarfafawa

Ƙimar Ƙarfafawa tare da Matsakaicin Ribbon Motsi

Ƙarfafawa yana taka muhimmiyar rawa a cikin tasirin Matsakaicin Ribbon Motsi. Babban canji sau da yawa yana haifar da yaduwa mai faɗi tsakanin matsakaicin motsi, yana nuna alamun haɓaka mai ƙarfi amma kuma babban haɗarin juyawa cikin sauri. Akasin haka, ƙananan rashin ƙarfi na iya haifar da kunkuntar yadawa da kuma yawan ƙetare, mai nuni ga ƙayyadaddun kasuwa tare da ƙarancin jagora.

Traders na iya auna rashin daidaituwa ta hanyar lura da fadadawa da raguwa na ribbon. Ƙaƙƙarfan kintinkiri yana nuna ƙara haɓakawa da yuwuwar haɓakar haɓakawa. A gefe guda kuma, kintinkiri na kwangila na iya sigina raguwar rashin daidaituwa, galibi ana danganta shi da sauyi mai zuwa a alkiblar yanayi ko ƙaura zuwa kasuwa mai iyaka.

| Matsayin Karɓatawa | Yada Ribbon | Tasirin Kasuwa |

|---|---|---|

| high | wide | Trend mai ƙarfi, Haɗari mafi girma |

| low | Tatsuniya | Ƙarfafawa, Ƙananan Haɗari |

Don kewaya kasuwanni masu canzawa tare da Matsakaicin Ribbon Motsi, yana da kyau a daidaita ƙwarai na matsakaita masu motsi. Ana iya amfani da gajeren lokaci don amsawa da sauri ga sauye-sauyen farashi, yayin da tsayin lokaci na iya rage tasirin rashin daidaituwa, samar da layin da ya fi dacewa da rashin iya yin bulala.

Hada kan rashin daidaituwa, kamar VIX, ko a nuna rashin daidaituwa, kamar Matsakaicin Gaskiya Range (ATR), na iya samar da ƙarin mahallin. Waɗannan kayan aikin na iya taimakawa tabbatar da ko canjin kasuwa na yanzu ya yi daidai da sigina daga Matsakaicin Ribbon Motsawa, yana ba da damar ƙarin shigarwar da fita.

Ta hanyar sa ido sosai da daidaitawa ga rashin daidaituwar da ake samu, traders na iya daidaita martanin Motsi Matsakaicin Ribbon, haɓaka amfanin sa a matsayin ɓangaren ingantaccen dabarun ciniki.

5.2. Iyakance Matsakaicin Ribbon

Lagging Nature

Matsakaicin Ribbon Motsi, ta ƙira, shine a lagging nuna alama. Yana dogara ne akan bayanan farashin da ya gabata don samar da layinsa, wanda ke nufin yana ba da hangen nesa na tarihi kuma yana iya ƙila yin hasashen motsin farashin nan gaba daidai. Wannan jinkirin na iya haifar da jinkiri a cikin samar da sigina, yana haifar da shigarwar marigayi ko fita a cikin kasuwanni masu sauri.

Tsaftace Sigina a Kasuwannin Gefe

Matsakaicin Ribbon Motsawa na iya samar da sigina marasa ma'ana a gefe ko kasuwanni masu jeri. Matsakaicin motsi yakan yi karo da juna akai-akai, wanda zai iya haifar da jerin farawar karya ko alamun yanayin yaudara. Wannan na iya haifar da ƙarin farashin ciniki da rage riba saboda bulala trades.

Yawan dogaro da Ragewa

Traders na iya zama mai dogaro ga Matsakaicin Ribbon Motsi, yana ɗaukan kayan aiki ne mai aminci don nazarin kasuwa. Wannan wuce gona da iri na iya haifar da jin daɗi, inda traders sakaci da wasu muhimman al'amurran bincike na fasaha, kamar price mataki or girma. Bai kamata a yi amfani da alamar guda ɗaya a keɓe ba, kuma ribbon ba banda.

Hankali ga Yanayin Kasuwa

Daidaita Matsakaicin Matsakaicin Hankalin Ribbon takobi ne mai kaifi biyu. Saita matsakaita masu motsi gajarta sosai, kuma ribbon zai amsa ga kowane ƙaramin canjin farashi, yana ƙara haɗarin alamun karya. Sanya su tsayi da yawa, kuma kintinkiri na iya sauƙaƙe motsin kasuwa mai mahimmanci, haifar da jinkirin halayen zuwa ainihin canjin canje-canje.

Tasirin Sauyawa

Ƙunƙarar ƙarfi na iya yin mummunan tasiri akan ayyukan Motsi Matsakaicin Ribbon. Babban rashin daidaituwa na iya haifar da faffadan kintinkiri, wanda zai iya ba da shawarar haɓaka mai ƙarfi yayin da, a zahiri, yana iya zama wuce gona da iri na kasuwa. Sabanin haka, ƙananan rashin ƙarfi na iya sa ribbon ya yi kwangila, mai yuwuwar rage mahimmancin ci gaba na gaskiya.

| Iyakance | Sakamakon |

|---|---|

| Alamar Lagging | Matsalolin shigarwa/fita, dama da aka rasa |

| Sigina na Kasuwa na Gede | Sigina marasa ma'ana, ƙara ƙimar ƙarya |

| Yawan dogaro | Sakaci da sauran kayan aikin bincike, gamsuwa |

| Daidaitawar Saiti | Haɗarin siginar ƙarya ko jinkirin gane yanayin |

| Tasirin Ƙarfafawa | Ƙarfin fassarar ƙarfi ko raunin abubuwan da ke faruwa |

Fahimtar waɗannan iyakoki yana da mahimmanci ga traders don rage haɗari da amfani da Matsakaicin Ribbon Motsi yadda ya kamata a cikin dabarun ciniki mafi fa'ida.

5.3. Muhimmancin Gwajin Baya

Komawa baya: Larura don Tabbatar da Dabarun

Komawa wani sashe ne mai mahimmanci na haɓakawa da kuma daidaita dabarun ciniki. Ta hanyar amfani da Matsakaicin Ribbon Motsawa zuwa bayanan tarihi, traders na iya kimanta aikin wannan kayan aiki da gaske a cikin yanayin kasuwa daban-daban. Wannan tsari yana ba da damar haɓaka sigogin kintinkiri, kamar zaɓin matsakaicin lokacin motsi wanda ya fi dacewa da aikin farashin kadari da rashin ƙarfi.

Babban fa'idar goyan baya yana cikin ikonsa na nuna ƙarfi da raunin dabara ba tare da haɗarin ainihin jari ba. Misali, a trader zai iya tantance idan Matsakaicin Ribbon Motsawa a koyaushe yana ba da siginonin shigarwa da wuri a kasuwannin da ke faruwa ko kuma idan yana samar da ƙimar ƙarya da yawa yayin lokutan iyaka. Ta hanyar gano waɗannan alamu, traders iya saita tace masu dacewa da kuma daidaita dabarun sarrafa haɗari, kamar sanyawa na tsayawa-asara da oda na riba, don inganta ingantaccen tsarin su gabaɗaya.

Haka kuma, backtesting yana sauƙaƙe gwajin gwaji ƙarƙashin yanayi daban-daban na kasuwa, gami da manyan abubuwan da suka faru na rashin ƙarfi da rugujewar kasuwa. Traders sun sami fahimtar yadda dabarun da za su yi a lokacin rikicin kasuwa da suka gabata, yana ba su damar haɗa matakan kariya a cikin tsare-tsaren ciniki na yanzu.

Duk da yake goyan baya baya garantin aiki na gaba saboda canjin yanayin kasuwa koyaushe, yana aiki a matsayin muhimmin mataki na haɓaka dabarun. Yana taimakawa traders gina kwarin gwiwa a cikin hanyoyin su kuma yana ba da tushe don ci gaba da ingantawa. Gwajin baya na yau da kullun, haɗe tare da gwaji na gaba a cikin yanayin demo, yana tabbatar da cewa dabarar ta kasance mai dacewa da ƙarfi a kan yanayin yanayin kasuwa mai tasowa.

| Bangaren Bayarwa | Nufa | Sakamakon |

|---|---|---|

| Inganta Siga | Madaidaicin Matsakaicin Matsakaicin Saitunan Ribbon | Ingantattun dabarun daidaitawa tare da yanayin kasuwa |

| Gwajin aikin | Yi la'akari da ingancin dabarun tarihi | Sanarwa gyare-gyare ga tsarin ciniki |

| hadarin Management | Gwajin ingancin matakan kariya | Ingantattun dabarun adana jari |

| Gwajin danniya | Kwatanta dabarar juriya a cikin rikice-rikice | Shiri don matsananciyar yanayin kasuwa |

Ta hanyar rungumar ja da baya a matsayin ginshiƙin haɓaka dabarun haɓakawa, traders tabbatar da cewa amfani da Matsakaicin Matsakaicin Ribbon ba ya dogara ne akan zato na ka'idar ba amma akan kwararan hujjoji waɗanda zasu iya jure gwajin lokaci.